Oct 1, 2020

These are the big third-quarter winners in European stocks

, Bloomberg News

BNN Bloomberg's closing bell update: September 30, 2020

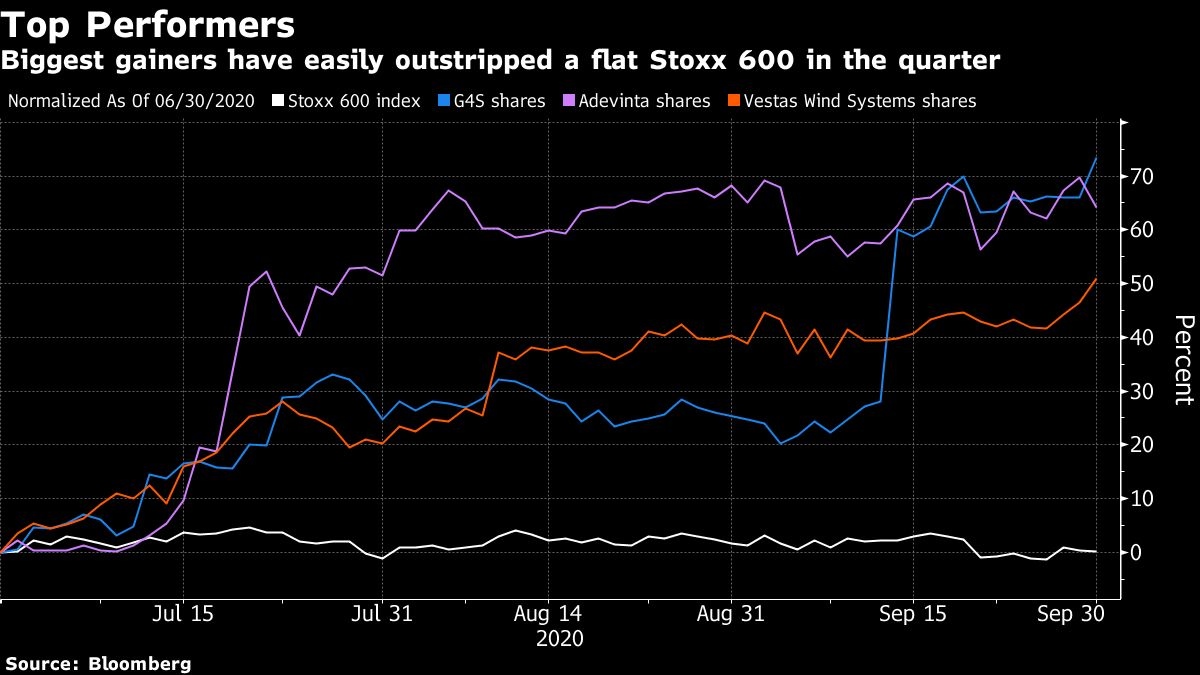

While Europe’s big stock-market winners of the first half were framed by pandemic restrictions, those of the past three months have been marked by green shoots of M&A and excitement around wind power.

Many of the third-quarter’s biggest outperformers such as G4S Plc and Adevinta ASA benefited from a pick-up in dealmaking activity that’s been stoked by record low interest rates. Renewables stocks including Vestas Wind Systems A/S and Siemens Gamesa Renewable Energy SA were boosted by planned government investment in green energy.

Trying to find a theme for Europe’s third-quarter winners isn’t as simple as the first half of 2020, when suppliers of remote-working technology and online takeout providers were boosted by the impact of the pandemic. In addition to beneficiaries of deals and wind power, home-improvement retailers were helped by people diverting spending from travel toward upgrading their property, while gold’s haven status was a boon for miners of the yellow metal.

Here’s a selection of the winning themes in the Stoxx 600 Europe index in the third quarter, plus one where momentum slowed down:

M&A

After a lull in M&A activity that coincided with the pandemic’s spread earlier in the year, the pace has started to pick up. The value of deals in Europe last quarter was down just 8.4 per cent year-on-year, compared with a 64 per cent drop for the second quarter, according to Bloomberg data. And with money so cheap to borrow, many expect the theme to persist in coming quarters.

