Jun 30, 2022

Thai Tourism Faces Tough Rebuild as All Covid Travel Curbs End

, Bloomberg News

(Bloomberg) -- Thailand removed the last of its pandemic-related travel restrictions Friday, but the nation’s once-vibrant tourism industry still faces plenty of challenges on its long road to recovery, not least the continued absence of big-spending Chinese visitors.

Anyone can now travel to the Southeast Asian country without having to register for a so-called Thailand Pass before arriving, the last entry requirement remaining after Thailand had ditched all other Covid entry rules.

Friday’s move itself is unlikely to spark a sudden rush of visitors, especially as it is now the low season. And while the earlier dismantling of other, more onerous rules such as quarantine has helped lure some visitors back to the country, Thai businesses still desperately need a bigger influx of customers after Covid torched international travel and left tourist hotspots deserted.

“Tourists will return, but our survival will be challenging,” Tourism Council of Thailand President Chamnan Srisawat said. “Less than half of tourism businesses have resumed, and those that are open again don’t have enough customers to operate profitably.”

Thailand expects 9.3 million foreign arrivals this year, compared with only about 428,000 in 2021. That’s still a far cry from the 40 million visitors in 2019. Arrivals are expected to reach 24 million, or 60% of pre-pandemic levels, as far off as 2024, the World Bank said in a report Wednesday.

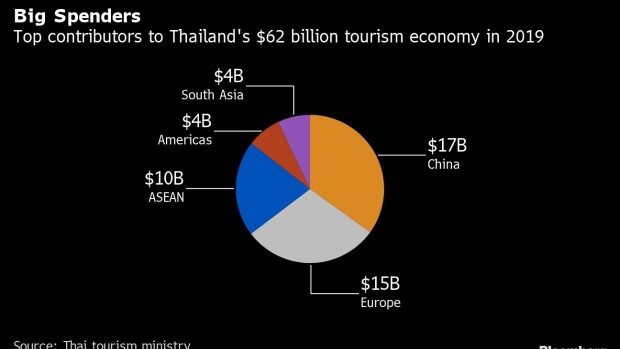

International tourists spent 1.9 trillion baht ($54 billion) in Thailand in 2019, and the industry has typically accounted for about 12% of the country’s gross domestic product, according to official figures. Data Thursday showed foreign travel spending in the first quarter this year was 65.9 billion baht, an 86% increase from the lows of the same period of 2021.

China Chasm

China used to be the biggest source of tourists, making up more than a quarter of international arrivals. But Thailand will have to rebuild without that crucial inflow for the foreseeable future as Beijing maintains a tight grip on travel in its pursuit of Covid Zero.

“Chinese tourists are a key factor to the recovery,” said Suksit Suvunditkul, president of Thai Hotels Association’s southern chapter. Phuket is particularly popular with Chinese visitors, he said. “They used to fill every hotel, everywhere, whether seaside or downtown, all year round.”

Just to break even, hotels will need to increase occupancy rates to 50% from 30% now, said Marisa Sukosol Nunbhakdi, president of Thai Hotels Association, which last week urged the government to assist their recovery by allowing hotel operators to pay their 2022 land tax over 10 installments and giving them more concessions between 2023 to 2025.

“With incurring expenses and no revenue, we had to endure massive losses,” Marisa said. “Staff who left have not returned to the sector.”

Hotels had debts of more than 400 billion baht with Thai commercial banks around the end of 2021, according to the Bank of Thailand, while the tourism industry lost more than 3 million workers from the start of the pandemic to the third quarter of 2021, based on Tourism Council of Thailand estimates.

“The main challenge is to stay afloat through the third year of the pandemic, with income less than 30% what it was and many service workers gone,” Suksit from the Thai Hotels Association said.

Phuket Sandbox

Thailand began its reopening process with a so-called sandbox program on the tropical island of Phuket, which allowed visitors to move freely outside their accommodation but required them to remain on the island for seven days before traveling to other destinations in the country.

Phuket received more than 100,000 international visitors in June and reported hotel occupancy rates of about 40%, Suksit said. Prior to Covid, it averaged 800,000 arrivals a month and 80%-90% occupancy rates.

Phuket and other tourist meccas have generally been eerily quiet through much of the pandemic, with once-bustling beaches and temples devoid of tourists and tuk-tuk drivers scouring empty streets for customers.

“I used to look up and see so many feet when I prostrated before the Emerald Buddha. But now there are none,” said Taniwan Koonmongkon, president of the Thai Restaurant Association, who said a shortage of service workers is also plaguing the food and beverage industry.

Tourist numbers should increase toward the end of the year as the high season arrives, with Europeans exchanging cold winter climes for sunny beaches. Now that they can travel freely, there is hope on the horizon for the tourism industry, provided operators can make it that far.

“Since Thailand started to reopen last year, we have seen bookings resume at an ever increasing pace,” said Garth Simmons, chief executive officer for Southeast Asia at Accor SA, which operates 82 hotels across Thailand and is set to open five more this year.

“This is a resilient industry,” he said. “We are confident that demand will not only return to pre-pandemic levels, but likely exceed what we have ever witnessed before.”

©2022 Bloomberg L.P.