Mar 8, 2023

The Pay Gap for Women Who Have Never Been Married Is Getting Bigger

, Bloomberg News

(Bloomberg) -- Never-married women are the fastest growing cohort in the labor market. Yet, as their ranks have swelled their wage gap has, too.

The group’s median weekly earnings are 92.1% of what men who have never married make, a new report from Wells Fargo released Wednesday found. That gap has increased from a decade ago, when they brought in 95.8% of what men did.

Overall, women make around 83% of what men do in the US, according to the Census Bureau. But given that the motherhood penalty accounts for such a large part of the pay gap, Wells Fargo economist Sarah House was surprised by the growing wage gap among single women.

“Having more years of work experience and less likelihood of taking breaks to raise a child at the same time that you have growing educational attainment among women — I would’ve expected to see some more tangible inroads in terms of the pay pay gap there,” she said. The persistence of the wage gap is in part due to pay disparities between industries dominated by women, such as teaching, and those dominated by men, such as construction, House said.

The number of never-married women in the labor force has grown three times faster than the broader labor pool over the past decade. That’s partly because the median age for marriage for women has climbed to around 28 years old up from around 26 in 2010, according to the Wells Fargo report. More Americans are also choosing not to get married at all.

Read more: Being Single and Smart Is Bad for Young Women’s Careers, Study Finds

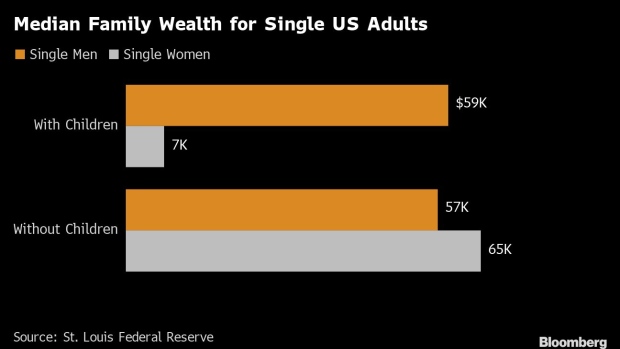

The wage gap is also resulting in a wealth gap: Never-married women have 29% less wealth then never-married men, largely driven by a gap between single men with kids and single women with kids. Having kids has almost no effect on single men’s wealth; the contrary isn’t true for women with kids.

Women who stay single and don’t have kids, on the other hand, have more wealth than all other never-married groups. Those women are more likely to have real estate assets than their male counterparts and save more, too. They’re also on pace with married couples when it comes to preparing for retirement.

©2023 Bloomberg L.P.