May 27, 2020

The World’s Most Controversial Mine Is in a Hole

, Bloomberg News

(Bloomberg Opinion) -- It’s not unusual for large new mines to attract opposition and controversy. But rarely has so much energy, political and financial capital been spent on a project with as little prospect of making money as Australia’s Carmichael mine.

As we’ve written, the sums used to justify the pit being developed by an affiliate of billionaire Gautam Adani’s ports-to-power Adani Group don’t really make sense. At reasonable costs for production, transport, finance and infrastructure, its low-grade coal would be far more expensive than comparable product available elsewhere. Adani’s Indian-based power unit already loses money on every kilowatt-hour of electricity it sells and runs well below capacity. Fueling its power stations at the cost needed to make Carmichael stand up would make matters even worse.

Adani has always said that the economics of the project “remain strong,” but its published accounts for the year ended in March suggest the company is finding it harder to make that assessment. “It is not likely that taxable income will be earned in the foreseeable future,” they state for the first time this year, in reference to a A$1.29 billion ($857 million) tax loss that’s been run up so far.

That doesn’t exactly mean the project will never spit out cash of any sort. Such remarks can just be boilerplate to define where the potential A$386 million tax benefit belongs on the balance sheet. Still, looking at the way the company values its own project shows just how generous your assumptions must be to believe this mine can actually make money. The company uses “industry-standard techniques” in valuing the project, a spokesperson said by email.(3)

Take Carmichael’s base valuation of A$1.07 billion as of March 31. A discount rate of 13.5% leaves the project extremely sensitive to the price of coal in its first four or five years of operation, a period that would account for about half of its lifetime cashflow.

Should the coal price fall by just 10%, that valuation would decline by A$882 million, according to the accounts — more than 80% of its balance sheet value. That would push accumulated losses, which already amount to A$795 million, uncomfortably close to A$2 billion.

A 10% fall in a commodity price is not a particularly dramatic event. Futures based on the main Asian coal pricing benchmark — 6,000 kilocalorie product from Australia’s Newcastle port — have slid by 9% or more in about three out of every 10 quarters over the past decade. After a price surge between 2016 and 2018 they slumped 34% last year, and have dropped a further 16% so far this year. Since Adani’s valuation date at the end of March, the average futures price over the 12 months through May 2021 has slumped 14%.

Viktor Tanevski, principal analyst for coal research at Wood Mackenzie, estimates that Carmichael's product would price at a discount of 32% to 35% to the Newcastle benchmark, translating to around A$45 a metric ton. The mine won’t be economically viable unless prices for high-ash coal rise from their current levels, he wrote by e-mail, adding that he expects prices will climb and put the project in the black in the medium term.

Carmichael’s discount rate is also worth examining, since it was reduced over the past year to 13.5% from 14%. That enhances the assessed value of the project — indeed, a 1 percentage point increase would reduce its value by A$345 million, according to the accounts. Some rate reduction isn’t entirely unreasonable: The project is closer to operation than it was a year ago, so it should be less risky while interest rates generally have fallen.

Still, it looks generous compared to other Australian coal mines. Whitehaven Coal Ltd. applied a discount rate of 11% to its operations at the time of its 2017 annual report(2), and Yancoal Australia Ltd. currently uses a rate of 10.5%. Their mines have been in operation for years, often decades, and their few development projects won’t add significantly to their near-term revenue. Carmichael, on the other hand, is a single greenfield project in the early stages of construction, and major lenders in Australia have already made clear they won’t finance it. Such a thin risk premium could be very useful in producing a positive valuation in the accounts.

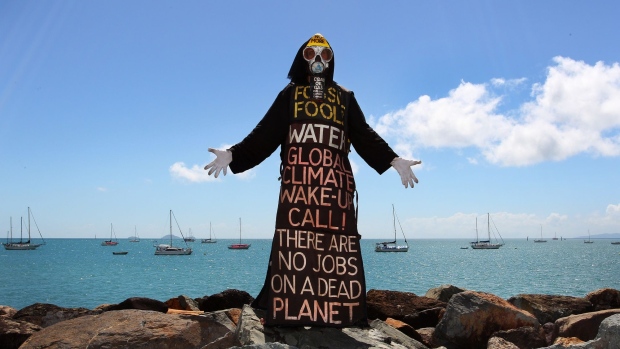

Why should this matter? The controversy attached to Carmichael seems out of all proportion to its significance. While the world’s climate needs fewer, not more thermal coal mines, comparable projects like MACH Energy Australia Pty.’s Mount Pleasant and Whitehaven Coal’s Vickery have quietly advanced without the opposition and demands for government support that Carmichael has attracted.

Adani’s motivation in pursuing such a questionable project is hard to fathom, as is the persistence with which both sides of Australian politics pretend this emperor still has clothes. And all of it is predicated on the notion that this is an economically viable project with a positive net present value.

If Carmichael is going to earn money, pay taxes and employ workers for years, it might be justified in chewing up so much political time and money. If it’s unable to stand on its own feet, then Australia’s fossil fuel-friendly politicians are likely to end up with a white elephant reliant on state support for as long as it’s able to keep going. Coal’s days are numbered. The sooner Adani and Canberra recognize that, the better.

(1) “We apply industry standard techniques for the purpose of calculating fair value of our Carmichael asset, inclusive of engaging independent external third parties to undertake such valuation work," a spokesperson for Adani wrote by e-mail. "We also utilise independent third parties for the provision of long term commodity price forecasts and FX forecasts for incorporation into the valuation of the asset. Given that Carmichael construction is now well progressed the project is significantly de-risked from an execution perspective which of course translates into a lower discount factor.”

(2) It hasn't reported the number since.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

David Fickling is a Bloomberg Opinion columnist covering commodities, as well as industrial and consumer companies. He has been a reporter for Bloomberg News, Dow Jones, the Wall Street Journal, the Financial Times and the Guardian.

©2020 Bloomberg L.P.