“M&A will continue, now it’s started, for sure,” Alasdair McKinnon, lead manager of the Scottish Investment Trust, said in a phone interview. “Whenever markets go up, M&A picks up because companies always like to try and grow.”

U.K. security firm G4S was the best-performing stock in the Stoxx Europe 600 Index last quarter, with its shares up 76 per cent following an approach from Canada’s GardaWorld, which on Wednesday made a near 3 billion-pound ($3.8 billion) hostile offer.

Adevinta, a Norwegian online marketplace operator, rose 65 per cent following a deal to buy Ebay Inc.’s classifieds business for $9.2 billion. Majority owner Schibsted ASA gained about the same over the summer.

And Suez SA jumped 51 per cent after Veolia Environnement SA offered to buy a 29.9 per cent stake as a first step to a full takeover. GVC Holdings Plc was another big gainer after a bid for U.K. rival William Hill Plc by Caesars Entertainment Inc. highlighted the value of gambling stocks.

Renewable Energy

The massive green stimulus plan from the European Union and an increasing focus among investors on environmental, social and governance issues has driven an outperformance for stocks with clean energy credentials. Wind power firms Vestas and Siemens Gamesa surged 53 per cent and 46 per cent, respectively, in the third quarter, while Finnish refiner Neste Oyj is benefiting from its increased investment in renewables, rising 29 per cent.

The wind energy sector, in particular, has “proven resilient amid the coronavirus pandemic, and we anticipate this may continue into the fourth quarter, which is typically the strongest quarter for installs and revenue recognition,” said Bloomberg Intelligence clean-energy analyst James Evans.

DIY Retailers

Being confined to one’s home for an extended period of time and having to retool a property for a work-from-home lifestyle has been a boon to DIY retailers. The U.K.’s Kingfisher Plc and Finland’s Kesko Oyj have both benefited, with Kingfisher trading around the highest since mid-2018 and Kesko close to a record high, both among the Stoxx 600’s top 20 gainers of the third quarter.

For Kingfisher, a pure-play on DIY, there’s no reason why its momentum cannot continue “a bit longer,” Davy Stockbrokers analyst Florence O’Donoghue said by email. While there’s a risk that the DIY boom turns out to be temporary and that higher unemployment will curtail consumer spending, “in terms of what it can control, Kingfisher looks to be going in the right direction,” she said.

Gold Miners

A race to safe assets as the pandemic ravages the global economy has seen gold prices surge this year, even if they have slipped a little recently owing to a stronger dollar. The quarter’s top performer among gold miners, Argentina-focused Fresnillo Plc, has benefited from higher gold and silver prices and the stock is the biggest winner in the Stoxx 600 Basic Resources sector in 2020. Fellow gold miners Centamin Plc and Polymetal Plc are second and third-best.

There could be more to come too. Despite the good performance for gold miners this year, “equity valuations continue to be well below historical levels,” RBC analyst Tyler Broda said via email.

Health Care

After being one of the few bright spots in Europe in the first half of the year, the third quarter was distinctly lackluster for health care stocks. The sector was among the worst performers in the Stoxx 600 Index, dropping 2.3 per cent.

Much of the first-half performance was driven by the sector’s defensive nature, with strong financial performances and plenty of catalysts, Barclays Plc’s Emily Field said in an interview. Momentum was lost when most companies only maintained their guidance at the half-year reporting period, she said.

There were also some notable disappointments. The first-half’s star performer, Ambu A/S, delivered among the worst returns in the sector in the third quarter after trimming its outlook due to pandemic’s impact on elective procedures. Galapagos NV sank 31 per cent in the period after it failed to gain U.S. Food and Drug Administration approval for its rheumatoid arthritis treatment filgotinib.

“Going into the back half, investors have been seeing a lack of catalysts to get excited about” while becoming increasingly concerned about the U.S. Presidential election, Field said.