Jan 4, 2023

This Contrarian Stock Market Signal Is Losing Predictive Power

, Bloomberg News

(Bloomberg) -- A long-watched indicator of which way the stock market is likely to move next has lost predictive power lately, confounding investors who have come to rely on the signal embedded in options trades.

The put-call ratio, which compares the number of contracts traded in bearish versus bullish options, is widely considered a contrarian indicator; for example, when investors load up on puts allowing them to sell the underlying stock or index, markets may be primed to rally as the ratio spikes. In other words, the ratio can be a powerful indicator of the market’s mood.

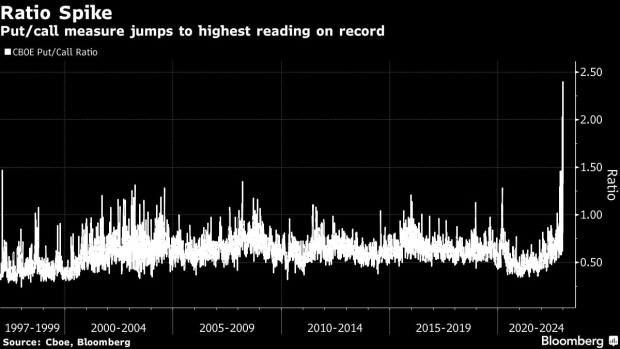

Since October, however, the gauge for options on the S&P 500 Index has proved erratic. Over this period, the S&P 500 has gained and market volatility has tumbled, yet the put-call ratio spiked multiple times, on some days even showing investor bearishness at levels unseen in data going back to 1997.

The reason may lie in unusual order flow patterns that are distorting the ratio, according to the CBOE Global Markets. Its analysis implies the picture is being blurred by large market players who are increasingly using “deep-in-the-money” puts, essentially options with strike prices above that of the underlying stock.

If so, this would be the latest indication of how options trading is being impacted by an influx of large participants. Last year’s surge in the use of very short-dated derivatives was attributed to defensively positioned money managers, who piled into bullish calls options to catch up with market rallies.

“All these indicators are very interesting but you need to take them with a pinch of salt and judge the overall situation,” said Alberto Tocchio, a portfolio manager at Kairos Partners. “I would therefore judge the high put-call ratio as a measure of low positioning but wouldn’t really take this measure as extreme with the current levels of implied and realized volatility, which are nearly the lowest in the last 12 months.”

In the case of the put-call ratio, the sheer volume of bearish contracts skewing the ratio since October may stem from various strategies deployed by traders that don’t in fact reflect a bearish market view, while bringing “noise” to the options market, CBOE wrote in a note on Dec. 29.

CBOE’s analysis shows that despite a surge in trading in put options for single-name stocks on one day, open interest remains little changed on the following day, suggesting those options are being exercised before they expire. Indeed, the data from the exchange show the put-call ratio now spiking consistently around Wednesdays, as large put volumes hit the market on those days.

One of the reasons why many large market players are exercising put options before expiry lies in last year’s sharp rise in US interest rates: the “carry” cost for holding on to in-the-money puts has jumped, which prompts holders to exercise them early.

Indeed, CBOE noted significantly higher in-the-money put activity in the last quarter of last year — a situation when the security’s price falls below the strike price of the put options. The proportion of in-the-money puts rose to about 11%, double the 5% average in recent years.

“The spike in put trading is not about hedging demand,” said Anthony Benichou, cross-asset sales trader at Louis Capital Markets, in London. “The put skew is near its lowest level ever, and investor positioning is not ‘long equities’ so there is less demand for hedging.”

--With assistance from Michael Msika and Ksenia Galouchko.

(Updates with an investor quote in sixth paragraph)

©2023 Bloomberg L.P.