Jan 19, 2019

Tesla's Model 3 Wait List May Undermine Musk, One Way or Another

, Bloomberg News

(Bloomberg) -- Elon Musk has backed himself into a corner with Tesla Inc.’s most crucial car.

Some would-be customers have waited almost three years to take delivery of the Model 3, a sedan they plopped down a $1,000 deposit for as early as March 2016. Musk, Tesla’s charismatic chief executive officer, has pitched it as the company’s first car for the masses, with a base price of just $35,000.

Thousands of those deposit holders still are standing by, and they could spell trouble for Tesla -- whether they stay patient or not.

Selling too many Model 3s at that price too soon would put the company out of business, Musk tweeted last year. At the very least, it undermines Tesla’s profitability, as he alluded to in an email to staff on Friday. He announced Tesla will cut about 7 percent of its workforce -- roughly more than 3,000 employees.

On the other hand, would-be customers like Nevine Melikian are running low on patience. Her family put down a deposit in the summer of 2017 and have since bought two Toyota Priuses -- one new for about $28,000, and one used for $13,000. They still want a Tesla but balked at the price -- around $48,000 -- that Tesla sales representatives commanded when calling to say they were next on the wait list.

May Not Wait

“We have been forgiving of Tesla because they’ve been on the forefront of electric cars, but they need to get their act together before they lose people like us,” Melikian, who lives in Phoenix, said Friday. “If another company comes up with a car similar in mileage range and style to Tesla, we may not wait.”

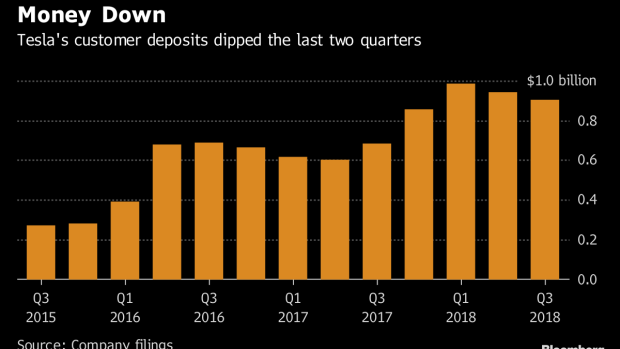

The amount of customer deposits Tesla has collected slipped to $905.8 million as of the end of September, a 3.9 percent dip from three months earlier. The company is expected to update this figure when it reports fourth-quarter earnings Jan. 30.

Musk, 47, wrote Friday that Tesla’s surprise profit in the third quarter was due partially to the company selling higher-priced Model 3 variants. While preliminary results indicate the carmaker earned a profit again in the last three months of 2018, earnings probably shrank on a sequential basis, he said.

This quarter, Tesla plans to start shipping pricier versions of the Model 3 to Europe and Asia, which Musk wrote will “hopefully allow us, with great difficulty, effort and some luck, to target a tiny profit.” Starting around May, Tesla will have to deliver mid-range Model 3s to all markets to reach enough customers who can afford its vehicles, he said.

Not Affordable

Daniel Sefton, who lives in London, is awaiting the base-price Model 3.

“It’s just not affordable for me to pay $50,000,” said Sefton, who’s eager to take the Model 3 on road trips across Europe. “I’d prefer to have a car I can drive freely, that I don’t have to worry about all the time.”

Other Musk fans are tapping their wallet for far more than usual to buy a new car -- a phenomenon some Model 3 buyers have called the “Tesla stretch.” Janelle Tarman bought her metallic blue sedan in December for $58,000. She was anxious to purchase, partly because she feared the base model Musk has promised will never materialize.

“I feel like it was almost a bait-and-switch kind of deal,” said Tarman, who paid extra for the paint job and Tesla’s Autopilot driver-assist system. “Not that I don’t love my car.”

Some of Tesla’s critics question whether the company should even be moving down-market in price. Musk should be satisfied he’s been able to create an electric-vehicle rival to Porsche, said David Kirsch, an associate professor of management and entrepreneurship at the University of Maryland. Tesla is attempting a technological Hail Mary by putting what are still-expensive batteries in cars and trying to sell them at mass-market prices, he said.

“Musk is living in a fantasy world,” Kirsch said.

--With assistance from Gabrielle Coppola.

To contact the reporter on this story: Alexandra Semenova in New York at asemenova10@bloomberg.net

To contact the editors responsible for this story: Craig Trudell at ctrudell1@bloomberg.net, Melinda Grenier

©2019 Bloomberg L.P.