Feb 22, 2020

The Virus Is Interrupting Supply Chains From Watches to Lobsters

, Bloomberg News

(Bloomberg) -- A Hong Kong watch maker who can’t get coils or wheels. New Zealand lobsters released back into the wild. A San Diego game studio facing delays to its latest fantasy board games.

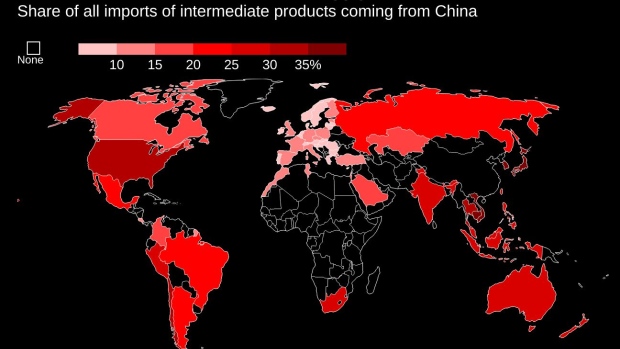

The coronavirus outbreak that has hobbled China’s economy is increasingly ricocheting through the world economy and supply chains. To gauge the impact, Bloomberg News reporters asked businesses around the world to share their experiences.

Here are their stories.

Hong Kong Watch Maker

High-end watch maker William Shum Wai-lam specializes in tourbillon watches that are designed and assembled in Hong Kong but source hundreds of specialist components—hands, dials, glass, straps and buckles—that go into each time piece from factories in mainland China. The shuttering of production has left his Memorigin Watch Company Ltd. with a pre-order book of around 2,000 watches that he can’t make.

“Every watch I promised customers has to be delayed,” he said. “This is the first time I encountered a supplier that cannot supply to me.”

The specialized nature of the watches he makes means Shum’s options for alternative suppliers outside China are limited given the extra costs involved.

“We cannot do anything but keep waiting.”

American Board Game Maker

Fans of Renegade Game Studios will have to wait longer this summer for the latest copies of the company’s fantasy board games.

San Diego-based Renegade makes specialty games featuring wizards, Viking warriors and even some cuddly kittens, sourcing them from manufacturers around Shanghai and Shenzhen. For now, two of the three factories that make its games are operating, although running at less than full capacity, President Scott Gaeta said.

Things would be a lot worse if the supply chain crunch came in the third quarter, a few months ahead of the holiday season. Still, the delays happening now at the factory will hurt his inventory come June and July.

“As of today, we’re expecting a two-to-six-week delay shipping out to our customers,” Gaeta said. “We’ll have to push back release dates. It’s very fluid.”

Masks in Mexico

Jonathan Bass, a Los Angeles businessman who makes wall art and furniture from a factory in Mexico, says some of the components he needs for production are stuck at a port south of Shanghai. Aluminum-backed mirrors, door hinges, and polyester pillow filler are among the items he’s awaiting, forcing him to scurry for alternative providers closer to home.

“The shipping lines keep telling us it’s another two weeks,” Bass said, annoyed at being charged a storage fee at the port as the vessel waits for authorization to depart.

A concern also has been how and where to get enough face masks, which he had been sourcing from China and which Mexican authorities require for his factory workers. China is experiencing a severe shortage. Bass is hoping he’ll be allowed to manufacture his own masks.

“If this flow doesn’t start happening from six to eight weeks from Chinese New Year, you’re going to see big impacts,” he said.

German Auto Parts

At German auto parts supplier Webasto AG, eight of its roughly 1,000 Stockdorf-based employees contracted the virus following the visit of a Chinese colleague for a training session in January, forcing the manufacturer to shut down operations at the plant for two weeks. The closure ended after around 180 employees were tested for the illness and the company hired specialists to disinfect its workspaces and meeting rooms.

“We are relieved that no new cases of illness have arisen among our employees,” Chief Executive Officer Holger Engelmann said earlier this month. “However, we remain cautious because we still know so little about this virus.”

The company says it has restarted production at most of its locations in China, however to a limited extent. It could take until early March before operations are running smoothly again, a spokesperson said. The manufacturer has 12 locations across China, two of which are in Hubei province, and has set up a global task force to address any issues in its supply chain.

Bloomberg Economics: What $9 Trillion of Market Cap Misses on Virus

Indonesian Garment Factories

On Indonesia’s main island of Java, the garment factories that make up the country’s textile belt are ramping up production as companies look to move business out of China. Those who hadn’t already shifted because of the trade war “see the virus as a wake-up call,” said Iwan Lukminto, president director of PT Sri Rejeki Isman.

