Jun 9, 2023

The More Inflation the Better: This Little-Discussed Insurance Broker Is Having a Moment

, Bloomberg News

(Bloomberg) -- It’s enemy No. 1 inside the halls of the Federal Reserve, dreaded in cash-strapped households across America and a headache for CFOs at countless companies, big and small.

But bring up inflation with executives at Arthur J. Gallagher & Co., an insurance broker outside Chicago, and you’ll get a very different reaction. “We win,” says J. Patrick Gallagher Jr., the firm’s CEO.

How much does Gallagher win?

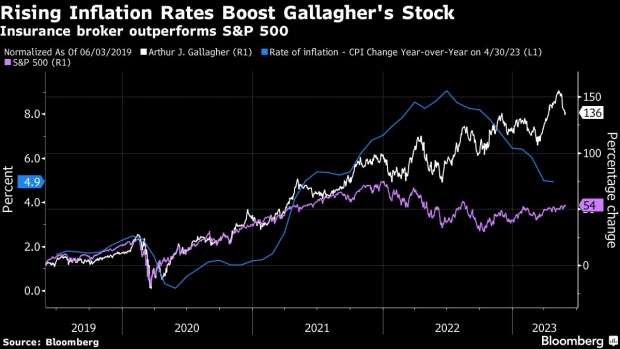

Since inflation started to take off at the start of 2021, its stock has soared 65%, almost five times the S&P 500’s gain. The firm’s brokerage revenue is up nearly 50%. Profits are up 40%.

This boom, Gallagher understands, is puzzling for many. So he’s quick to rattle off the reasons.

For one, the spike in home values and replacement costs fuels higher insurance premiums, which translates into more fees for the firm when it connects clients with policies. Second, the jump in interest rates — a byproduct of the inflation surge — boosts the return Gallagher gets on cash from clients it’s allowed to briefly hold. These revenue increases dwarf the hit they take on the cost side. Douglas K. Howell, the chief financial officer, estimates about 40% of the firm’s costs aren’t affected by inflation.

The stock’s rapid ascent underscores just how unevenly the inflation outbreak has coursed through the economy, picking out a handful of winners that have not only been spared the financial pain, but thrived.

Automakers, airlines and hotels, for instance, have all mastered the inflation game, finding little resistance from customers for rapid-fire price hikes that bolstered their profit margins.

But few have done quite as well as the insurance broker industry.

Gallagher, for instance, has quietly grown into a $44 billion company. “We’re one of the world’s best kept secrets,” Gallagher Jr. said in a Bloomberg Radio interview over the winter. And the stocks of the firm’s larger rivals, Marsh & McLennan Companies Inc. and Aon Plc., are up 50% and 48%, respectively, since the start of 2021. Unlike the insurers themselves, the brokers carry none of the underwriting risks associated with higher costs.

“They’ve proven themselves to be all-weather stocks,” said David Motemaden, an analyst at Evercore ISI.

There are, of course, plenty of risks to this boom. For one, the rate of inflation, while still high at an annual rate of 4.9%, has begun to come down. The more it slows, the more that quick-and-easy pass-through to revenue fades away. More importantly, the risk of a recession that financially squeezes the industry’s clients is mounting.

“Gallagher’s strong performance makes for tough 2023 comparisons,” said Bloomberg Intelligence analyst Matthew Palazola. “The company mostly competes with smaller brokers where it’s well-positioned due to superior capabilities. But continued margin improvement may depend on the longevity of rising insurance prices and economic activity.”

So far, though, Gallagher executives say they don’t see a downturn taking hold. They’re forecasting sales growth, once the effect of acquisitions is stripped out, of as much as 9% this year, almost matching last year’s 9.7%.

Evercore’s Motemaden expects the stock, which has given back some of its gains over the past month, to start rallying again. “I think there’s still room to run here.” He finds the stock cheap compared to its bigger rivals, making it a great way to tap into the inflation surge.

Inflation, he said, has been “a tailwind, driving what I would say has been a super cycle in organic growth.”

--With assistance from Max Reyes, Matthew Miller and Janet Freund.

©2023 Bloomberg L.P.