Jan 19, 2022

The Next Big Treasuries Shock Could Come From a Huge Option Position

, Bloomberg News

(Bloomberg) -- The potential catalyst for the next leg higher in Treasury yields is hiding in plain sight in the options market, where a single put strike expiring next month has exploded in size since the start of the year.

While the bearish option remains out-of-the-money, or uneconomical to exercise, falling prices for 10-year Treasury note futures are nearing the option strike price. Should they get there, hedging by dealers that are short the option could send yields to new highs.

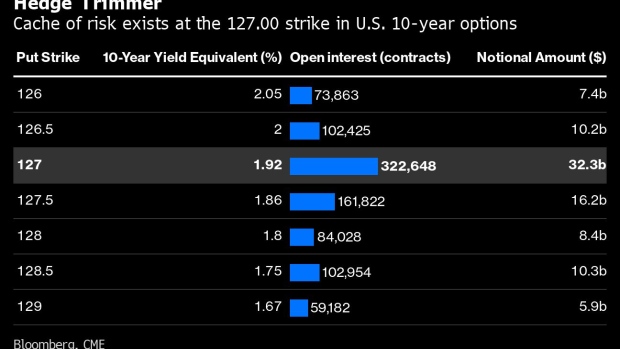

The strike is question is the March 127.00 put on U.S. 10-year note futures. A wave of buying has lifted open interest -- or the number of options in which traders have positions -- to 322,648 as of Tuesday’s close. That’s almost double the next-most-popular March put strike and amounts to a notional value of over $32 billion.

Dealers typically hedge options positions with the underlying asset. In the current scenario, they’d sell Treasury futures as a dynamic hedge as cash yields rise. In the case of the 127.00 put, their exposure would mount if 10-year Treasury yields, which topped 1.90% Wednesday, were to reach 1.92%. Most of the position has been amassed this month, with 50,000 bought on Jan. 3 and 30,000 on Jan. 12.

With risk also elevated in neighboring strikes above 127.00, selling U.S. 10-year futures as a hedge has the potential to lift yields above 1.95%, if not toward 2%. March options on Treasury futures expire Feb. 18.

©2022 Bloomberg L.P.