Oct 14, 2020

The Rolls-Royce of Junk Bonds Has Arrived

, Bloomberg News

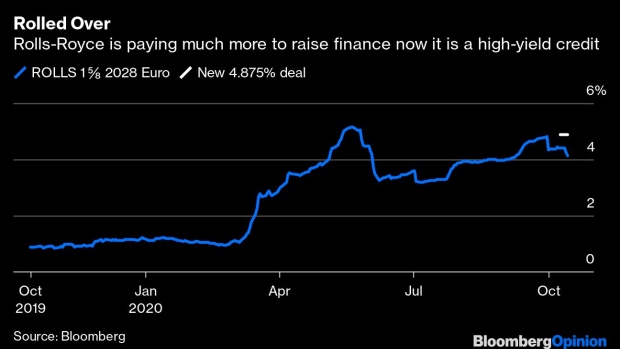

(Bloomberg Opinion) -- Rolls-Royce Holdings Plc, the famous old British jet-engine manufacturer, is paying the price for its recent troubles. A two billion-pound ($2.6 billion) bond sale on Wednesday — in dollars, euros and sterling — comes with much higher coupons than its previous debt issues. It will regret losing its investment-grade status earlier this year.

The company still has debt-market appeal, however. This is the third-biggest junk bond sale this year, and demand has been high. Back in June, we had Fiat Chrysler Automobiles NV’s 3.5 billion-euro ($4.1 billion) issue and a 2.25 billion-euro bond to finance the private equity buyout of ThyssenKrupp Elevators.

A high-profile name like Rolls-Royce might have fared even better by ditching its credit ratings and relying on its brand recognition to attract investors with a less juicy coupon. That’s a fairly common option for bond issuers who aren’t happy with their ratings and feel they could argue a better case directly with the market — especially as a “fallen angel” that’s being unduly punished because of the pandemic.

Despite still having BB-rated credit, toward the upper end of junk ratings, S&P Global has placed Rolls-Royce on negative watch for another downgrade. That means it has to offer a substantial premium to its existing debt to attract new high-yield investors.

In fairness to the ratings companies, the British manufacturer’s problems predate the catastrophic impact of Covid-19 on aviation. My colleague Chris Bryant has detailed how Rolls-Royce was stumbling beforehand. This bond offering is the last step in its refinancing plans after a two billion-pound equity raise, and up to five billion pounds of government and bank-loan facilities are already in place. After doubling the amount it wanted to raise from the bond markets, the company had to offer a bigger return.

Rolls-Royce’s last big bond issue, a 10-year maturity in euros sold in 2018, had a coupon of just 1.625%, although the yield on that has risen above 4% during the pandemic. This week’s new euro issue was offered initially at 5.25%, but it’s expected to price at 4.875%. Similar strong demand also let the lead managers “walk in” the final coupons on the new dollar and sterling notes by 25 basis points to 6%.

While this could have been even worse, it’s still painful for one of Britain’s last blue-chip industrial names. Rolls-Royce needs as big a liquidity buffer as possible to get through this crisis, but having to pay a coupon that’s three times higher than what it secured just two years ago will make its climb back up harder.

Rolls-Royce has paid a stiff price to ensure capital markets access. Its interest costs have just soared but at least it’s buying itself some breathing space.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Marcus Ashworth is a Bloomberg Opinion columnist covering European markets. He spent three decades in the banking industry, most recently as chief markets strategist at Haitong Securities in London.

©2020 Bloomberg L.P.