Oct 22, 2022

The Bitcoin Futures ETF at 1: $1.8 Billion Lured, Over Half Lost

, Bloomberg News

(Bloomberg) -- A year on from its blistering debut, America’s first Bitcoin futures ETF has been an almost unqualified success, unless of course you’re invested in it.

Operationally speaking, it’s performance has been near-flawless. A slew of worries over cryptocurrency volatility, the depth of the market for futures and the cost of rolling its underlying contracts have all fallen by the wayside in 12 months of solid functioning for the ProShares Bitcoin Strategy ETF (ticker BITO).

The ETF has enjoyed strong demand from loyal investors and in return has -- as promised -- successfully tracked the biggest digital asset.

It’s performance, on the other hand, is another story.

The fund has slumped over 70% since its launch, tracking a crypto collapse that dragged Bitcoin to around $20,000. At a year old, BITO has posted cumulative inflows of more than $1.8 billion, and yet as of Friday had just $619 million left.

“It’s been a bad year -- we’re looking at $1.2 billion burned,” said James Seyffart, a Bloomberg Intelligence analyst. “But if you just want exposure to Bitcoin, BITO is the best option in the ETF landscape, at least in the US.”

And investors have piled in. In the 12 months since the launch, only two saw outflows, even as digital-asset prices cratered.

BITO’s inauguration last year was a watershed moment that saw the fund notch a number of superlatives: its debut was the second-most heavily traded on record, and it reached $1.1 billion under management in just two days, a record. For crypto investors, it was memorable because it marked a big step by the industry into the staid world of traditional finance. On the back of the enthusiasm surrounding the launch, Bitcoin’s price rallied to new peaks, touching nearly $69,000 a few weeks later.

But, the ETF wasn’t exactly what die-hard fans had wanted. The fund doesn’t hold Bitcoin directly. Instead, it is based on futures contracts and was filed under mutual fund rules that Securities and Exchange Commission Chairman Gary Gensler had said provided “significant investor protections.”

US regulators have been hesitant to approve a product that tracks the real coin, citing volatility and manipulation, among other things.

Luckily for BITO, fears about its roll costs -- which are associated with having to continually roll futures forward as they expire, and which was a feature that proved to be a source of much hand-wringing at the fund’s debut -- have been largely unfounded.

“One could certainly argue that BITO has actually worked and performed as intended all while offering investors an SEC-approved wrapper with the convenience, liquidity and transparency of an investable ETF,” said Gregory d’Incelli, co-founder of Scenius Capital Management.

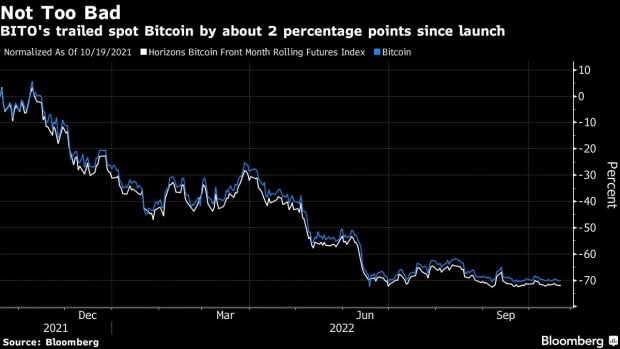

Bloomberg Intelligence had estimated that maintaining exposure to the front-month contract would cost investors 10 to 20 percentage points of performance per year, and issuers such as Bitwise Asset Management nixed plans on their own Bitcoin futures ETF over those potentially expensive costs. Instead, BITO has trailed the performance of spot Bitcoin by just about two percentage points in the past year, Bloomberg data show.

The late 2021 premiere was also inopportune as crypto prices have since floundered. Bitcoin has suffered as the Federal Reserve and other central banks raised interest rates, creating a less-favorable environment for riskier assets.

“BITO is one of the most ill-timed ETF launches in history, with its debut nearly perfectly coinciding with the price of spot Bitcoin topping out,” said Nate Geraci, president of The ETF Store, an advisory firm. “The upside of that extremely poor timing is that the Bitcoin futures curve flattened out, minimizing the negative impact of rolling contracts every month.”

But overall, all the pearl clutching over the fund’s suboptimal futures-based structure is still warranted, according to Geraci.

“The bottom line is that BITO still underperformed -- even during an absolutely brutal crypto winter.” If, and when, the crypto space turns around, he said, “expect the futures curve to steepen and the negative performance gap between BITO and spot Bitcoin to widen.”

“Meanwhile...Still. No. Spot. Bitcoin. ETF.”

--With assistance from Sam Potter.

©2022 Bloomberg L.P.