Dec 13, 2019

Thai Bank M&A Is About Coups and Condoms

, Bloomberg News

(Bloomberg Opinion) -- It’s only fitting that Thailand’s second-largest bank pipped a Japanese rival to buy a lender in Indonesia. The elixir of youth is a great attraction to those who no longer have it.

Just like in Japan, the aging Thai population is propelling the economy into long-term stagnation, leaving the likes of Bangkok Bank Pcl with no choice except to seek their fortunes in younger societies bubbling over with credit demand at juicy yields. Hence, the $2.7 billion bid for 90% of Indonesia’s PT Bank Permata.

At 1.8 times book value, the first major overseas acquisition by a Thai bank isn’t cheap. But the mid-tier Indonesian lender was a coveted asset. At one stage, Singapore’s Oversea-Chinese Banking Corp. had weighed a bid. Japan’s Sumitomo Mitsui Financial Group Inc. had also shown interest in buying out the existing owners, Standard Chartered Plc and PT Astra International. Since Astra is Toyota Motor Corp.’s Indonesian partner and controls half of the car market, it seemed logical that a Japanese institution would want to get into the driver’s seat at Permata, a specialist auto financier.

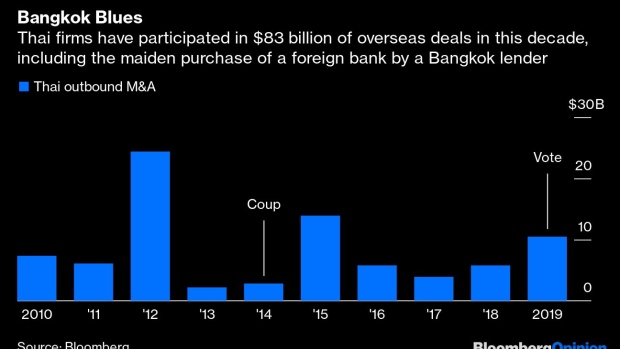

But Bangkok Bank decided to open its checkbook. And why not? When local businesses have been steadily funneling capital out of the country, how long can banks stay put at home? Since 2010, Thai companies have led or taken part in $83 billion of overseas M&A, including 18 deals of $1 billion or more. Billionaire Dhanin Chearavanont’s Charoen Pokphand Group Co., and Thai Beverage Pcl of Charoen Sirivadhanabhakdi have been the heavy hitters, fighting to acquire assets in China, Vietnam, the U.S., and wherever they can find them.

As I’ve noted before, Thailand’s per capita income is a fifth of South Korea’s, 73% less than Taiwan’s, and a third lower than Malaysia’s, but its outbound-to-inbound investment ratio of 1.9 is higher than all three. Thai demographics are also among the worst in the world. With a fertility rate of 1.5 live births per woman, far lower than the replacement rate of 2.1, it now appears that the small-family drive begun by activists like Mechai Viravaidya, known as Mr. Condom, in the 1970s, has worked a little too well: The 68 million population is expected to shrink by a third by the end of the century.

Apart from population, the other big driver is politics. The Thai overseas M&A wave picked up momentum as democracy was snuffed out in 2014 by the second military coup in eight years. Since then, private investment in the domestic economy has ebbed and flowed with global demand. Last year was good; this year is bad. Elections in March returned Prayuth Chan-Ocha, the former general who led the junta, as prime minister. But with efforts under way to break up the country’s most vocal opposition party, there’s little optimism about resumption of a real democracy in the Southeast Asian country.

Bangkok Bank shareholders are a little miffed about the overseas shopping expedition. Their dividend checks could be at risk. But the draw of a young market where large banks still earn a 15%-plus return on equity, the best in Asia, is compelling. Permata is not in the league of a PT Bank Rakyat Indonesia or a PT Bank Central Asia, but as Japanese lenders like Mitsubishi UFJ Financial Group Inc. know only too well, you try to get a foot in the door in Indonesia when it opens even a little.

The pull of Indonesia adds to the push to expand beyond a moribund home market. Even with dirt-cheap money — Thai 10-year government bond yields of 1.6% are lower than even in the U.S. — loan growth in the domestic economy has collapsed to 3.8%. The prognosis isn’t cheery, either. A quarter of Thailand’s people will be over 60 by 2030. And unlike Japan, which managed to get rich before it got old, per capita national income of $6,600 last year is only half of the high-income threshold. Indonesia is an even lower $4,000, but there, the ratio of people 65 or older is half that of Thailand’s 12%.

Bangkok lenders have to seek out youth — from Indonesia to India and Bangladesh. Condoms and coups have left them with no choice.

To contact the author of this story: Andy Mukherjee at amukherjee@bloomberg.net

To contact the editor responsible for this story: Patrick McDowell at pmcdowell10@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Andy Mukherjee is a Bloomberg Opinion columnist covering industrial companies and financial services. He previously was a columnist for Reuters Breakingviews. He has also worked for the Straits Times, ET NOW and Bloomberg News.

©2019 Bloomberg L.P.