Apr 12, 2022

The Near-500% Rally in Lithium Is Showing Cracks in China

, Bloomberg News

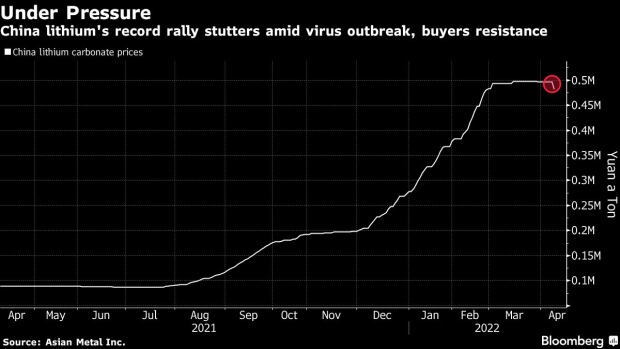

(Bloomberg) -- Lithium is showing signs of losing momentum -- at least in China -- after a powerful rally that carried prices to what Elon Musk called “insane levels”.

Chinese lithium carbonate, which has gained almost 500% in the past year, slipped slightly on Monday after steadying in the past week, according to Asian Metal Inc. The nation’s worsening coronavirus outbreak has upended the electric-vehicle supply chain, and buyers’ resistance to high prices is clouding the demand outlook.

“Downstream demand is weakening as the pandemic hinders carmakers’ production in China and inventory levels remain high at battery manufacturers,” said Maria Ma, an analyst at Shanghai Metals Market. “Companies are also pressured by the elevated lithium prices and there’s strong price resistance.”

A slew of global automakers including Tesla Inc. and Volkswagen AG have been forced to suspend production at their factories in Shanghai after a citywide lockdown, while Chinese EV upstart Nio Inc. said it had halted production and delayed deliveries. Contemporary Amperex Technology Co., the world’s largest battery manufacturer, is isolating workers in a so-called closed loop at its main factory in Ningde.

A prolonged lockdown in Shanghai could damp overall EV sales this year and ease a forecast deficit for the lithium market, according to Alice Yu, senior metals analyst at S&P Global Commodity Insights. Still, prices in China could find support in the short-term as logistical delays might prevent feedstock imports from reaching refineries and downstream users, she added.

The eye-popping rally has put lithium under the spotlight. Tesla’s chief tweeted that the EV giant may consider mining and refining the metal directly at scale. Carmakers in China are grappling with surging raw materials’ costs, and several have raised sticker prices in response. Last month, officials in Beijing summoned market players across the supply chain to discuss “a rational return” in lithium prices, just as risks around cost inflation flare.

©2022 Bloomberg L.P.