Jul 6, 2022

The Once-Unthinkable Is Now In Sight for Battered British Pound

, Bloomberg News

(Bloomberg) -- Sterling sinking below 1.05 per dollar -- something it has never done before and unthinkable only a few months ago -- is now given about a 1-in-35 chance of happening before the end of September by option markets.

It would be great to come up with a contrarian take on why this is a long shot, but from a hard-nosed data perspective, it’s tricky to find anything rosy-looking for sterling over the next few months. Real-rate differentials are marginally supportive, but show nothing compelling. Economic data in the UK is continuing to disappoint, although at a rate similar to the US, so giving the pound no relative advantage.

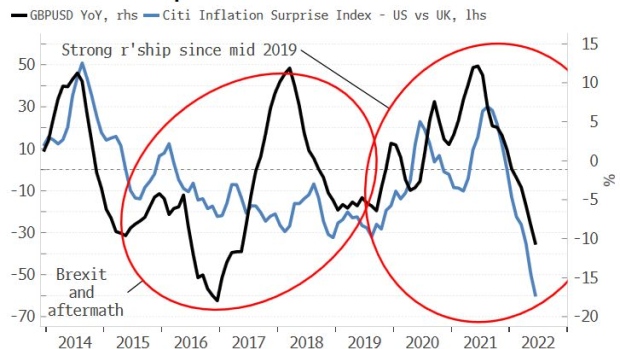

On the other hand, inflation surprises, as measured by the Citi indexes, show that the inflation backdrop is worse than expected compared to the US. This relationship has shown a good correlation with year-on-year changes in sterling over the past few years, and points to the possibility of further GBP/USD downside.

The elephant in the room and the one that could yet use its tusks to gore cable to death, or parity, is the UK’s large and worsening current account deficit. It clocked in at 4.2% of gross domestic product in the first quarter, one of the largest in the world, while the underlying drivers are getting worse.

The UK runs a goods deficit and a services surplus with the rest of the world. The goods deficit continues to worsen as Brexit hobbles UK trade, while the services surplus has shown scant improvement. The net effect is a deterioration in the UK’s current account, increasing the country’s reliance on kindly strangers to finance its ever-growing funding gap with the rest of the world. New lows in sterling are a material risk if there is a sudden stop in capital inflows from abroad.

Even more damning is the gradual decline -- since the 2008 financial crisis -- of primary income, the net interest and profits received on UK investments abroad and also part of the current account. The primary income through most of the 1990s and 2000s was in surplus, as the UK earned more more on its investments abroad than what it pays to foreign investors in the UK. For most of the last decade, the primary income has been in deficit, pointing to the demise of an exalted privilege the UK once enjoyed.

Financial markets are not sentimental, but their verdict here is brutal and inescapable: the UK is no longer a first-rate power, and has not been for some time. The current political pantomime is merely the manifestation of seeds that were sown several years ago.

- NOTE: Simon White is a macro strategist for Bloomberg’s Markets Live blog. The observations he makes are his own and not intended as investment advice. For more markets commentary, see the MLIV blog

©2022 Bloomberg L.P.