Feb 11, 2019

The World Economy Gets an Inflation Checkup This Week

, Bloomberg News

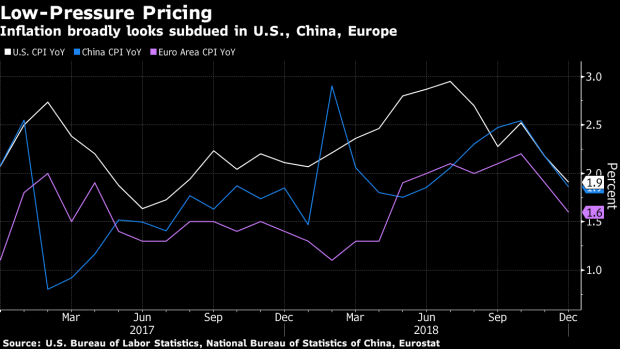

(Bloomberg) -- The world economy is set to get fresh insight into whether inflation is turning sluggish again as the U.S. and China publish price data that’s set to endorse the decision of central banks to steer away from tighter monetary policy.

A measure of U.S. core consumer inflation likely eased to 2.1 percent on an annual basis, helping to justify the Federal Reserve’s pause in its interest-rate hike cycle, according to economists surveyed ahead of a report due Wednesday. China’s factory inflation reading on Friday will probably show a mere 0.3 percent increase from a year earlier -- an ominous sign given the link to export prices.

Having already turned dovish in recent weeks, central banks will likely view the data as reason to keep monetary policy looser than perhaps they envisaged at the end of last year. JPMorgan Chase & Co. economists predict average worldwide inflation will slow to less than 2 percent this quarter from 2.8 percent in October.

“We don’t see inflation picking up any time soon and central banks’ persistently too-high forecasts are credibility-draining,” said Gabriel Sterne, head of global macro research at Oxford Economics in London.

A combination of cyclical and structural factors are keeping a lid on prices. The International Monetary Fund predicts global growth this year will be the slowest since 2016, while food and energy costs have also dipped.

U.S. inflation will be pored over for signals on what it means for the Fed. While cheaper fuel will weigh on the Labor Department’s consumer price index, ongoing wage and retail sales growth will offer support.

Analysts project the core index, which excludes food and energy, rose 0.2 percent from the prior month for the fifth straight time, indicating inflation is steady without flaring up. The expected 2.1 percent annual gain, following 2.2 percent in December, suggests that the Fed’s preferred core index -- a separate measure from the Commerce Department based on consumption -- remains below the central bank’s 2 percent inflation goal.

The inflation slowdown is more dramatic when looking at the headline gauge, which probably cooled to a 1.5 percent annual gain -- a two-year low -- from 1.9 percent.

In addition, a change in the Labor Department’s methodology for calculating prices of residential telecommunications, which starts with this week’s January report, “could put downward pressure on the CPI,” according to a JPMorgan research note.

China Slowdown

As for China, while its consumer prices were pushed higher by seasonal effects and more expensive food, slowing consumption will keep a lid on any gains. Some economists are even speculating an interest-rate cut may not be far away.

Another Chinese measure, factory inflation, slowed sharply in December, continuing the slowdown for a sixth straight month to the weakest level since late 2016 on softening demand and lower commodity prices. That slide has revived fears of a return of the deflation that dogged the economy through 2012-2016.

Compounding the mystery of missing inflation is the fact that jobless levels are at or below pre-financial crisis levels in big industrialized economies. Together, unemployment in the Group of 10 economies is the lowest since 1974, according to James McCormick, a strategist at NatWest Markets.

“Tight labor market conditions could yet trigger a surprise,” said Bloomberg Economics Chief Economist Tom Orlik, whose team forecasts two Fed rate hikes this year in the third and fourth quarter respectively.

For now though, the surprise is how tepid the global price outlook has become. That’ll make it harder for central banks to move away from crisis-era settings.

“Global demand will remain soggy this year, keeping a lid on underlying inflation pressures,” said Shweta Singh, the managing director of global macro at research firm TS Lombard. “Subdued global inflation could mean that policy will remain easier for longer.”

--With assistance from Tassia Sipahutar.

To contact the reporters on this story: Enda Curran in Hong Kong at ecurran8@bloomberg.net;Michelle Jamrisko in Singapore at mjamrisko@bloomberg.net

To contact the editors responsible for this story: Malcolm Scott at mscott23@bloomberg.net, Simon Kennedy

©2019 Bloomberg L.P.