Apr 10, 2020

Thailand Considers Local, Foreign Borrowing for $30.6 Billion Debt

, Bloomberg News

(Bloomberg) -- Thailand said it will explore domestic and foreign funding options for planned borrowing of 1 trillion baht ($30.6 billion) to finance a major economic stimulus program.

The debt is a key element of a 1.9-trillion-baht package to help low-income households, farmers and companies reeling from the impact of the novel coronavirus outbreak. Southeast Asia’s second-largest economy may contract 5.3% this year, according to the Bank of Thailand.

Read More: Thailand Plans $30.6 Billion Borrowing for Latest Stimulus

“We’ll explore all possibilities,” Patricia Mongkhonvanit, director general of the Finance Ministry’s Public Debt Management Office, said in an interview Thursday. “We won’t borrow 1 trillion baht all at once. We’ll proceed gradually, as the funding need arises.”

The scale of the borrowing led to questions about how the government would achieve it. Patricia said the ministry is looking at a mix of instruments, including government bonds, treasury bills, promissory notes, term loans and savings bonds. Tapping international organizations like the Asian Development Bank and foreign debt markets are also options, she said.

“Our objective is mainly to tap the local market first,” Patricia said. “There is ample domestic liquidity and demand for our products.”

Executive Decree

A pending executive decree will permit the fund-raising efforts to run through September 2021, a time-frame designed to give officials flexibility since the duration of the outbreak is uncertain. The 1 trillion baht additional borrowing is more than double the average annual budget deficit of recent years, according to Australia & New Zealand Banking Group Ltd.

The administration will look at short- and long-term instruments, and the issue-size of savings bonds will likely top the usual 50 billion baht per year, Patricia said. Officials are also evaluating the strengths and challenges of foreign-currency debt.

“We’re considering foreign investors’ response,” she said. “It looks interesting. But we have to assess costs and foreign-exchange risk.”

International organizations “have very good packages and we’re in talks with them,” Patricia said, adding “their interest rates are quite competitive after swapping back to our currency.”

The extra borrowing under the stimulus plan won’t be accounted for in the government’s regular fiscal deficit because it falls under a special law, meaning it will be treated separately, she said.

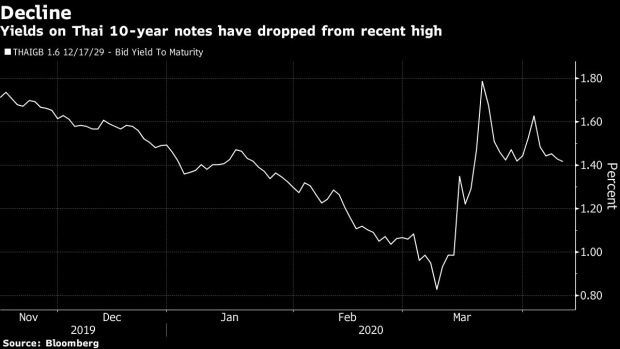

Investor panic induced by the coronavirus crisis led the Bank of Thailand to roll out a liquidity backstop to support the fixed-income mutual fund and corporate bond sectors.

Read More: Widening Bank of Thailand Liquidity Support Calms Edgy Markets

“The market volatility is just short term,” Patricia said. “The bond market has improved from two weeks ago. I don’t think it will be a problem -- it’s about what kind of tools investors want during this situation.”

©2020 Bloomberg L.P.