May 4, 2021

This company is capitalizing on favourable conditions in Ontario’s Greenstone Belt

- Analysts are predicting gold prices will increase by 11.5 per cent in 2021 and companies who discover new deposits or expand existing ones stand to benefit

- Ready Set Gold has a new VP of Exploration and a new model for its Northshore project in Ontario that could significantly grow its existing 1.2 Moz resource

- Initial results from a winter drilling program at Northshore are confirming that model, giving the company confidence as it makes its 2021 exploration plans

Gold had a great year in 2020, as did almost all major stock indices, thanks to a flood of fiscal stimulus and the very loose monetary policies unleashed by the world’s central banks.

While the yellow metal has retreated from its August highs (even as stocks, in general, have continued to surge), analysts are still expecting an up year for gold prices. The current low interest rate regime and growing inflation expectations will likely provide a supportive environment.

Indeed, a metals prices forecast conducted earlier this year by the London Bullion Market Association resulted in an average analyst forecast for gold of USD$1,974, which would be an 11.5 per cent improvement on its average trading price in 2020.

With a flagship project in Ontario’s Hemlo-Schreiber Greenstone Belt, a prolific district for gold deposits, exploration company, Ready Set Gold (CSE: RDY | FSE: 0MZ | USA: RDYFF), is looking to ride gold’s gains to new heights.

“We’re trading around USD$6 an ounce on the basis of Northshore’s known in-ground resource. That represents a big discount to our peers, and the project’s upside potential is huge.” — Christian Scovenna, CEO, Ready Set Gold Corp.

Recent Northshore drilling results hit economic gold grades

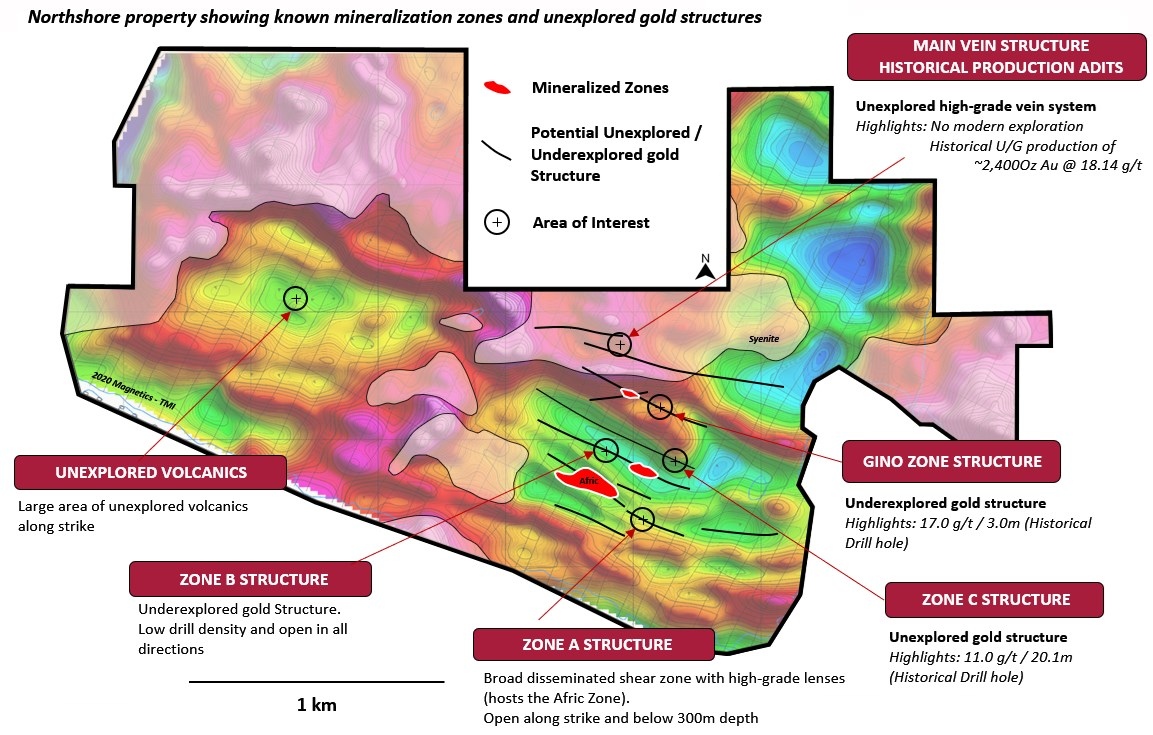

Already, the initial results from winter drilling at their flagship project, Northshore, are demonstrating the viability of a new geological model to grow its existing, 1.2 Moz resource.

