Mar 15, 2019

The SEC Isn't Doing Volkswagen Investors Any Favors

, Bloomberg News

(Bloomberg Opinion) -- It’s impossible to feel sorry for Volkswagen AG over the 2015 “dieselgate” scandal, but sometimes you do sympathize with its investors.

The U.S. Securities and Exchange Commission is suing the German automaker giant, and its then chief executive Martin Winterkorn, for failing to tell bond investors between 2010 and 2015 that it was violating emissions standards. The photographs of Winterkorn in the complaint (see page 15) with a tape measure and looking under a car at a motor show add a touch of the surreal.

It would have been interesting reading the honest bond prospectuses that the SEC says VW should have published when it sold more than $8 billion of standard corporate bonds and $5 billion of asset-backed securities (backed by auto-finance loans) in 2014 and 2015. Maybe the risk factors section would have looked a little like this: “We have been manipulating the emissions of our diesel vehicles in the US. We’re hoping they don’t notice so we can sell more cars. If they do find out, your bonds might be worth less.”

None of this is to be flippant about the seriousness of the emissions scandal, both from an environmental and financial perspective. Whether or not Winterkorn knew about what was going on back then is a matter for the courts to decide. But there’s a question here about whether opening this new front will do bondholders many favors. Hurting shareholders with more massive fines would theoretically weaken the company’s credit – thereby hurting current debt investors.

While Volkswagen’s share price fell late on Thursday after the SEC news, it has largely recovered and there was no discernable impact on its credit spreads, so the market appears sanguine. The SEC will stress it is doing its duty, but the timing is unfortunate for Volkswagen as it creates another potential liability at a time when it’s already coping with the business impact of Donald Trump’s trade wars.

The scandal has already cost Volkswagen more than $30 billion, and it believed it had settled U.S. liabilities with the Justice Department in 2017. Any new fine would be set aside to compensate victims but determining quite how much would be tricky. The timing and reason of any sale during the period concerned would all have to be taken into context – there were winners as well as losers.

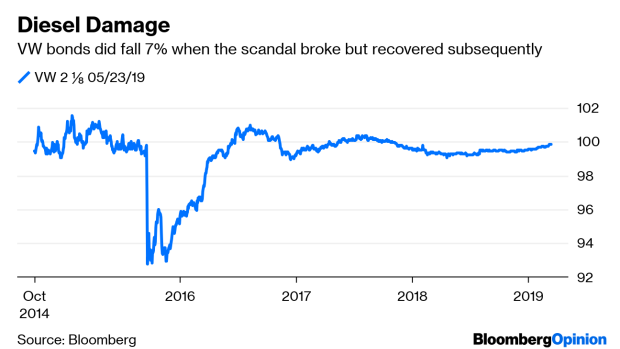

The initial 7 percent selloff in the 2.125 percent May 2019 bond is the simplest way of looking at what prompted the SEC’s action, and there will have been plenty of unhappy investors. But while the credit spreads on Volkswagen debt did rise sharply when the scandal broke in September 2015, within seven months they were back to the trading levels prior to the revelations.

Volkswagen stayed out of the dollar market for the next three years until November 2018, when it issued a raft of seven bonds across maturities. That 13 billion-euro ($14.7 billion) splurge did have a seismic effect on VW’s credit spreads, but that does not form part of the complaint.

It’s pretty tough to claim that on balance bond investors have been harmed much overall, although there will be individual cases of forced losses. Due legal process is due legal process, of course, but one wonders what this latest SEC salvo will achieve.

To contact the author of this story: Marcus Ashworth at mashworth4@bloomberg.net

To contact the editor responsible for this story: James Boxell at jboxell@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Marcus Ashworth is a Bloomberg Opinion columnist covering European markets. He spent three decades in the banking industry, most recently as chief markets strategist at Haitong Securities in London.

©2019 Bloomberg L.P.