Oct 22, 2019

The Bar Might Not Be Low Enough for Some Companies

, Bloomberg News

(Bloomberg) -- It’s that time of the year again. Companies have started to make adjustments to their annual outlooks and while we’ve had some painful profit warnings from the likes of Renault and Danone, all is not lost for European earnings, with Novartis raising its profit forecast this morning. All in all, the bar has been lowered going into this earnings season, but it still might not be low enough for some companies.

“The upcoming earnings season will be shaky, as we expect that negative surprises will be sharply sanctioned,” says Cedric Ozazman, Head of Investments and portfolio management at Reyl Group. Indeed, looking at last Friday’s sharp moves on Renault, Danone, Thales or Temenos, such warnings came as a surprise for some investors. On the plus side, LVMH and SAP experienced decent buying pressure after posting strong results.

For JPMorgan strategists, the current earnings season shouldn’t derail their bullish view overall, mostly because the bar is quite low and the macro backdrop is stabilizing, they say. Profit growth expectations for the second half of this year are now lower than what was delivered in the first half, a historically unusual situation. This might be too pessimistic and we could see a positive surprise like in the second quarter, they say.

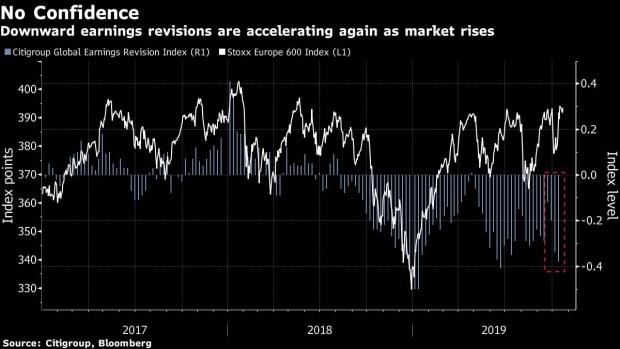

Golmdman Sachs analysts are not that bullish and say EPS growth remains lackluster across regions, and they see further downside risks in Europe. That’s why they remain neutral into year-end. Looking at the Citi EPS revision index, analysts have continued to downgrade earnings heavily.

The bar may be low, but not low enough according to UBS analysts, particularly for 2020. While earning growth estimates for 2019 may have fallen from 8.4% in January to 1% currently, the consensus still expects 10% EPS growth for next year, when UBS’s top-down models point to a drop of 4% in profits. As for the third quarter, UBS says to watch margin pressure and FX headwinds. A silver lining could be that the worst of downgrades for cyclicals might be behind us, they say.

Still, it doesn’t faze JPMorgan strategists, who write this is nothing unusual to see consensus forecasts of this magnitude one year out.

In the meantime, Euro Stoxx 50 futures are little changed, while S&P 500 contracts are up 0.2% ahead of the European open.

SECTORS IN FOCUS TODAY:

- Watch miners and steelmakers after a small rise in iron ore, a continued decline in nickel and as tensions in Chile impact copper markets.

- Watch the pound and U.K. stocks as U.K. Prime Minister Boris Johnson will put his deal to parliament vote later today. The long-term case for pound bulls is arguably still strong, while U.K. stocks are finally “investable” again, according to analysts at Morgan Stanley.

- Watch trade-sensitive sectors as President Trump said China indicated that negotiations over an initial deal are advancing. In a positive sign on global trade, A.P. Moller-Maersk A/S, the world’s largest container carrier, raised its 2019 profit forecast on Monday.

COMMENT:

- “Despite performing in-line with the S&P 500 so far this year, the Euro Stoxx 50 index continues to face challenges,” Bloomberg Intelligence strategists Laurent Douillet and Tim Craighead write in a note. “Looser monetary policies have enabled European equities to shrug off bad news and ride the wave of lower bond yields. Though the index’s higher valuation multiples appear justified by a safer sector composition vs. history, and lower rates, earnings expectations for next year remain high and will be tested by the economic malaise. Our fair value for the index, derived from our quantitative models, is 8% below the current level, driven mainly by lower EPS forecasts.”

NOTES FROM THE SELL SIDE:

- TUI shares may have reacted positively to the collapse of Thomas Cook and a diminishing Brexit risk, but guidance for FY20 is likely to be wide and below consensus on demand uncertainty and grounding of Boeing 737 MAX aircraft, Morgan Stanley says in note as cuts to equal-weight.

- Maersk’s raised 2019 Ebitda forecast was at least partly expected, and indicates an increasing cost focus ahead of $2b higher bunker costs under IMO 2020 and a fragile FY20 market balance, Jefferies (buy) says.

- AIB Group investors have long been skeptical about the prospect of the Irish lender returning excess capital, but that could now be getting closer to reality, Berenberg (buy) writes in a note.

