Mar 12, 2020

‘This Is All Coming to a Head’: Investors React to Market Chaos

, Bloomberg News

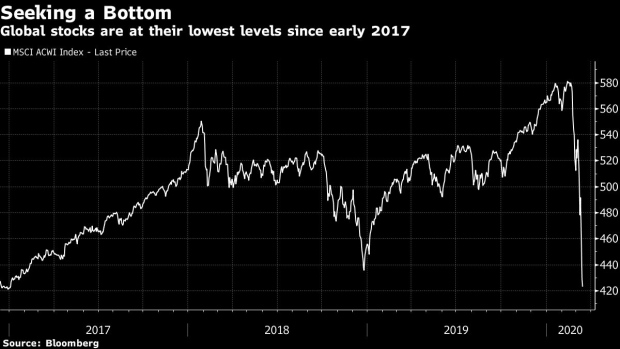

(Bloomberg) -- On the last day of an historic week for global markets, there’s little sign of an end to the volatility that roiled bonds and currencies and sent stocks to their steepest plunge since the depths of the global financial crisis.

Mounting concerns that the coronavirus pandemic will spark a worldwide recession fueled a fresh round of selling in Asia on Friday. Benchmark stock indexes in South Korea, Japan, the Philippines and Australia all tumbled more than 7%, while some policy makers rushed to limit wild fluctuations in currencies and sovereign debt.

Here’s what strategists and investors are saying about the market turmoil:

Coming to a Head

“This is all coming to a head very rapidly,” said Brian Barish, chief investment officer in Denver at Cambiar Investors LLC, which manages about $14 billion. “Markets are making it loud and clear that a business-as-usual approach is untenable. We are buying cosmetics and booze and select industrial businesses with pretty durable forms of demand. We have not developed the courage as of yet to jump on airlines or hotels. But maybe getting close with those.”

“At this point, no sane investor should be concerned with 2020 earnings - they are cooked! - but with getting through to the other side of this.”

‘Too Late’ for Hedges...

“It’s simply too late to engage in new long volatility hedge strategies,” said Peter Cecchini, global chief market strategist at Cantor Fitzgerald LP. “Equity markets tend not to move in a straight line. We’d be monetizing hedges aggressively. Both the volatility surface and index technical setups suggest this action is prudent.”

“All the factors we look at are extreme and point to a near-term bounce, including spot VIX at the highest since 2008. We still maintain a sell-the-rally mindset, as fair value on the S&P remains roughly 2,450 on a base case but with significant risk to a downside overshoot.”

...So Try This

“While there is no free lunch, investors are seeking cost mitigation as hedges become more and more expensive,” said Amy Wu Silverman, equity derivatives strategist at RBC Capital Markets.

“Selling a call spread still allows investors to retain upside should we get a sharp reversal (e.g. we have found a Coronavirus cure); meanwhile, it provides a wide expanse of protection on the downside.”

Dangerous Times

“The toxic fallout from the coronavirus pandemic’s bursting of the Fed’s ‘everything bubble’ has collided with the grotesquely over-leveraged and vulnerable U.S. corporate sector -- this puts equity markets in an even more vulnerable position,” said Albert Edwards, a strategist at Societe Generale SA known for his bearish views.

“With an anomalously low testing rate the U.S. will as a consequence suffer a high headline death rate, although the true death rate will be no worse than elsewhere. The big death rate headlines will likely hit consumer confidence very hard indeed and deepen an already likely deep recession and equity market collapse, potentially causing a significant backlash against the current U.S. administration. These are dangerous times indeed.”

‘Close to’ Bazooka

“While the market may have been disappointed that Trump did not break out the bazooka last night, the reality is the Fed came close to doing that today -- though the market remained unimpressed,” said RBC Capital Markets LLC economists Tom Porcelli and Jacob Oubina. “They promised to do $500 billion each in 1-mo and 3-mo repos for the foreseeable future and they are going to expand Treasury purchases beyond bills. For a market focused on liquidity issues, this is good first step. We continue to hear that liquidity is terrible in off-the-run Treasuries so by expanding their purchases beyond bills, they no doubt hope to alleviate that issue. The problem is, spreading around the $60 billion in monthly purchases they were already making may not be enough. We think this is just the beginning.”

Right Conditions

“Market sentiment will remain jittery in the near term as the Covid-19 outbreak continues to accelerate in the U.S. and Europe,” said Tai Hui, chief Asia market strategist at JPMorgan Asset Management. “As we have experienced in China and other parts of Asia, the right policies to contain the outbreak should work but this involves some sharp, short term pain. We are likely to go through such pain in the weeks ahead in the U.S. and Europe.”

“For markets to be less anxious, we need to see the number of new infections stabilize, as we did with China (since mid-February) and South Korea (in recent days). We also need to see fiscal and monetary policy support implementation. Hence, we are not looking at specific time or valuation to advise investors to add back equities, but instead we are looking for the right conditions.”

EM Outperformers

“We no longer recommend investors overweight emerging-market equity positions relative toeuro-zone stocks” after outperformance by EM in recent days, said Mark Haefele, chief investment officer at UBS Global Wealth Management. “Equity markets are pessimistic today and volatility is elevated, making downside protection more expensive and access to upside participation relatively cheap. This presents an opportunity for investors looking to maintain exposure to equities, while also managing downside risks, to implement strategies such as put-writing or structured investments, which can offer a degree of capital protection and upside participation.”

Safety Beats Everything

“There’s a whole host of uncertainties out there and markets aren’t sure that the policy measures they have seen so far are coherent, cohesive and coordinated enough to tackle what’s at hand,” said Vishnu Varathan, head of economics and strategy at Mizuho Bank Ltd. “It’s beside the point that we’ve gone into an area where valuations are attractive until the fright stabilizes and is alleviated. It’s difficult for markets to be convinced to be taking the risk in catching falling knives.”

“Everybody just wants to hold perceived safe havens. There’s certainly a flight out of risky assets, which include in the universe emerging-market assets across the equities and FX space, and the flight hasn’t ended.”

Liquidity Constraints

“Despite the recent injections of liquidity from major central banks, they are not flowing into Asia,” said Eugenia Fabon Victorino, head of Asia strategy at Skandinaviska Enskilda Banken in Singapore. “As Asia braces for tighter USD funding, long USD/Asia seems to be the way to go. The dollar index continues to gain ground, re-emerging as the ultimate safe haven. Equity and bond flows into Asia are deeply in the red, with a few Asian equity markets triggering trading halts.”

Useless Valuations

“The market is in a state where it’s a bit out of control,” said Hiroshi Matsumoto, head of Japan investment at Pictet Asset Management Ltd. “We’ve come to a stage were we can’t predict earnings. Earnings-based valuations have become useless right now. It could be that there’s an overshoot here towards the downside. Honestly, we can’t judge based on these valuations.”

--With assistance from Cormac Mullen, Lilian Karunungan and Min Jeong Lee.

To contact the reporter on this story: Joanna Ossinger in Singapore at jossinger@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, Michael Patterson

©2020 Bloomberg L.P.