Feb 21, 2019

The Tiny Dairy Stock That Skyrocketed to New Zealand's Biggest

, Bloomberg News

(Bloomberg) -- A2 Milk Co. is giving New Zealand equity stalwarts a run for their money.

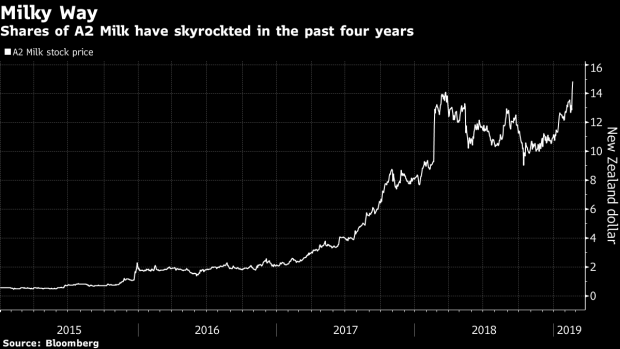

In a span of about four years, its market cap has surged more than 3,000 percent, making it New Zealand’s most valuable company. It now has a value of about NZ$10.9 billion ($7.5 billion) -- that’s larger than some of the mainstays of the nation’s bourse such as Auckland International Airport Ltd. and Fonterra Co-operative Group Ltd.

A2 Milk, with offices in Australia and New Zealand, said Wednesday that revenue from China surged 50 percent to NZ$172 million in the first half, contributing to a 55 percent increase in net income. It’s doubling down in the Asian nation, betting it can take a bigger share of the infant-formula market from global dairy giants like Danone and Nestle SA.

The stock jumped 10 percent Wednesday to a fresh record and extended its rally Thursday with another 4.4 percent climb. While investors have jumped on the dairy bandwagon for A2 Milk, not everyone’s convinced that the company can win more than the 10 percent market share in China already implied by its current valuation.

The sustainability of sales via the daigou channel, which allows cross-border exports to customers in China, is lower than going through channels like cross border ecommerce or mother-baby retail stores, Morgan Stanley analysts led by Thomas Kierath wrote in a Feb. 20 report, citing regulatory risk and potential for channel fill. Overall formula consumption market share rose to 5.7 percent as of Dec. 31 from 5.1 percent on June 30, the company said Wednesday. A2 Milk’s sales to daigou rose 55 percent compared with the prior year, driving more than half of the total revenue growth for the first six months.

Revenue estimates imply that A2 Milk’s China market share would be more than 10 percent, which would trail Nestle but jump ahead of Danone and China’s Heilongjiang Feihe Dairy Co. That “seems unlikely for a single-premium price point brand,” Kierath said.

--With assistance from Tim Smith.

To contact the reporter on this story: Divya Balji in Singapore at dbalji1@bloomberg.net

To contact the editors responsible for this story: Chris Nagi at chrisnagi@bloomberg.net, Cecile Vannucci, Gearoid Reidy

©2019 Bloomberg L.P.