Aug 17, 2020

The World’s Top Miner Broadens Plans to Exit Coal Operations

, Bloomberg News

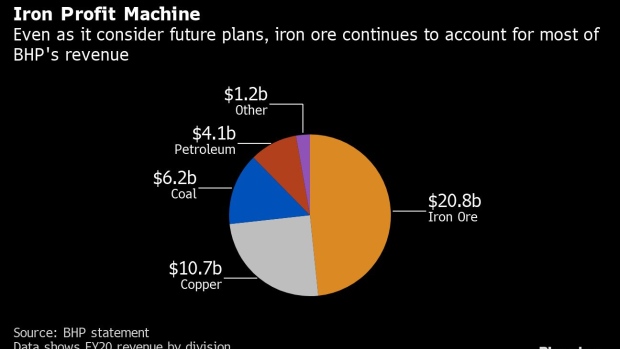

(Bloomberg) -- BHP Group will broaden plans to exit coal operations and review opportunities to shed aging oil and gas assets under new CEO Mike Henry’s more urgent push to reshape the world’s top miner’s portfolio for a low-emissions future.

The producer aims to sell, or spinoff, its 80% share in the BHP Mitsui Coal joint venture, which owns two coking coal operations in Australia, along with exiting thermal coal mines and some oil and gas operations, the company said Tuesday when reporting annual profits held steady at $9.1 billion, boosted by higher iron ore prices.

Henry, installed as chief executive officer in January, is focusing BHP on supplying higher-quality iron ore and coking coal to capture China’s shift to prioritize premium raw materials for its steel sector. At the same time, he’s laying the ground for a longer-term transition to favor growth in copper and nickel to meet expected rising demand from renewable energy and the electrification of transport.

“The world is rapidly changing with decarbonization of energy sources, population growth and the drive for higher living standards in the developing world,” the company said. “It will require us to continue to be active portfolio managers.”

BHP has been considering plans to offload its Australian thermal coal mine and one-third stake in the Cerrejon operation in Colombia for more than a year and has rejected some early offers, people familiar with the matter said last month. A process to exit those mines, and the coking coal venture with Mitsui & Co., will now advance options for trade sales, or a demerger into a separate listed entity.

Read more: BHP Is Said to Rebuff Early Bids Under Plan to Quit Thermal Coal

The company confirmed it will also plan to sell its 50% stake in the Bass Strait oil and gas joint venture with Exxon Mobil Corp. in southeastern Australia. Exxon said in September it also plans to exit. “We will seek to divest oil and gas assets that are mature or which are likely to realize greater value under different ownership,” Henry said.

A decision on adding potash production through the initial development of the Jansen project in Canada has been delayed until mid-2021, BHP said. The project, which may cost as much as $5.7 billion, could benefit from improving supply and demand dynamics from the late 2020s or early 2030s, the company said.

To support plans to reshape BHP’s portfolio, Henry promoted Johan van Jaarsveld as Chief Development Officer. In other appointments, Laura Tyler was moved into a new role as Chief Technical Officer and Ragnar Udd will become President, Minerals Americas.

©2020 Bloomberg L.P.