Mar 30, 2023

The $59 Billion Swiss Franc Debt Sales Market Is Up for Grabs

, Bloomberg News

(Bloomberg) -- For the past two decades, Credit Suisse Group AG dominated the business of arranging Swiss franc bond sales. Its sudden collapse presents an opportunity for the likes of Deutsche Bank AG and BNP Paribas SA in a market that saw $59 billion in deals last year.

Some of the business will probably be picked up by acquirer UBS Group AG, but given that they already arrange a quarter of so-called Swissie sales — and because it’s not clear what the debt sales business will look like in the merged bank — there may be an opening for others.

Deutsche Bank, Commerzbank AG and BNP Paribas, which are already active in the Swissie market, are likely to compete for international issuance, people familiar with the matter said. Regional lenders such as Raiffeisen Schweiz and Zürcher Kantonalbank will probably pick up some of the domestic issuance, the people added.

A spokesperson for Zürcher Kantonalbank said in an email that the bank expects to consolidate its position in the business of arranging bonds for Swiss issuers after the merger of Credit Suisse and UBS.

Credit Suisse, Deutsche Bank and BNP Paribas declined to comment. UBS, Commerzbank and Raiffeisen Schweiz didn’t immediately respond to requests for comment.

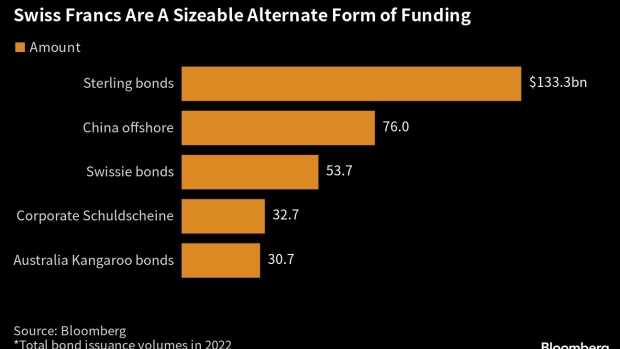

The Swissie market is fairly niche — less than half the size of the UK sterling market — but it’s a lucrative fee pool for banks, and the upheaval at such a prominent player shows the ripple effects of the UBS takeover in many different corners of financial markets. Issuers like Verizon Communications Inc. and Royal Bank of Canada are typically drawn to the market because of its maturity and dependable investor base.

The opportunity for rivals comes as UBS navigates the biggest banking takeover since 2008. The Swiss bank is aiming to cut thousands of jobs and reduce costs by more than $8 billion over the next few years. All that turmoil may lead executives that want to raise money in Swiss francs to look at using other banks.

“Credit Suisse was an important player, especially when it comes to bringing foreign issuers into the market,” said Markus Thoeny, head of Swiss fixed income at Lombard Odier Investment Managers. “However, we are confident that other banks will be able to close this gap in the future.”

Credit Suisse was the top arranger of Swiss franc bond issuance every year since at least 1999, according to data compiled by Bloomberg. In 2022, it was overtaken by UBS, but was still credited for about 30% of sales.

Credit Suisse is still arranging bond sales at the moment, and led a 150 million Swiss franc, five-year deal for real estate firm Allreal Holding AG, alongside UBS and ZKB, on Wednesday.

Read more: Credit Suisse Takeover Hands Swiss Business a Big Headache

The fee pool for the Swiss bond market may tempt other international banks to try to get involved. Fees are typically around 1 cent per franc raised on three-year bonds, 1.5 cents on five-year bonds and 2 cents on 10-year bonds, one of the people said. At the midpoint, that puts the fee pool last year at around 875 million Swiss francs.

The banks also make fees on associated derivative transactions such as the swap market when international borrowers switch from Swiss francs to their currency of choice.

--With assistance from Tasos Vossos.

(Adds chart on market share of Swiss franc bond issuance)

©2023 Bloomberg L.P.