(Bloomberg) -- Three months after China started to emerge from its coronavirus restrictions, its army of shoppers that help power the global economy are still nervous of travel, reticent to spend and forming habits that may change the face of consumption permanently.

In this first edition of a regular fixture, Bloomberg News has brought together a range of data from property spending to dining out, gambling to air travel, for a comprehensive look at the health of the Chinese consumer.

The verdict for now: a recovery is indeed underway -- but it’s slow and vulnerable to setbacks like the latest virus flareup in Beijing.

With global demand for China’s manufacturing goods most likely depressed this year due to the accelerating pandemic, domestic consumer behavior matters even more for the country, as well as the wider global economy.

China powered one-third of global consumption growth from 2010 to 2017, according to a report from McKinsey Global Institute. Over the next 10 years, the growth in Chinese consumption is expected to equal that of the U.S. and Western Europe combined.

Retail sales data due this week is forecast to show a return to growth in June, but the value of sales so far this year will still be well down on the first half of last year.

“Leading indicators suggest retail sales should have continued to recover in June,” according to a report from Bloomberg Economists Chang Shu and David Qu. “Even so, the revival in consumption probably remains a long way off, given changes in behavior to the detriment of contact-intensive services, as well as stress in the labor market and dented incomes.”

CHINA INSIGHT: Recovery Slows, Virus Flares Up -- Dashboard

High-frequency data for June and the early days of July paint a similarly mixed picture. While housing sales rose in early June from last year, car sales were down.

When all is well, data on gambling receipts in Macau -- China’s Las Vegas -- can illustrate the confidence of a rapidly growing economy. This year’s data are a stark reminder that the pandemic is far from over: with borders largely closed to Chinese punters, revenue has plunged by more than 90% for three consecutive months, while casinos are losing $15 million daily in expenses, estimated Morgan Stanley.

Less Travel

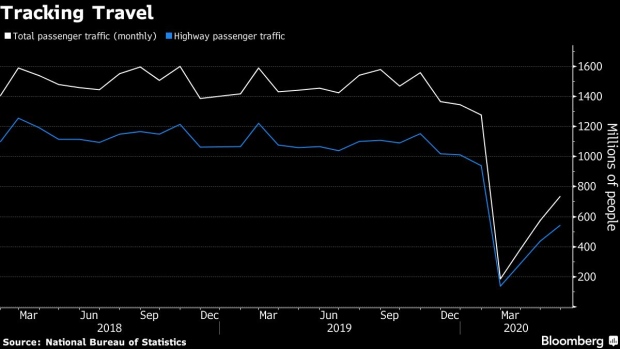

As an indicator of economic activity, travel data show a picture of incomplete recovery. Highways and rail passenger traffic still shows fewer people traveling than the same period last year, indicating that many aren’t traversing long distances, whether for work or tourism.

Tourism during June’s national holidays was down about half compared to 2019 and the stay-at-home impulse is still strong in the biggest cities, with subway ridership in Beijing and Shanghai remaining below normal levels.

One silver lining for retail has been the almost complete halt of global travel and disrupted networks of parallel importers, which have trapped high-end shoppers at home.

Chinese buyers power over a third of the global industry, and their inability to travel is set to boost the luxury market on the mainland by as much as 10% this year, compared to a 45% plunge in the global industry, according to estimates by Boston Consulting Group.

Physical economic activity is moving online at a rapid pace, judging by the speed at which the delivery of parcels and mail is growing, a bright spot amid a sea of slowing indicators.

The recovery in China provides an example for other nations about how quickly economic demand can rebound once the viral outbreak is contained and people are more confident that just going out and shopping won’t make them ill. But it also shows that any revival will be limited.

“China’s recovery path supports our current baseline forecasts for private consumption in other major economies, which are lagging by 1-2 quarters,” according to Wang Tao, chief China economist at UBS AG. “Robust sequential rebound in retail sales and consumer services, but a soft overall recovery due to weak labor markets and income growth, and persistent concerns about safety and future outlook.”

©2020 Bloomberg L.P.