Apr 2, 2019

The prospect of bad monetary policy is keeping Ontario Teachers’ CEO awake

, BNN Bloomberg

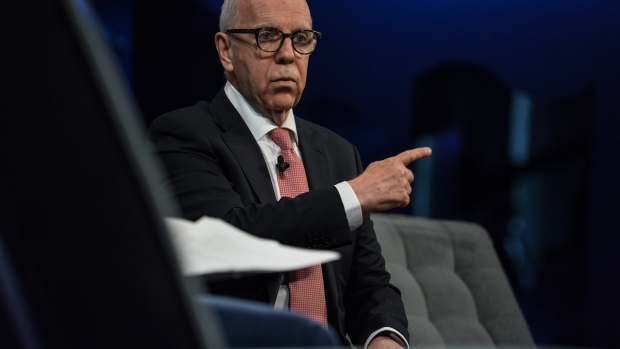

If you ask Ron Mock what’s keeping him up at night, his answer is two-fold: The possibility of bad policy decisions and irrational trade moves.

“The things that would keep me awake, and do actually a little bit, include policy mistakes. Interest rates being pulled higher when, clearly, this is not the time to be doing that,” Mock, president and CEO of Ontario Teachers’ Pension Plan, told BNN Bloomberg’s Amanda Lang in an interview Tuesday.

“Irrational trade moves are not something that you want to see. So there’s a lot of things for someone like me to have to worry about in this role.”

The Bank of Canada has increased its benchmark interest rate five times since July 2017, but has toned down its narrative on future rate hikes amid global economic uncertainty.

Despite political sagas like Brexit and the U.S.-China trade war, which have weighed on global equity markets, Mock maintains that it’s important the fund continues to grow its international profile while being selective on its investment choices.

“Balancing out a global portfolio is critically important for us,” Mock said.

“Where we really look to opportunities is through global diversification. We have operations in Hong Kong, we have operations throughout Europe, throughout Asia. This diversification opportunity set is what is critically important while we are sitting with a pretty balanced portfolio at this juncture, given the uncertainties that are out there in the market.”

Mock added that Ontario Teachers’ continues to hold and buy assets in the U.K. even though the future of Brexit remains uncertain, prompting firms like Canaccord Genuity Group Inc. to reorganize its business and cut jobs in the country.

“We are very, very selective – and we have to be, given asset pricing right now,” Mock said.

The Toronto-based Ontario Teachers' – the largest single-profession pension fund in Canada – reported Tuesday it held $191.1 billion in assets as of Dec. 31, marking a $1.6 billion increase from the same month last year. The total-fund net return was 2.5 per cent for the year.