Dec 3, 2018

The next challenge for Canada's oil patch comes from the sea

, Bloomberg News

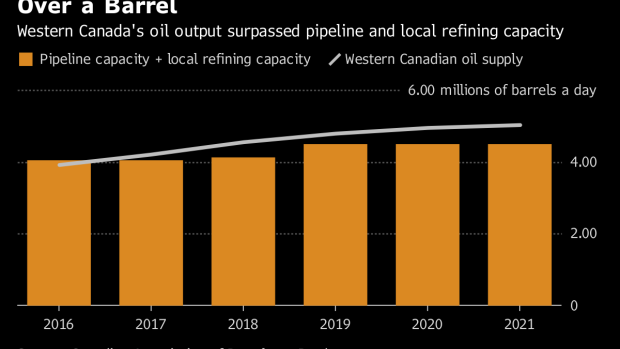

A new threat looms for Canada’s largest oil producing province, even as it imposes mandatory output cuts to ease a glut that has driven down crude prices.

A rule taking effect in 2020 aimed at reducing pollution by cutting the sulfur content of maritime fuel will make sulfur-heavy oil sands crude less desirable. The change may dampen the long-term impact of a mandatory production curtailment in Alberta Sunday, and lessen the benefit of plans to ease the region’s transport bottleneck.

Heavy oil prices sank to less than US$15 a barrel last month, as rising production swamped existing pipelines and rail routes, forcing some producers to shut in output. The situation got to the point that Alberta Premier Rachel Notley mandated supply cuts across the industry.

“We’ve got challenges with respect to pipelines, we’ve got challenges with respect to rail and now we’ve got challenges with respect to our demand market,” Allan Fogwill, chief executive officer of the Canadian Energy Research Institute said at a presentation in Calgary Wednesday.

Next year, rail exports could almost double from a record 270,000 barrels a day in September, according to company announcements. In the second half of 2019, Enbridge’s Line 3 will add 375,000 barrels a day of extra pipeline capacity. That’s around the time the International Maritime Organization 2020 rule starts to impact local crude prices, according to analysts including CERI’s Fogwill, IHS Markit’s Kurt Barrow and Wood Mackenzie’s Mark Oberstoetter.

Western Canadian Select, the main oil sands grade, may average about US$20 a barrel below West Texas Intermediate for most of next year, about equal to the cost of rail transport, said Wood Mackenzie’s Oberstoetter, lead analyst for Canadian upstream research. Gains from Line 3 will almost be canceled out by losses from the IMO ship fuel rules.

During the first year, the ship-fuel standard will make WCS crude about US$7 or US$8 a barrel cheaper relative to West Texas Intermediate futures than it would normally be, IHS Markit’s Barrow, vice president of the oil markets for midstream and downstream energy, said by phone from Houston. WCS traded at US$29 a barrel less than futures on Friday, data compiled by Bloomberg show.

“We are at an historically crucial point in terms of how tight this infrastructure is,” Oberstoetter said.