Apr 3, 2018

The future will destroy you: How streaming's past, present inform Spotify's market destiny

, BNN Bloomberg

“… And you may ask yourself, well: How did I get here?” – David Byrne, 1981

Spotify is finally making its public stock market debut.

The music streaming platform (SPOT.N) began trading on the New York Stock Exchange Tuesday providing a bold new step to a company that has proven a game-changer for online music consumption.

Unlike some of its maverick file-sharing and streaming predecessors, Spotify dishes out royalties to the labels and artists on its platform. And, unlike much of its current major competition, the platform is not backed by one of the FAANG behemoths.

Still, some experts believe the platform is primed to become the Netflix of the music streaming business.

“They’ve dominated the music industry in general in terms for distributing music [and] as being, I think, the most user-friendly and artist-friendly service. It’s grown to 71 million paid listeners, which is about twice that of Apple (Music) and they’ve put themselves in a wonderful position to dominate distribution of music over the internet, globally,” Ross Gerber, CEO and president of Gerber Kawasaki Wealth Investment Management told BNN in an interview in March.

Spotify made its online debut in 2006 as a peer-to-peer file sharing service and offered its users access to an online music library two years later as an alternative to paying for individual mp3 downloads via services like Apple’s iTunes.

The company has had agreements with major U.S. labels in place since 2011, which has in part allowed it to outlast some of its independent contemporaries – like Rdio or Pandora – as streaming-only platforms.

But the future – depending on who you ask – is either odd, unwritten or will just plain “destroy you.”

“The issue that Spotify faces is the same issue that Netflix faced three, four, five years ago where, yeah, it might be nice to distribute, but you have to buy your product from somebody else and, essentially, Spotify just loses money in this process,” Gerber said. “So, they’re going to have to get into original content, which means owning, and producing [music] and managing bands. And, they don’t know this yet, but there’s no money in the model that they currently have.”

“They have the potential to be a huge monster, if they do this right. Or, they could just be a money-losing hole in the wall like Pandora.”

One analyst, however, doesn’t think Spotify should be trying to be 'the Netflix of music.'

David Garrity, CEO of GVA Research, thinks the company should carve out its own niche in the music streaming space.

“One might say that maybe the bigger risk for Spotify over time is if they decide to diversify away from music and perhaps try to go after Netflix,” Garrity told BNN on Tuesday.

“Some people are saying that as long as Spotify stays within their lane, stays in the area that they know – online music and music creation – that they may actually stand a fair chance over the longer term of growing into a profitable company.”

So, it’s back to David Byrne’s 37-year-old prophecy... How did we get here?

To some, the idea of accessing music by going to an HMV or Tower Records and physically purchasing a compact disc seems antiquated. Memories of advanced listening stations and personal record booths are drenched in sepia and may just as well feature 8-track tapes for how long the music –consuming public is removed from physical media’s prime.

Yet, like cassettes replacing vinyl only to be eventually usurped by CDs, the whole thing is linear.

CDs, a digital storage, allowed the first file-sharing communities to crop up in the 1990s. This - along with a reluctance to pay $20 for an album you could get for free from someone else that had the files – helped give birth to Napster.

Napster, in turn, shook the music industry into thinking digital by changing the mp3 from a file format into a musical commodity. This also helped turn Apple into more than just a computer company, as Steve Jobs revolutionized the industry once more with the iPod and its ever-present mothership, iTunes.

But as technology moved away from the iPod and people (with the help of Apple’s iPhones) started realizing they no longer needed a dedicated player and were just as happy accessing it from mobile devices, the streaming era began.

Spotify has become the industry leader in terms of paid subscribers, but it certainly wasn’t the first to enter the space and, in all probability it won’t be the last.

--

THE ROAD TO (NOW)HERE

“Maybe, just maybe, you might challenge me. God needs the devil. The Beatles needed The Rolling Stones. Even Diane Sawyer needed Katie Couric.”

– Talladega Nights: The Ballad of Ricky Bobby, 2006

Spotify didn’t just appear out of the ether.

Some of what has made it the platform of choice for many listeners is based on developments from previous services. Likewise, it must fend off well-coffered competition from the likes of Amazon, Apple and Google… to say nothing of what may still be to come.

“The biggest question when it comes to streaming services is what their purpose is,” Siobhan Özege, a music industry professional with experience in both the streaming revenue and digital marketing fields told BNN.ca. “Is it exclusively for discoverability? Is it to help us replicate our physical media collections?”

“I think, having tried a number of these services, they leave a lot to be desired in terms of answering that question, with more leaning towards discoverability than replacing iTunes libraries or record collections.”

