Apr 15, 2021

The Battery-Powered Future Depends on a Few Crucial Metals

, Bloomberg News

(Bloomberg) --

In the big, exciting future that’s measured in kilowatt- and gigawatt-hours, batteries are enabling mass electrification across many sectors. The rapid decline in battery prices has ensured burgeoning interest from electric-vehicle makers and consumer-electronics manufacturers—even from the energy industry, for enormous stationary storage systems operating on the power grid.

Companies such as QuantumScape Corp. are developing next-generation batteries that could accelerate the transition. The field is so competitive that the industry is shrouded in secrecy, but the market still values the company at more than $16 billion despite no promise of real revenue for many years to come.

In an exclusive story this week, Bloomberg Green went inside QuantumScape to tell the previously unreported 10-year history of one startup’s push to beyond the lithium-ion technology that has dominated batteries since the 1990s. The process involved round-the-clock laboratory work—backed by hundreds of millions of dollars in venture capital and investment, including from Volkswagen AG, the world’s largest automaker—to create new materials. The goal: a solid-state battery capable of charging faster and driving up to 50% further than today’s battery technology.

It will be years before any battery breakthroughs reach the mass market. But it’s already virtually certain that rising demand for existing lithium-ion batteries will be exponential and can be matched by manufacturers only if the materials used to make batteries—primarily lithium, cobalt, and nickel—are also supplied adequately. These curves will become steeper in the decade ahead. Just take a look at six charts that show where things are headed.

Electrification has become a key theme for automakers in the U.S. and Europe. While it was barely mentioned a decade ago, company executives are increasingly talking up batteries and electric vehicles to investors.

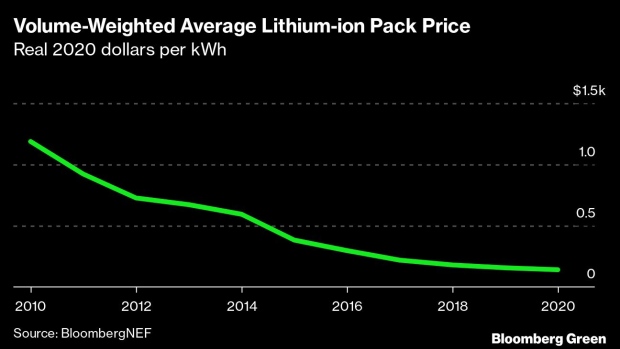

The rapid decline of battery costs over the past decade has surprised even the most optimistic analysts. That has played a crucial role in opening up new markets for batteries to find applications.

Electric cars will be the biggest force behind the boom in demand for batteries this decade. But batteries will also increasingly be used for smaller vehicles like scooters, commercial vehicles and to store electricity from the grid.

The decline in battery prices have helped grow the investment case for storing electricity. Companies and financial firms are now investing over $100 billion a year on energy storage and the electrification of transportation.

All the energy stored in a growing number of batteries will require a significant increase in a few key metals, lithium, cobalt and nickel.

Akshat Rathi writes the Net Zero newsletter on the intersection of climate science and emission-free tech. You can email him with feedback.

©2021 Bloomberg L.P.