Dec 28, 2022

Tesla fans keep buying, unbowed by the US$720B wipeout

, Bloomberg News

Musk may have to sell more Tesla shares in the new year to fund Twitter: Strategist

Even the worst year ever for Tesla Inc. shares hasn’t shaken individual investors’ faith in the electric-vehicle maker and its billionaire chief executive officer, Elon Musk.

Such retail traders have continued piling into the shares, data from Vanda Research show. In fact, they’ve been strong buyers every day this month, driving their net purchases to record highs in both December and the fourth quarter.

- Sign up to get breaking news email alerts sent directly to your inbox

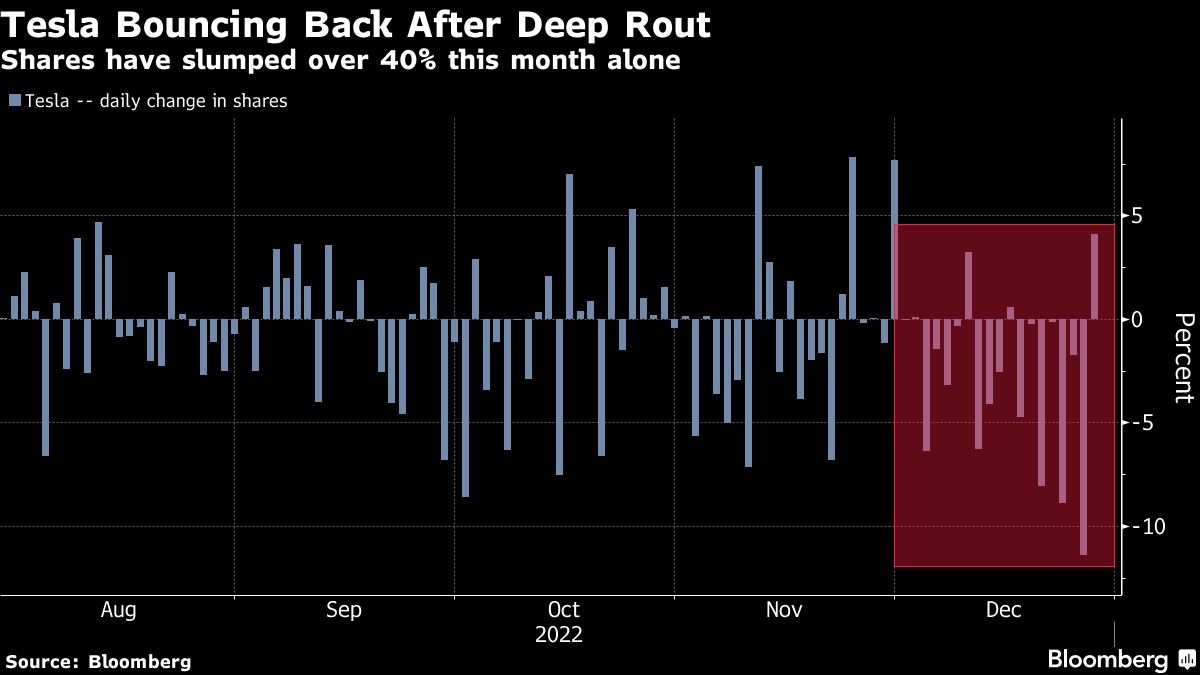

On Wednesday, they appeared poised to get a small reward for their loyalty: Tesla shares closed 3.3 per cent higher at US$112.71 in New York, halting a seven-day losing streak that had driven them down 70 per cent this year through Tuesday and erased almost US$720 billion from the company’s stock-market capitalization.

The drubbing has been fueled by rising interest rates that battered growth stocks, worries that demand will erode if there’s a recession, and concerns that Musk’s acquisition of Twitter will divert his attention and increase his sales of Tesla stock to keep the social-media company afloat. The drop had, at one point, made it the third-worst performer in the S&P 500 Index this year.

Yet for Tesla’s diehard fans among retail investors, the risks to electric-vehicle demand or Musk’s preoccupation with Twitter haven’t been enough to sour them on a stock that became one of Wall Street’s highest fliers during the pandemic.

“Retail investors have bought more Tesla stock over the last 6 months than they have done overall in the 60 months prior to this,” Vanda’s senior strategist Viraj Patel said. “For institutional investors, it’s a seller’s paradise when you have a buyer that is clearly not reading the fundamental signals.”

On Tuesday, Tesla was hit by an 11 per cent slump on fresh concerns about a production halt at its Shanghai plant and last week’s report that Tesla is offering U.S. consumers a hefty US$7,500 discount to take delivery of its cars before year-end.

That fueled concerns about eroding demand ahead of fourth-quarter delivery numbers expected in early January. Estimates have been coming down in recent weeks, and on Wednesday Baird analyst Ben Kallo was the latest to lower his, citing the “potential for weakening of demand.”

Growth stocks overall have been hammered this year, with the Nasdaq 100 slumping 35 per cent as the Federal Reserve hiked interest rates aggressively to tame inflation. Tesla was among the biggest drags on the index, with this year’s plunge marking a stark turnaround from the company’s 1,163 per cent rally over the prior two years. Musk’s sales of Tesla stock and the distraction caused by his Twitter takeover also haven’t helped.

“It feels like confidence is gone, and Tesla’s fairy tale suddenly ended,” said Ipek Ozkardeskaya, senior analyst at Swissquote Bank. “Investors are more eager to see how the looming recession will hit Tesla demand, how competition from other electric-vehicle makers will impact Tesla’s market share, and when Elon Musk will stop messing elsewhere while Tesla is shaking badly.”