Jan 28, 2020

The Daily Chase: Stocks stabilize; U.K. limits Huawei's role in 5G

By Noah Zivitz

Global stocks are stabilizing this morning after yesterday’s selling pressure that sent the TSX composite index and S&P 500 to their biggest declines since October. There are now at least 106 dead and more than 4,500 confirmed cases of coronavirus in China and authorities are restricting travel to and from Hong Kong as containment efforts widen. As earnings season heats up today with names like Apple and CN Rail on deck, we’ll watch for any commentary about how they’re being affected by the outbreak, if at all.

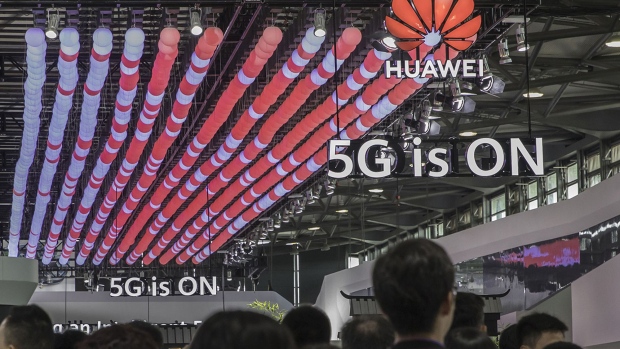

U.K. LIMITS HUAWEI’S ROLE IN 5G

Boris Johnson’s government today announced Huawei will be granted a limited role in developing the United Kingdom’s 5G infrastructure. The Chinese telecom giant, described as a “high risk vendor,” will be barred from the core of networks while facing a 35 per cent cap on involvement in “non-sensitive” elements of the next-generation technology. In a statement via Twitter, Huawei said it’s “reassured ... [by] this evidence-based decision.” More details here and we’ll explore how this might set the stage for the decision facing Justin Trudeau’s minority government in Ottawa. Good time to refer back to what BCE CEO Mirko Bibic told us earlier this month about his desire for “clarity” from the feds while touting Huawei’s gear as “top notch”: (standard disclaimer: BNN Bloomberg is owned by BCE through its Bell Media division)

MEDIPHARM-HEXO FALLOUT

If you missed it, David George-Cosh’s sleuthing allowed him to solve the mystery around MediPharm Labs’ legal tussle with Hexo, whose identity wasn’t reported until DGC tracked down a statement of claim. In ensuing reports to clients, MKM Partners analyst Bill Kirk downgraded shares of Hexo, pointing to Dave’s reporting as “the straw that has broken our back” on the pot producer; meanwhile, Desjardins analyst John Chu underscored in his note that Hexo is “refusing to pay rather than being unable to pay” the tab for a cannabis oil sales pact.

GOLD DEAL GOES TO VOTES

Shareholders of Kirkland Lake Gold and Detour Gold will have their say today on the proposal for them to join forces. That arrangement was unveiled on Nov. 25, with Kirkland offering 0.4343 of a share for each Detour share. Leading proxy advisory services have come out in favour of the takeover while Kirkland has lost 11% of its value since the deal was announced.

OTHER NOTABLE STORIES

-Superior Plus will be on our radar today after it is opting to hang on to its Specialty Chemicals unit after concluding a strategic review.

-Metro is nudging up its quarterly dividend, saying it’s “strong financial position” is allowing it to hike its payout range target. The company also reported a modestly higher first-quarter profit as it benefitted from the acquisition of Jean Coutu (pharmacy same-store sales rose 3.6 per cent versus 1.4 per cent for traditional food sales).

-A new Angus Reid Institute survey shows opposition to the Trans Mountain expansion project is rising in B.C., Ontario and Quebec, while support remains widespread in Alberta and Saskatchewan. Overall, 55 per cent of Canadians are in favour of the pipeline (down from 58 per cent in the previous survey).

-Bombardier reportedly has another unsatisfied customer with Deutche Bahn turning away 25 trains from the Montreal-based manufacturer, according to a local media report. In a statement to BNN Bloomberg, a spokesperson for Bombardier didn’t dispute the report and acknowledged certain trains “are currently on operating with the reliability expected…”

-3M shares are falling in pre-market trading after delivering a profit outlook and fourth-quarter earnings that largely fall short of expectations. It also announced plans to cut 1,500 jobs.

NOTABLE RELEASES/EVENTS

-Notable earnings: CN Rail, Metro, Pfizer, 3M, Lockheed Martin, United Technologies, Harley-Davidson, Apple, eBay, Advanced Micro Devices, Starbucks

-Notable data: U.S. durable goods orders

-10:00 a.m. ET: Parliamentary Budget Officer releases cost estimate of increasing the basic personal income tax credit

-Shareholder votes in Toronto on Kirkland Lake's proposed acquisition of Detour Gold (11:00 a.m. ET and 10:00 a.m. ET, respectively)

-12:00 p.m. ET: U.S. president Donald Trump delivers remarks alongside Israel PM Benjamin Netanyahu at the White House

-Statistics Canada releases report on representation of women on boards of directors (in 2017)

Every morning BNN Bloomberg's Managing Editor Noah Zivitz writes a ‘chase note’ to BNN Bloomberg's editorial staff listing the stories and events that will be in the spotlight that day. Have it delivered to your inbox before the trading day begins by heading to www.bnnbloomberg.ca/subscribe.