At a Sri Rejeki factory on the outskirts of Solo, in Central Java, where thousands of workers stitch clothes for the likes of J.C. Penney Co., Guess? Inc., Walmart Inc. and other major brands, the sewing machines are running at full capacity. “The virus has confirmed that everyone has been too dependent on China,” Lukminto said, adding that the jump in orders means they will be working at their peak for the next six months at least.

Lukminto said he had also received an order from Indonesia’s National Disaster Mitigation Agency for 20,000 chem-suits. The full-body overalls, otherwise known as CBRN because they protect against chemical, biological, radiological and nuclear threats, would be rolled out to people on the front-line of defense if there were to be an outbreak of the virus in Indonesia. There’s also been interest from China and Taiwan, Lukminto said.

But there’s a negative impact too. Budiarto Tjandra, the director of PT Panarub Industry, which makes shoes for Adidas and Mizuno, said the shuttering of factories in China was already causing problems. “Our material supplies have been disrupted because some of our material is imported from China, and the supplier’s factory is still closed,” he said.

Malaysian Pet Store

Nutri Pro Pets Sdn Bhd., a Malaysian pet products company, is imposing purchase restrictions on its cat litter, which it imports from China.

“My biggest problem right now is all my customers got a little panicked and rushed to buy my company’s products,” said Steve Soh, Nutri Pro Pets’ marketing manager. “This situation makes it impossible for my inventory to last for more than a month.”

“And now, all I can do is just ask the supplier when it will be able to produce,” he said.

The High Seas

William Fairclough, managing director of Wah Kwong Maritime Transport Holdings Ltd., which jointly owns bulkcarriers, tankers and small pressurized LPG carriers, said his firm will have to wait a little longer for the orders it has placed.

“We’ve got a couple of ships that are due to be delivered from shipyards in China, one in April and one in June, and we have already been sent a force majeure by the yard because they simply don’t have the workers, they are not there.”

“We had a ship that called in China for dry dock regular maintenance and we turned up at the shipyard last week and they just said ‘sorry, there’s just no people here.’”

He expects that to change over coming weeks as the Chinese government encourages workers to return. “It’s not an end of days game-changing event.”

New Zealand Lobsters

New Zealand’s government said on Feb. 5 that between 150 and 180 tons of live rock lobster were being held in the country in pots and tanks, at sea and on land, after Chinese buyers canceled their orders.

The government said it would allow a limited release of rock lobster back into the wild. Fisheries Minister Stuart Nash said in a release that the “decision will affect the live crayfish in holding pots at sea, and some held in tanks on land. It means they can be harvested again when the trade disruptions are resolved.”

Japanese Diggers

Japan’s Komatsu Ltd., the No. 2 maker of mining equipment, will move production of some parts from China to other Asian countries because of factory constraints. To avoid disrupting the global supply of its gigantic diggers, Komatsu will need to make or buy components used in vehicle frames, wire harnesses and casting parts in other countries such as Japan, Vietnam and Thailand, according to spokeswoman Naoko Furumai.

Rival Hitachi Construction Machinery Co. was forced to cease production of machines and parts at its plant in the eastern Chinese province of Anhui because of restrictions put in place to contain the virus. It’s going to take some time to restart manufacturing at the plant, according to Tokyo-based spokeswoman Sayori Nagaoka.

Vietnam Furniture Makers

A few months ago, Xuan Hoa Vietnam Joint Stock Co. was hosting prospective overseas clients looking to shift some of their furniture production to Vietnam from China. Now the company is scrambling to find key parts such as plastic chair netting and rubber washers to keep its assembly lines operating after Chinese suppliers closed factories.

“We are trying to keep the factory running by getting materials from other sources domestically, but we are very worried now,” said Chief Executive Officer Le Duy Anh, whose clients include Swedish furniture giant Ikea. Anh, whose factory of 500 workers lies northwest of Hanoi, has reduced employee hours as he trims production.

“We hope things will get better when summer comes and it kills the virus,” he said. “But right now we are struggling.”

--With assistance from Yantoultra Ngui, Nguyen Dieu Tu Uyen, Masumi Suga and Carolynn Look.

To contact the authors of this story: Enda Curran in Hong Kong at ecurran8@bloomberg.netMichael Sasso in Atlanta at msasso9@bloomberg.netKarlis Salna in Jakarta at ksalna@bloomberg.net

To contact the editor responsible for this story: Malcolm Scott at mscott23@bloomberg.net, Nasreen Seria

©2020 Bloomberg L.P.