This new model shows that this resource remains open (and underexplored) both along the strike of the mineralization and at depth.

Drilling highlights from the resource-hosting Afric zone show its potential to host both lower-grade, bulk-mineable gold close to surface and higher-grade gold below the known deposit.

Overall, the Northshore project remains underexplored with approximately only 5 per cent of the area systematically evaluated. Additionally, the depth potential of the gold mineralized zones remains untested with the deepest drill intercepts at 250 m.

Ready Set Gold CEO, Christian Scovenna, likes Northshore’s northern Ontario location as a place to go looking for more gold, commenting, “It’s a very mining-friendly location that’s blessed with a wealth of infrastructure and a number of large deposits with consistent gold grades.”

Scovenna’s hope is that these winter results will provide momentum for the company as it makes its plans for the summer and fall at Northshore. More results from this 13-hole, 2,900 m program are on the way and will help confirm the company’s ability to expand the resource at Afric and elsewhere on the property.

$RDY's Northshore property is vastly under explored with large upside potential.

— Ready Set Gold Corp (@readyset_gold) March 8, 2021

• Only the Afric Zone veins have been tested

• Underexplored project area, limited to Afric zone

• Multiple quartz veins mapped and sampled on surface

Details👇#DrillingProgram #Invest

Chance at discovery lures new VP Exploration

This potential to grow Northshore’s resource by making a big new discovery in the area immediately around and under Afric convinced Brad Lazich to come on board this past February as Ready Set Gold’s VP Exploration.

Lazich spent his first 13 years as a geologist working in generative, regional and advanced exploration for major miners such as Teck, Vale and Glencore. He has both led and been a part of teams that outlined significant new deposits.

In Northshore, he sees “a good opportunity to explore a historical asset and make some new discoveries. Our new exploration model opens the project up for growth along strike and at depth.”

Using that 1.2 Moz resource as a base, the plan is to use current and future drilling results to grow it substantially. Based on Lazich’s model, the project is significantly underexplored and capable of hosting much more gold than previous operators had thought.

“We’re targeting producing a new resource calculation and a feasibility study for Northshore within the next 18-24 months,” notes Lazich.

Results appear to verify Lazich’s new Northshore model

With the drilling already confirming Northshore’s growth potential, all eyes will be on the company as it embarks on its summer and fall exploration programs. Lazich is planning another round of geophysics and surface mapping to hone in on targets, with another drill program to follow in the late summer or early fall.

