Feb 19, 2019

The Mining Industry’s Waste Problem Will Only Get Worse

, Bloomberg News

(Bloomberg Opinion) -- It’s taken two tragedies in just over three years, but the mining industry is finally starting to clean up its act.

Brazil’s government Monday announced plans to ban upstream tailings dams, a low-cost method of storing mining waste implicated in last month’s Brumadinho disaster and the similar Samarco collapse in 2015. Something of the sort was already on the cards: State-controlled Vale SA, operator or joint-operator of both facilities, is already decommissioning all of its dams that use the technology. Chile, where earthquakes pose a particular threat to the stability of tailings ponds, banned upstream dams in 1970.

The move may be the bare minimum for the industry to protect itself. By their very nature, mining companies turn public mineral resources into private profits. When they’re seen to be dumping too much of the intervening costs back on the public (whether through pollution, disasters or inadequate cleanup) they risk being regulated out of existence. The Philippines, with one of the richest mineral endowments in the world, remains more or less off-limits to global miners after a series of tailings dam failures in the 1980s and 1990s prompted a popular backlash.

The obvious solution should be for miners to invest more in better waste-disposal methods and regain the public trust. But there’s good reason to think that’s going to get harder, not easier, in the coming decades.

One problem is that ore grades – the share of key minerals in the rock that’s dug from the ground – have been declining for decades. Elemental copper made up about 0.74 percent of copper ores mined in 2005, according to consultancy AME Group; by 2017, that had fallen to 0.59 percent:

That doesn’t sound very dramatic, until you consider it in the context of an industry that produces about 20 million metric tons of copper a year. On a back-of-the-envelope estimate, copper mines produced an additional 1.4 billion annual tons of extra waste in 2017 compared with 2005. About half of that can be attributed to grade decline, with the other half coming from increased production.(1)

While major miners have battled and even profited from grade decline by taking advantage of economies of scale to exploit bigger and lower-quality deposits than previously thought possible, the result has been a vast increase in tailings production, amounting to about 14 billion metric tons in 2010. In addition to increasing the volume of mining waste, that raises the costs of separating it from the valuable stuff, making cheap and risky disposal methods more attractive.

As a result, the most serious large-scale tailings dam collapses like those in Brumadinho and Samarco have actually been increasing in recent decades despite an overall decline in breaches, according to a database maintained by consultants Lindsay Newland Bowker and David Chambers.

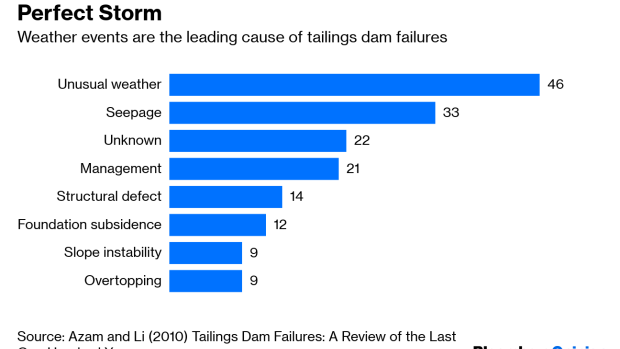

There’s another issue. Outside of earthquake zones, the biggest causes of tailings failures normally relate to water – the amount in the mineral slurry backed up behind the dam, the quantity entering the impoundment, and how much is being drained away to solidify the silty waste.

More pronounced wet and dry seasons increase the challenge of maintaining dams safely, by speeding the erosion of embankments and causing ground to expand and contract like a house on unstable foundations. Heavier downpours also raise the risk of major rainfall events that can push facilities beyond their design parameters, resulting in catastrophic failures.

Both factors are likely to get worse as a result of climate change. For instance, rainfall in Brazil’s Minas Gerais state, where both the Brumadinho and Samarco disasters occurred, is projected to intensify between January and March and lessen through the rest of the year, according to a 2017 study.

The results of these trends will be widespread. As Sanford C. Bernstein analyst Paul Gait wrote in a note to clients this week, tightening tailings regulation ultimately will mean that “capital costs for new mining projects will be higher, lead times on new project development will be longer, and the cost of capital for the industry, especially for mining juniors, has risen sharply.”

That’s not just a problem for mining companies. Ultimately it will get passed on to the prices of the commodities they produce. It may be a small and worthwhile penalty to prevent another Brumadinho, but we’re all going to end up shouldering it.

(1) Tailings aren't necessarily the same thing as waste rock. Miners typically dig through overburden to get at an ore body, which is stacked up as waste rock. At metal mines, the ore is then crushed and treated to release metal-heavy concentrates. The waste material from this process, mixed with water, goes to create tailings.

To contact the author of this story: David Fickling at dfickling@bloomberg.net

To contact the editor responsible for this story: Rachel Rosenthal at rrosenthal21@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

David Fickling is a Bloomberg Opinion columnist covering commodities, as well as industrial and consumer companies. He has been a reporter for Bloomberg News, Dow Jones, the Wall Street Journal, the Financial Times and the Guardian.

©2019 Bloomberg L.P.