COMPANY NEWS AND M&A:

- Novartis Raises 2019 Sales, Operating Income Guidance (2)

- UBS Pulls in $16 Billion From Rich Clients as Assets Hit Record

- Banco Santander to Sell Lender in Puerto Rico for $1.1 Billion

- Thales 9-Month Order Intake EU10.4b; Organic Change -6%

- Reckitt Third Quarter Like-for-like Sales Miss Estimates

- AMS Fourth Quarter Revenue Forecast 4.5% Above Estimates

- Imerys Says CEO Keijzer Resigns, Lowers 2019 Outlook

- Malone’s $6.4 Billion UPC Sale Unravels as Sunrise Cancels Vote

- Randstad Sees 4Q Gross Margin Slightly Lower Sequentially (1)

- Telecom Italia Names Former Central Banker Rossi as Chairman

- Galp Third Quarter Adjusted Net Misses Estimates

- Kuehne + Nagel 9m Ebit +6.6% Y/y; Joebstl Purchase Price CHF23m

- Enagas Nine Month Net Income EU333.1 Mln Vs. EU325.7 Mln Y/Y (1)

- BioMerieux Sees FY Sales Growth at Bottom of Previous Range

- Software AG 3Q Ebit EU59 Mln, +8.3% Y/y; Outlook Confirmed

- Klepierre 9M Gross Rental Income EU936M; Confirms FY Guidance

- Logitech Second Quarter Operating Income Misses Lowest Estimate

- Villar Mir in Talks to Sell OHL Stake to Amodio: Expansion

- Aker BP Third Quarter Loss Wider Than Estimates

TECHNICAL OUTLOOK for Stoxx 600 index:

- Resistance at 395.1 (July high); 397.9 (June 2018 high)

- Support at 383.3 (50-DMA); 378.7 (200-DMA); 365.5 (50% Fibo)

- RSI: 60

TECHNICAL OUTLOOK for Euro Stoxx 50 index:

- Resistance at 3,636 (February 2018 high); 3,687 (January 2018 high)

- Support at 3,519 (76.4% Fibo); 3,471 (50-DMA); 3,403 (61.8% Fibo)

- RSI: 61.6

MAIN RESEARCH AND RATING CHANGES:UPGRADES:

- KGHM raised to neutral at JPMorgan; PT 81 zloty

- Poste Italiane raised to buy at Goldman; PT 13 euros

- SSE raised to buy at HSBC; PT 1,480 pence

- Tomra raised to hold at SEB Equities; PT 220 kroner

- Umicore raised to overweight at JPMorgan; PT 42 euros

DOWNGRADES:

- Atlas Copco cut to sell at Pareto Securities; PT 320 kronor

- Lanxess cut to neutral at JPMorgan; PT 60 euros

- Lloyds cut to neutral at Citi

- Maersk cut to hold at Fearnley; PT 8,100 kroner

- Sabre Insurance cut to add at Peel Hunt

- TUI cut to equal-weight at Morgan Stanley; PT 1,050 pence

INITIATIONS:

- Amundi reinstated underweight at Barclays; PT 57 euros

- CD Projekt rated new equal-weight at Barclays; PT 260 zloty

- CYBG rated new buy at HSBC; PT 160 pence

- Capital & Regional reinstated hold at Peel Hunt; PT 28 pence

- DWS reinstated overweight at Barclays; PT 34 euros

- Inficon rated new buy at Jefferies; PT 759 Swiss francs

- JEMI LN rated new buy at Investec

- Metro Bank rated new hold at HSBC; PT 180 pence

- Pfeiffer Vacuum rated new hold at Jefferies; PT 140 euros

- SIT SpA rated new outperform at Mediobanca SpA; PT 9 euros

MARKETS:

- MSCI Asia Pacific up 0.4%, Nikkei 225 up 0.2%

- S&P 500 up 0.7%, Dow up 0.2%, Nasdaq up 0.9%

- Euro up 0.04% at $1.1154

- Dollar Index down 0.05% at 97.28

- Yen up 0.02% at 108.6

- Brent down 0.2% at $58.9/bbl, WTI down 0.2% to $53.2/bbl

- LME 3m Copper up 0.1% at $5833/MT

- Gold spot little changed at $1484.9/oz

- US 10Yr yield up 5bps at 1.8%

ECONOMIC DATA (All times CET):

- 10am: (SP) Aug. Trade Balance, prior -2.49b

- 10:30am: (UK) Sept. Public Finances (PSNCR), prior 6.4b

- 10:30am: (UK) Sept. Central Government NCR, prior 5.6b

- 10:30am: (UK) Sept. Public Sector Net Borrowing, est. 8.9b, prior 5.8b

- 10:30am: (UK) Sept. PSNB ex Banking Groups, est. 9.7b, prior 6.4b

- 12pm: (UK) Oct. CBI Trends Total Orders, est. -30, prior -28

- 12pm: (UK) Oct. CBI Trends Selling Prices, prior 12

- 12pm: (UK) Oct. CBI Business Optimism, est. -30, prior -32

--With assistance from James Cone.

To contact the reporter on this story: Michael Msika in London at mmsika4@bloomberg.net

To contact the editor responsible for this story: Blaise Robinson at brobinson58@bloomberg.net

©2019 Bloomberg L.P.