Jan 7, 2021

Thailand Skipped Lockdown to Save Economy, But Growth Takes Hit

, Bloomberg News

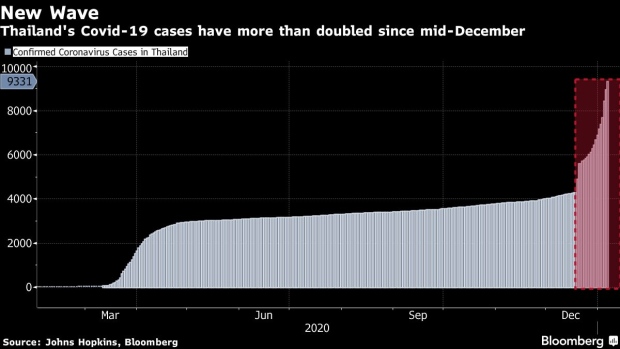

(Bloomberg) -- Thailand’s latest virus outbreak is likely to crimp consumer spending and delay a tourism revival, prompting warnings the economy may undershoot expectations for a rebound this year and next.

Thailand hopes to avoid a full national lockdown to stem a wave of infections that began in mid-December and has spread to more than 50 of 77 provinces. Prime Minister Prayuth Chan-Ocha this week ordered some businesses to close and curbed travel in the worst-hit regions, as opposed to the hard lockdown imposed to quell the initial outbreak last March.

A prolonged outbreak would likely hurt consumer spending as people curtail travel and shopping, weakening an economy already hard hit by international travel restrictions. Data Thursday showed consumer confidence fell to a five-month low in December as infections spread.

“This outbreak won’t be contained quickly like last year, because we traded off a full lockdown for the sake of the economy,” said Somprawin Manprasert, chief economist at Bank of Ayudhya Pcl. “It will last a while. This will be a marathon, not a sprint.”

Bank of Ayudhya hasn’t yet tweaked its forecast for 3.3% gross domestic product growth this year, but sees additional downside risks, Somprawin said. If a lockdown is needed, a month-long closure could shave 0.5 to 1.5 percentage points off GDP, while a two-month shutdown could wipe out growth altogether, he said.

On Wednesday, the Bank of Thailand said the new outbreak has been more severe than expected and makes it more likely the economy will undershoot its baseline forecasts for 3.2% growth this year and 4.8% next year.

The government is mindful of the economic impact and has about 200 billion baht ($6.7 billion) to spend to cushion the blow, said Danucha Pichayanan, secretary general of the National Economic and Social Development Council. Policy makers will unveil specific measures within two weeks, he said.

Thailand was among the worst-hit economies in Asia last year after a three-month lockdown caused growth to contract a record 12.1% in the second quarter. The economic council forecast GDP to shrink 6% for all of 2020.

“A lockdown that stops transport, logistics and export activities will affect growth more than a lockdown that restricts travel,” Somprawin said. “The current control measures are focused on limiting people’s interaction, which could affect consumption but doesn’t affect the supply of goods.”

After unveiling a 1.9 trillion baht stimulus package last year, policy makers still have space to ramp up spending and extend programs to prop up domestic consumption.

“The quick reimbursement and spending subsidy on travel and goods purchases has really provided some support to domestic consumption,” said Komsorn Prakobphol, senior investment strategist at Tisco Financial Group Pcl. “If the government accelerates the already approved budget, it would offer a good cushion to the economy.”

Currency Hurdle

Another hurdle is the strong baht, which has resisted Bank of Thailand efforts to curb its gains. The local currency has rallied about 10% from last April’s 17-month low, and the central bank has said continued rapid appreciation will hurt the economy.

A stronger baht is “the main reason why the Thai stock market and economy have lagged other Asian countries,” Tisco’s Komsorn said. “The BOT has limited scope to deal with it because the dollar’s outlook is very weak.”

Thailand is still months away from securing enough vaccines to inoculate its population, potentially delaying any reopening to foreign visitors.

“The recent resurgence of Covid-19 cases in Thailand as well as globally could put a dent in the recovery anticipated for the first quarter,” Billy Toh Kian Hin, an economist at RHB Bank Bhd., said in a note. The latest outbreak “is a reminder that the recovery ahead would be a long and uneven path.”

©2021 Bloomberg L.P.