Oct 5, 2020

Theater Stocks Plunge After Cineworld Shutdown Caps ‘Lost Year’

, Bloomberg News

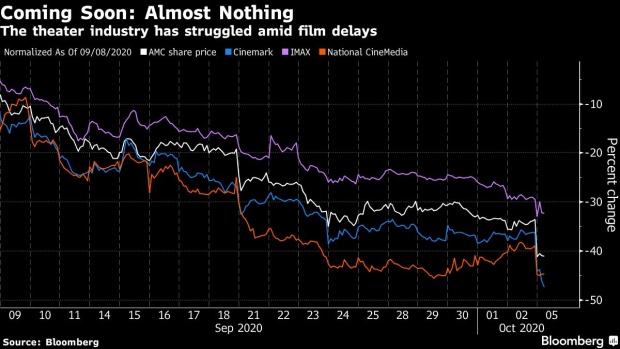

(Bloomberg) -- Shares of movie-theater companies fell on Monday after Cineworld Group Plc decided to temporarily suspend operations at all its American and British movie theaters, the latest sign of how pandemic-related film delays are ravaging the industry.

Credit agencies downgraded Cineworld’s rating over the weekend, warning the company may run out of cash as early as next month. Other theater-chain operators are facing similarly dire economics. AMC Entertainment Holdings Inc., the largest cinema company in the world, was downgraded by S&P Global Ratings last week, with the firm warning that the theater chain may default on its debt.

The industry took a turn for the worse after the delay of Metro-Goldwyn-Mayer’s latest James Bond installment, “No Time to Die,” which was pushed back to April from November. Cinema operators were counting on the film to end a drought of new movies, helping them recover from closures throughout 2020. But MGM, like most other studios, has opted against releasing big new movies this year.

Studios are “seemingly not willing to keep the exhibition industry intact,” B Riley FBR analyst Eric Wold said in a note. They need to be “willing to take a hit to feed the industry and keep the exhibitor group from completely falling apart.”

Cineworld shares fell as much as 60% on Monday in London to 15.64 pence, their lowest level on record, before recovering somewhat. AMC shares declined as much as 13% to $4.05, the lowest level since August, while No. 3 chain Cinemark Holdings Inc. tumbled as much as 19%.

It looks equally bleak -- if not more so -- for smaller exhibitors. Last week, a trade group representing U.S. cinema operators warned that 70% of small and midsize theater businesses may fail.

While the entire year has been tough for cinema chains, with indoor gatherings banned or limited in most places, the situation has become particularly tough in the past month. AT&T Inc.’s Warner Bros. released “Tenet,” a $200 million sci-fi thriller, expecting the new release would draw people back to the theater. In some locations, people did flock to see it, but it failed to generate significant ticket sales in the U.S.

The performance of the movie, along with the uncertain nature of the virus, has frightened other studio executives considering releasing their own major films in 2020, and all but halted a plan to welcome audiences back to movie theaters in autumn. With the exception of “Soul,” an animated film from Walt Disney Co., and Universal’s “The Croods: A New Age,” studios won’t release any big new movies until late December.

Disney previously released “Mulan” on home video in the U.S., charging streaming customers $30 to see it. But the muted response to that movie suggests the approach isn’t a surefire strategy either, according to Bloomberg Intelligence.

Cinema operators have repeatedly warned that without new films, it’s hard to draw big enough crowds to cover the expenses associated with keeping theaters open. Other major chains haven’t yet taken the drastic step of shuttering all their theaters, though AMC said its U.K. locations would now be open only on the weekend. Credit-ratings companies warned that means cinema chains will probably have to find new capital before the end of the year -- or else they’ll run out of cash.

Canada’s Cineplex Inc., meanwhile, was downgraded to underperform from market perform by BMO Capital Markets, which cited Cineworld’s move.

“2020 is now a lost year for exhibitors like Cineplex,” according to the firm.

©2020 Bloomberg L.P.