Feb 8, 2023

Thailand May Borrow Less as Buoyant Tax Collection Cuts Deficit

, Bloomberg News

(Bloomberg) -- Thailand is set to borrow less than previously forecast to finance the nation’s budget deficit this year as a better-than-expected rebound in economic activities buoy tax collections, according to a government official.

The fund-raising required to bridge the shortfall is seen below the 695 billion baht ($20.7 billion) penciled in the budget for the fiscal year that started on Oct. 1, Public Debt Management Office Director-General Patricia Mongkhonvanit said. The government will issue fewer promissory notes and reduce borrowing through term loans this year while keeping the overall bond-sale plan intact, she said.

“We are quite positive about” the prospects of borrowing less, Patricia said in an interview on Wednesday. “We will use short-term instruments to adjust the plan, but won’t touch the bond supply.”

Southeast Asia’s second-largest economy is forecast to buck a global slowdown and is set to post the highest growth rate in five years as it benefits from an upswing in local consumption and an influx of foreign tourists. That’s helped the government beat its revenue collection target in the first quarter, a trend officials say will continue for the rest of the year.

Prime Minister Prayuth Chan-Ocha expects Thai economy to expand 4% this year, the highest rate of growth since 2018. Revenue collections jumped about 19% in the three months through December, prompting the debt office to slash deficit financing by 28% to 221 billion baht during the period. The budget deficit also narrowed 22% from a year earlier to 408 billion baht, according to finance ministry data.

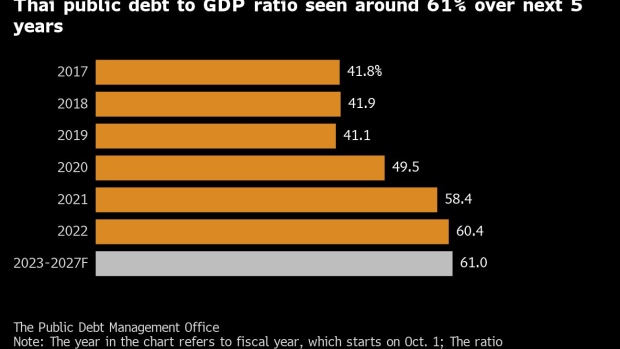

Thailand’s public debt to GDP ratio is unlikely to fall below 60% over the next five years because of the 1.5 trillion baht borrowed to deal with the fallout of the Covid-19 outbreak, Patricia said. It may hover between 61% and 62% unless a new government decides to borrow big to finance its plans, she said.

The public debt stood at 10.6 trillion baht, or 60.7% of Thailand’s GDP, at the end of last year, official data show.

“Our key challenge is refinancing risk as we need to make sure the debt maturity spans out properly and won’t create too much burden ant any particular period,” Patricia said.

The debt office plans to focus on widen the maturity period of its outstanding debt over the next three years by turning to pre-funding and bond switching programs as key instruments, Patricia said. The target is to increase the average time-to-maturity of its debt portfolio to 10 years from around eight years now, she said.

Other key points from the interview:

- PDMO plans to issue as much as 10 billion baht promissory notes by May based on Thai Overnight Repurchase Rate, known as THOR, as a pilot project to promote the nation’s new reference rate

- Thailand is unlikely to issue dollar bonds for now as overseas borrowing cost is much higher than the local rates where liquidity remains ample

- PDMO isn’t concerned about rising interest rate as 85% of the government debts are tied to fixed-rates

©2023 Bloomberg L.P.