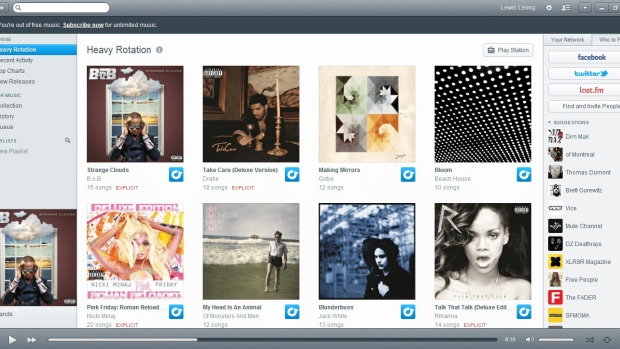

To take a look at the evolution of the streaming platform and what has informed Spotify’s ascent to becoming the platform du jour, one needs to take a look at the ghosts of streaming’s past and present.

Pandora

Launched in 2000 in conjunction with the Music Genome Project, Pandora offered a radio platform that tailored the user’s listening experience based on the elements of what they liked. Giving an artist like The White Stripes a thumbs-up would open the door to its influences and offshoots, including 1970s garage rock, late 90s indie or the delta blues.

Pandora IPO’d in 2011 and still exists today as Pandora Radio.

“They were basically first to market, but it feels like a series of failures to stick the landing,” Özege said. “Just look at their history of acquisitions, ways that they’ve changed their offerings, et cetera. Pandora is unique for its connection to radio, but rather than capitalizing on that, it feels like they want to compete with other services that already have better market penetration.”

Rdio

Rdio took Pandora a step further. It incorporated habit-based listening suggestions with a wider streaming platform that allowed the user more control over what they listened to, as opposed to simply offering a personalized radio stream.

After building a devoted user-base, it filed for chapter 11 bankruptcy in 2015, selling some intellectual property to Pandora.

“Rdio was really ahead of its time – especially its mobile offerings,” Özege said. “Current functionality on existing platforms still misses what Rdio got right. Unlike with Spotify, where you need to scroll through you entire catalogue before finding what you’ve marked as ‘downloaded,’ Rdio only showed what was in your offline collection, which made it easy to manage your music when offline.”

“I loved their “listen to more like x” function – it helped me discover a lot of great artists that were entirely in my wheelhouse.”

Spotify

What has made Spotify the platform to beat?

"Nothing ever happens in a straight line – the past ten years have certainly taught me that," Spotify CEO Daniel Ek wrote in a blog post on the company’s site on Monday.

While the platform has obtained ubiquity, it’s far from a finished product. Özege said the platform’s maximum number of songs available to each user in his or her library has the potential to cut out the die-hard listeners.

“As a heavy music user, I find the song cap on Spotify really frustrating,” she said. “If we’re hoping for streaming services to add value like our physical media collections did, we can’t really cap them. Rdio didn’t have a cap, which was great.”

Apple Music, Google Play, Amazon Prime Music

The FAANG companies are not about to let Spotify run unopposed.

While Apple’s current platform only dates back to 2015, its exoskeleton can be traced back to the birth of iTunes in 2001.

Google Play Music joined the party in 2011, while Prime joined the fray in 2014.

“Apple and other smartphone-tied services have the advantage of being already in the tech you’re using,” Özege said. “I only have experience using Apple Music, which I recently got rid of after several months of using it, for a few reasons, including poor user experience with playlists, the lack of a desktop option and issues syncing between devices.”

“That said,” she added, “Apple Music definitely has the best playlists out there. Whoever’s running that area is doing a great job.”

Tidal

Billed as an artists-first platform, Jay-Z, Beyoncé, Kanye West, Coldplay and others backed Tidal upon its 2014 unveiling.

The platform boasts access to better audio, but can also boast higher fees (US$19.99 for HiFi access as opposed $9.99 Canadian for Spotify Premium).

One of Tidal’s early advantages has been the caliber of artists willing to offer exclusivity: The platform was the first to get Beyoncé’s ground-breaking 2016 album Lemonade, as well as Kanye West’s ever-evolving The Life of Pablo.

Tidal is trying really hard to capitalize on the exclusivity that came from physical releases – the lining up for a product, or pre-ordering,” Özege said. “Unfortunately, I don’t know that it has the listener support so much as it has the star power.”

“That said, Tidal tends to have a lot of things that other services don’t have, which is an interesting dilemma as an artist,” she added. “Do you want your stuff made widely available, or exclusively? If it’s the latter, the platform itself needs to really draw people in beyond just top titles. It needs to have the functionality and catalogue to support it.”

HAVE YOUR SAY