Apr 1, 2020

This Light Bulb Deal Wasn’t Such a Bright Idea

, Bloomberg News

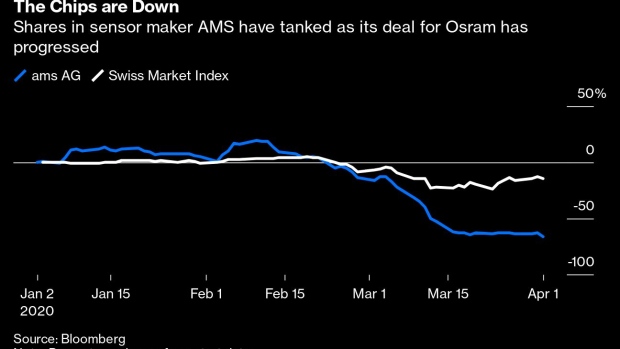

(Bloomberg Opinion) -- HSBC Holdings Plc and UBS Group AG are having their loyalty to Austrian tech group AMS AG tested. The investment banks led the underwriting of a 1.8 billion-Swiss franc ($1.9 billion) share sale to support its takeover of German lighting group Osram Licht AG. That backstop became real yesterday after AMS’s shareholders failed to support the fundraising in full, leaving up to 38% of the shares having to be purchased by the banks.

True, majority take-up is impressive in this market. The underwriters were also able to offload some of the residual holding overnight. But the fact remains that the banking syndicate was still left with shares worth around 500 million francs at the current market price, and a roughly 25 million-franc paper loss (ignoring their fees). And that’s not all. Having also lent to AMS to fund the rest of the 4 billion-euro ($4.4 billion) acquisition, the financing group now has a large debt and equity exposure to a single client. That ties up financial capacity at a time when other customers are drawing down credit lines.

Investors are already testing the lenders’ tolerance for taking losses on the position. One tricky question now is the price at which the banks could unload such a large stake. Maybe there are some insurance arrangements with hedge funds to mop it up, but these could already have been exhausted. Or maybe a big strategic investor or activist could come to the rescue. There’s a chance to grab a big stake in AMS, which makes sensors and supplies the smartphone industry, on the cheap.

Recall that it was a struggle to get this takeover deal over the line. After some work, AMS got to 60% of acceptances from Osram holders. It should now be relieved it secured more financing than it actually needed. Investors, largely hedge funds, held back some of their Osram shares hoping to hold AMS to ransom if it wanted to raise its position to 75%. That’s the level where the Austrian company can get direct access to Osram’s cash flows so long as it agrees to pay a chunky dividend to remaining holdouts. AMS has no incentive to enter such an expensive operation today given Osram’s cash flow is going to be pretty weak this year.

Is this just bad luck for all concerned? The situation was foreseeable in general, if not the specifics. The underwriting terms were fixed after the coronavirus had become a clear threat to global health and economic activity. The board of Osram voiced concerns about developments that could derail the fundraising. One risk was that the rights offer wouldn’t go ahead at all and AMS would have to pay for the deal entirely in debt. As it happens, AMS got the cash, but its business will now be under more pressure due to the impact of the pandemic-provoked global downturn. Still, its problems are now shared with shareholders in HSBC, UBS and those Osram investors who gambled on a very different outcome.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Chris Hughes is a Bloomberg Opinion columnist covering deals. He previously worked for Reuters Breakingviews, as well as the Financial Times and the Independent newspaper.

©2020 Bloomberg L.P.