Sep 23, 2020

Thailand Holds Rate at Record Low With Spotlight on Fiscal Steps

, Bloomberg News

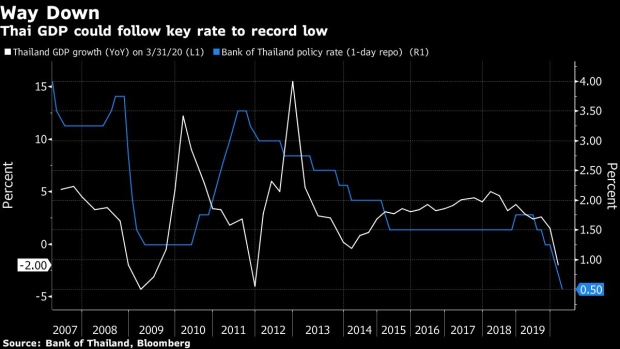

(Bloomberg) -- The Bank of Thailand kept its benchmark interest rate unchanged for a third straight meeting to save its limited policy space, allowing fiscal policy to take the lead in reviving an economy headed for its worst annual performance ever.

The central bank kept the policy rate unchanged Wednesday at 0.5% in a unanimous decision, after lowering rates three times earlier this year. All 22 economists in a Bloomberg survey predicted the hold.

The bank revised up its growth forecast, predicting a 7.8% contraction for the year, compared with a previous projection of an 8.1% decline. The pandemic has devastated two of the economy’s main growth drivers, tourism and trade, prompting the government to take a series of steps, including passing a $2.2 billion program of cash handouts and co-pay programs this week to boost consumption and jobs.

Governor Veerathai Santiprabhob said in a recent interview that the bank has been studying unconventional policy steps such as yield-curve control, but doesn’t think they’re needed right now. While all options, including interest-rate cuts, remain on the table, targeted policies that get funds to the sectors that need them can be most effective, he said.

Thailand will undergo a transition in fiscal and monetary policy leadership over the next few months. Veerathai is leaving the central bank at the end of this month when his five-year term expires, handing over to Sethaput Suthiwart-Narueput, a member of the Monetary Policy Committee. The government also is seeking a replacement for Finance Minister Predee Daochai, who resigned in early September after less than a month in the position.

©2020 Bloomberg L.P.