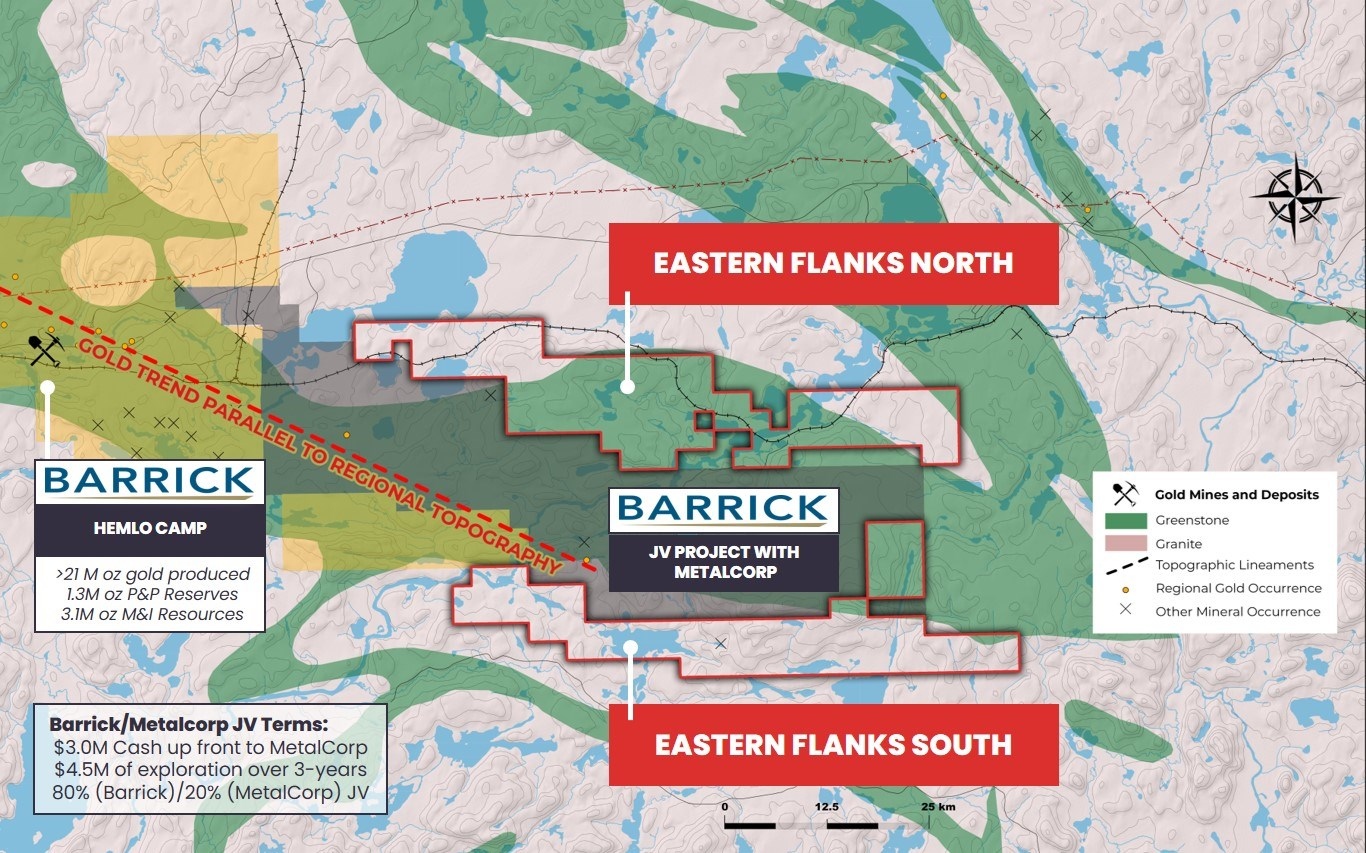

The company will also conduct some initial surface work this summer on its Hemlo Eastern Flanks project, where their geological team has identified a prospective trend.

This exploration is expected to include a detailed airborne and/or ground magnetic survey followed by surface mapping, sampling, and a soil survey.

The project lies down the road from Barrick’s Hemlo mine, which has produced more than 21 Moz of gold in its three-decades-plus of operation.

Hemlo Eastern Flanks also borders Metalcorp’s project in the area, which it recently optioned to Barrick for $3 million in cash and a three-year, $4.5 million work commitment.

The project adds some earlier-stage exploration upside to the resource growth and discovery story Ready Set Gold is building at Northshore.

Table set for busy summer and fall for Ready Set Gold

Scovenna and his management team have collectively raised more than $1 billion in the capital markets and are quite excited about Ready Set Gold’s potential.

Of the company’s present valuation, Scovenna notes, “We’re trading around USD$6 an ounce on the basis of Northshore’s in-ground resource. That represents a big discount to our peers, and the project’s upside potential is huge.”

$RDY.C aims to discover low-cost, economic gold deposits in stable jurisdictions in Canada’s most prolific region for gold mining.

— Ready Set Gold Corp (@readyset_gold) April 20, 2021

Read @stockhouse's article to learn about our initiatives, including at Ready Set's flagship Northshore project: https://t.co/oauYdT2NSj pic.twitter.com/MpY8LFziq3

Assays are still pending from winter drilling at Northshore; that robust follow-up program will begin there soon and will run through the summer and into the fall. Hemlo Eastern Flanks will see further exploration this year as well.

All this activity should position Ready Set Gold to leverage another up year for the yellow metal.

Visit Ready Set Gold’s website to learn more.

Follow Ready Set Gold on social media for the most up-to-date news: