May 31, 2023

Thailand Raises Key Rate to 8-Year High to Win Inflation Fight

, Bloomberg News

(Bloomberg) -- Thailand’s central bank raised its benchmark interest rate to the highest level in eight years, while making a case for retaining a tightening bias to anchor inflation firmly in the tourism-fueled economy.

The Bank of Thailand’s Monetary Policy Committee voted unanimously to raise the one-day repurchase rate by 25 basis points to 2% on Wednesday, as seen by 22 of 24 economists in a Bloomberg survey, with two predicting no change. The key rate was at 2% back in January 2015.

Short-term inflation may moderate, but the MPC still sees upside risk to prices from later this year, Assistant Governor Piti Disyatat said at a briefing after the decision. “It’s still appropriate to continue the current strategy that we have adopted,” he said, given the uncertainty on the new government’s policies and a need to monitor how they will affect prices.

Although headline inflation has eased every month since January, returning within the BOT’s 1%-3% target in March, the central bank has emphasized the need to keep price gains in check over time. The key risks are increased consumption from a tourism-led pickup in economic activity and possibly higher spending by a new government following the May 14 election that saw several populist political pledges.

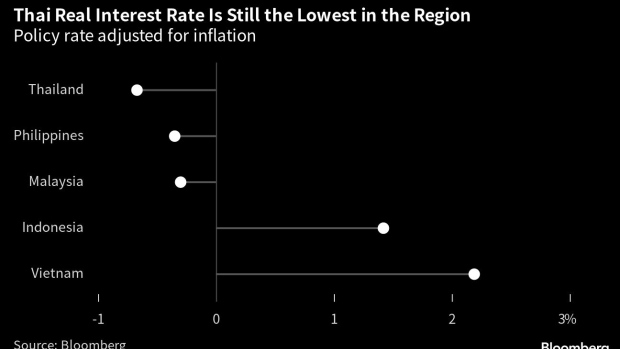

Wednesday’s tightening will help narrow Thailand’s real interest rate to a negative 0.67% from a negative 0.92% previously — still making it Southeast Asia’s lowest after adjusting for prices.

“Thailand should have positive real interest rate when economy returns to equilibrium,” Piti said. “Now we are not 100% normal yet. Even if our economy has returned to pre-Covid level, we still have a gap to reach potential growth.”

The Thai baht traded 0.1% higher at 3:40 p.m. local time. It has weakened more than 1.5% in the past month.

Foreign investors have turned net sellers of local bonds and stocks on concerns about possible delay in formation of a new government, which will affect budget spending and investment.

The rate panel is closely monitoring financial markets and for signs of volatility, according to the BOT statement, which underlined the authority’s focus on maintaining price stability and enabling sustainable economic growth.

What Bloomberg Economics Says...

It kept a tightening bias but signaled its preparedness to adjust the size and timing of “normalization” depending on indications for growth and inflation. This suggests a shift to a data-driven stance.

— Tamara Mast Henderson, Asean economist

For the full note, click here

The BOT sees a steady pace of economic expansion, with growth forecasts for this year and the next retained at 3.6% and 3.8%, respectively. Cooling price gains prompted the central bank to lower its 2023 inflation view to an average of 2.5% from 2.9% seen in March.

“The Committee recognizes upside risks to domestic growth, in part owing to forthcoming government economic policies,” the central bank said. “At the same time, there is a need to monitor the uncertain economic and monetary policy outlook of major economies.”

The Thai decision came shortly after a US central bank official signaled the need for more tightening. Federal Reserve Bank of Cleveland President Loretta Mester told the Financial Times that she sees no “compelling reason” to pause interest-rate increases. The only reason for skipping a rate increase when it is clear more tightening is necessary would be extreme market volatility or some other shock, she said.

--With assistance from Tomoko Sato, Pathom Sangwongwanich, Anuchit Nguyen, Patpicha Tanakasempipat and Napat Kongsawad.

(Updates with details throughout.)

©2023 Bloomberg L.P.