Mar 29, 2023

Thai Central Bank Raises Rate for a Fifth Time to 1.75%

, Bloomberg News

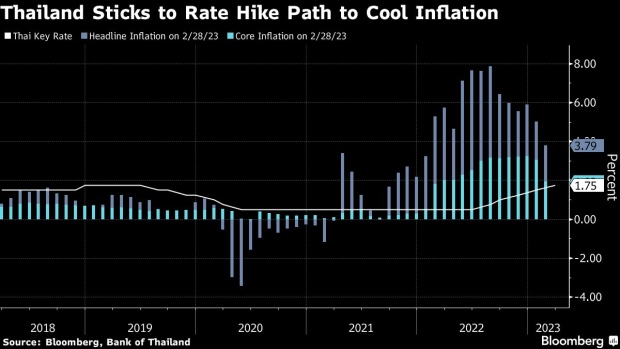

(Bloomberg) -- Thailand’s central bank raised its benchmark interest rate for a fifth straight time and signaled more monetary tightening is on the horizon to return inflation to target.

“With all the data that we have now, we think the rate normalization should continue,” Piti Disyatat, assistant governor at the Bank of Thailand, told a briefing Wednesday after policymakers raised the one-day repurchase rate by 25 basis points to 1.75%. The decision, the fifth straight increase, was predicted by 19 of 22 economists in a Bloomberg survey.

The baht gained 0.3% to 34.194 against the dollar, making it the top gainer among major Asian currencies today.

A rebound in tourism in Southeast Asia’s second-largest economy is boosting activity and demand in the economy, which the BOT expects to expand 3.6% this year and 3.8% in the next. At the same time, above target headline inflation and expectations for the core measure — which strips out volatile food and fuel prices — to stay elevated boosts the pressure on authorities to tighten further.

There’s room for lenders and borrowers to still cope with rising financial costs from gradual rate hikes, according to the BOT.

The monetary authority sees upside risks from higher cost pass-through and demand pressures. Persistently high inflation and banking stresses in some advanced economies as risks to the global economic outlook, according to the central bank.

Wednesday’s hike marks the continuing divergence of policy path of central banks in Southeast Asia, with Thailand and the Philippines still staying their tightening course amid a still hawkish Federal Reserve, while Indonesia and Malaysia have opted for a pause. Vietnam on the other hand has already pivoted to a rate reduction.

Still, some economists see the BOT halting hikes after one more quarter-point move at its next meeting in May.

“Our forecast terminal rate remains 2%,” said Tim Leelahaphan, a Bangkok-based economist at Standard Chartered Bank Plc. “A potential inflation reversal, financial instability concerns in a low-rate environment, and Thailand’s still-wide rate differential with the Fed support our call for a final 25 basis-point hike in May.”

--With assistance from Tomoko Sato, Anuchit Nguyen, Patpicha Tanakasempipat, Cecilia Yap, Ditas Lopez, Marcus Wong and Pathom Sangwongwanich.

(Updates with central bank comments on rate outlook)

©2023 Bloomberg L.P.