Jul 21, 2021

Texas Instruments Sales Forecast Stirs Concern Over Chip Demand

, Bloomberg News

(Bloomberg) -- Texas Instruments Inc. gave a wide range for its revenue forecast in the current period, indicating uncertainty about whether a jump in chip demand caused by the pandemic will continue. The stock fell in late trading.Sales will be $4.4 billion to $4.76 billion in the period ending in September, Texas Instruments said Wednesday in a statement. Profit will be $1.87 to $2.13 a share, the company said. On average, analysts predicted profit of $1.97 a share and sales of $4.59 billion, according to data compiled by Bloomberg.

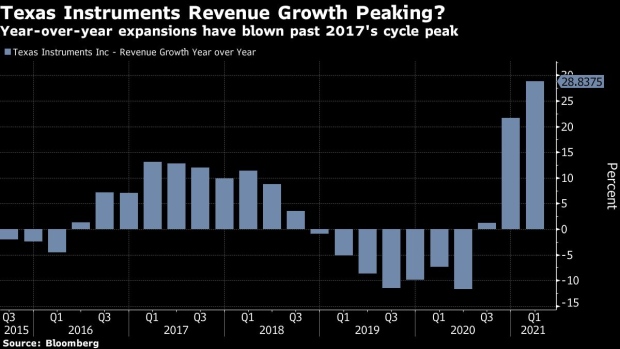

Like other chipmakers, Texas Instruments has posted multiple quarters of double-digit percentage revenue growth, boosted by demand for a wide variety of devices that contain its tiny electronic components. The rapid run-up has caused concern among analysts and investors that some of the orders reflect panic buying by customers who are concerned they won’t be able get enough supply. Such behavior in the past has caused crashes.

Texas Instruments’ management has said there’s no dangerous accumulation of inventory. Their high level of in-house manufacturing and move away from chip distributors to direct sales to customers means they have a clearer picture than their peers of the balance between supply and demand, the company has said. Many chipmakers outsource large chunks of their manufacturing, with some never having owned their own plants. Texas Instruments has factories that provide about 80% of its own needs.

The Dallas-based company has tens of thousands of products and more than 100,000 customers who make everything from phones to military hardware. That reach as the largest manufacturer of analog and embedded processing chips makes the company a bellwether for electronics demand. A large chunk of its products go into industrial machinery.Texas Instruments shares have kept pace with the overall advances by chip stocks this year, gaining 18% to $194.24 at the close. The stock fell about 3.5% in extended trading after the results were announced.

In the second quarter, net income rose to $1.93 billion, or $2.05 per share, from $1.38 billion, or $1.48 a share, a year earlier. Revenue increased 41% to $4.58 billion. Analysts, on average, estimated $4.36 billion.

Earlier this month Texas Instruments said it’s buying a plant in Lehi, Utah, from Micron Technology Inc. for $900 million. The company is taking the lead in using relatively advanced plants for chips that have typically not required the kind of production necessary for Intel Corp.’s microprocessors or Micron’s computer memory. That’s giving Texas Instruments an advantage in cost and control of its own supply, the company has argued.

©2021 Bloomberg L.P.