Nov 30, 2022

Thailand Delivers Third Modest Rate Increase as Economy Recovers

, Bloomberg News

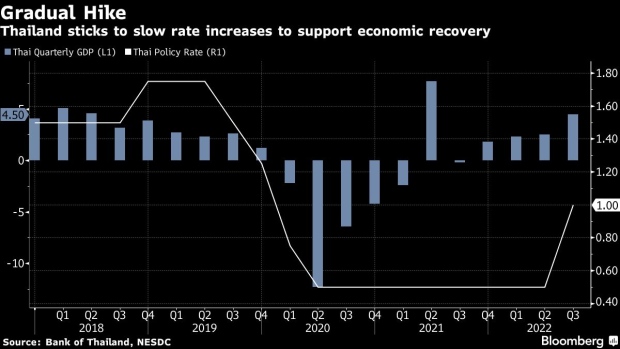

(Bloomberg) -- Thailand increased its key interest rate by a quarter point for a third straight meeting and raised its inflation estimate for 2023 while reiterating it’s ready to adjust the size and timing of its tightening.

The Bank of Thailand’s monetary policy committee voted unanimously to raise the one-day repurchase rate by 25 basis points to 1.25% on Wednesday, as seen by 20 of 21 economists in a Bloomberg survey, with one predicting no change.

The central bank revised its forecast for 2023 headline inflation to 3% from a previous 2.6% estimate while it slightly lowered economic growth projection to 3.2% for 2022 and 3.7% next year. The outlook for headline price gains to return to target was pushed to third quarter of next year from previously anticipated second quarter.

“Economic recovery will be on track, albeit with risks to inflation,” the BOT said in a statement. “Given the heightened uncertainties surrounding the global economy, the Committee is ready to adjust the size and timing of policy normalization should the growth and inflation outlook shift from the current assessment.”

Thailand is sticking to its gradual tightening approach even as some analysts previously thought the moves were too little to cool price gains at a 14-year high and a currency hitting a 16-year low. Since then, the baht has rebounded and headline consumer prices eased to a six-month low.

“We think the economy has recovered and headline inflation has passed the peak,” Assistant Governor Piti Disyatat told a briefing Wednesday. “A gradual policy normalization remains an appropriate course for monetary policy given the growth and inflation outlook,” he said.

What Bloomberg Economics Says...

With medium-term inflation expectations still well-anchored, the central bank has scope to slow its tightening cycle as global growth risks mount in 2023. We expect another 50 basis points of rate hikes in 2023, but not back-to-back.

-- Tamara Mast Henderson, Asean economist

For the full note, click here

Core inflation is projected to ease to 2.5% in 2023 and further to 2% in 2024 from an estimated 2.6% this year. Headline inflation is seen to cool to 2.1% in 2024.

Despite the forecast of persistent price pressures, some economists say BOT may pause its tightening cycle as it’s close to hitting a terminal rate. Standard Chartered Bank Plc economist Tim Leelahaphan expects a pause in the first half of next year before tightening resumes in the third quarter that may see a terminal rate of 2% by the end of 2024.

While the upward revision in BOT’s 2023 inflation forecast “was a slightly hawkish surprise,” Nomura Holdings Inc. is penciling in just one more hike of 25 basis points in January as the bank sees significant downside risks to the central bank’s inflation forecasts, according to analyst Charnon Boonnuch.

Tourism Boost

The baht extended gains to as much as 0.6% after the rate hike, poised to cap its biggest monthly gain since 1998. The currency has advanced more than 7% this month. The benchmark stock index gained 0.7% while the yield on 10-year sovereign bonds rose four basis points to 2.722%.

The nation will likely buck the global trend of slowing growth next year, powered by a resurgent tourism sector that’s helping boost local demand. The central bank sees gross domestic product growth accelerating to 3.9% in 2024 as foreign visitors are expected to reach 31.5 million that year.

The monetary authority also raised its estimate for tourist arrivals to 10.5 million this year from 9.5 million earlier, and to 22 million in 2023, up by a million from its September forecast.

That may help the nation swing back into a current account surplus of $3.8 billion next year from a deficit seen at $16.5 billion this year, the central bank said.

--With assistance from Anuchit Nguyen, Margo Towie, Pathom Sangwongwanich, Patpicha Tanakasempipat, Tomoko Sato and Michael J. Munoz.

(Updates with analyst comments from eighth paragraph.)

©2022 Bloomberg L.P.