Mar 5, 2020

The Airline Industry’s Virus Woes Seep Into a Bond Market Haven

, Bloomberg News

(Bloomberg) -- Even one of the world’s safest financial havens isn’t totally immune from the coronavirus.

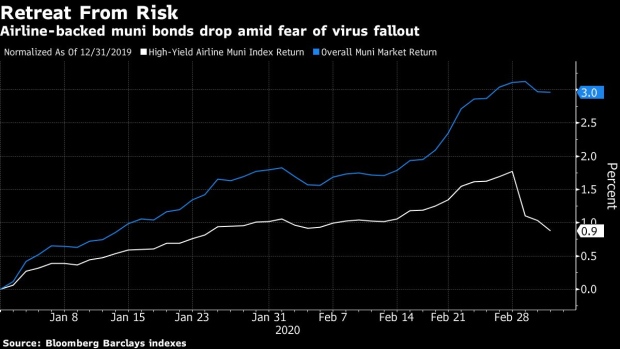

Investors have been demanding bigger yields on state and local government bonds backed by U.S. airline companies, which are already showing signs of being hurt by a slowdown in travel brought on by the widening outbreak. The Bloomberg Barclays index of lower-rated municipal debt tied to airlines -- including those secured by lease payments they make on airport terminals -- has slid for the past three days, driving it to a loss of 0.88% this month, nearly triple that of the broader municipal junk-bond market.

“It might just be prudent to be cautious on airports in the short-term,” said Peter Stettler, a director for Piper Sandler, an underwriter and investment management firm.

The growing number of cases worldwide and in the U.S. has prompted businesses and vacationers to scale back their travel plans. United Airlines Holdings Inc. and JetBlue Airways Corp. are cutting their number of flights and Southwest Airlines Co. said it expects the epidemic to reduce its first-quarter revenue. The International Air Transport Association Thursday projected the impact of the coronavirus will cost the airline industry $63 billion to $113 billion in lost revenue this year, up from an estimate for a $30 billion loss just two weeks ago.

United Airlines-backed debt issued by the California Municipal Finance Authority that financed a new aircraft maintenance and ground services complex at Los Angeles International Airport traded Thursday at a yield of 2.17%, or about 1.3 percentage points more than top-rated bonds with the same maturity. On Feb. 20 investors demanded a 0.7 percentage point premium.

American Airlines-backed bonds issued in 2016 by a New York agency related to the construction of its terminal at New York’s John F. Kennedy International Airport traded at yield of 2%, about 0.8 percentage point more than where Bloomberg Valuation pegged that spread on Feb. 28.

It’s impossible to judge whether the virus will have a long-term impact, given the lack of certainty about how much it will spread and how severely it affects economic growth. But Piper Sandler has recommended that investors pare their exposure to airports for the short term, especially given how high prices ran up amid the market’s rally over the past few years.

“We expect that to continue but over the next couple of months as this plays out we might see a decline in passenger volume,” Stettler said. “It’s a short-term cautionary play.”

To contact the reporters on this story: Shruti Date Singh in Chicago at ssingh28@bloomberg.net;Martin Z. Braun in New York at mbraun6@bloomberg.net

To contact the editors responsible for this story: Elizabeth Campbell at ecampbell14@bloomberg.net, William Selway, Allan Lopez

©2020 Bloomberg L.P.