May 26, 2023

The AI Stock Frenzy Stands to Boost the Dollar, Barclays Says

, Bloomberg News

(Bloomberg) -- The emergence of artificial intelligence is adding yet another reason for the US dollar to surge.

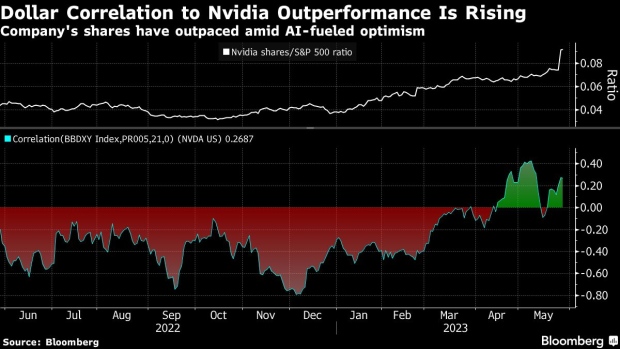

That’s the argument, at least, of analysts at Barclays Plc, who’ve noticed a correlation in recent weeks between the greenback and a proxy for AI-linked stocks they created. As they see it, it’s an early sign that global investors are pouring into US stocks that use the nascent technology — and spurring positive momentum for the dollar

“While the evidence is tentative,” wrote Themistoklis Fiotakis and others in a note, “the enormous impact that the rise of US tech stocks have had on the dollar over the past decade via a surge in US equity inflows and net foreign liabilities gives us pause for thought.”

The appeal of the up-and-coming technology has started to power US equities, especially in the wake of Nvidia Corp.’s recent AI-fueled sales forecast. The outlook blew Wall Street’s targets out of the water and pushed the firm closer to a $1 trillion markets capitalization.

To Barclays, the impact of stock trends on currency markets is often underestimated. Plus, the surge in foreign ownership of US assets — especially tech shares — since the global financial crisis is among the reasons for the rise in dollar valuations, the analysts wrote.

A Bloomberg gauge of the dollar has soared 14% since the end of March 2009, with the S&P 500 Index up more than 400% in the same period.

Even so, Fiotakis and his colleagues have a caveat as AI weasels its way into investor strategies and develops a tentative correlation with the greenback.

“To be sure, this could be random, temporary and circumstantial,” they wrote. “But if the recent result from Nvidia reflects a potential new trend in US tech, then we think it is fair to question whether there will be a revival of a tech bid for the US dollar.”

--With assistance from Robert Fullem.

©2023 Bloomberg L.P.