May 23, 2019

This May Hurt a Little (Or a Lot) as Opioids Haunt Pharma Bonds

, Bloomberg News

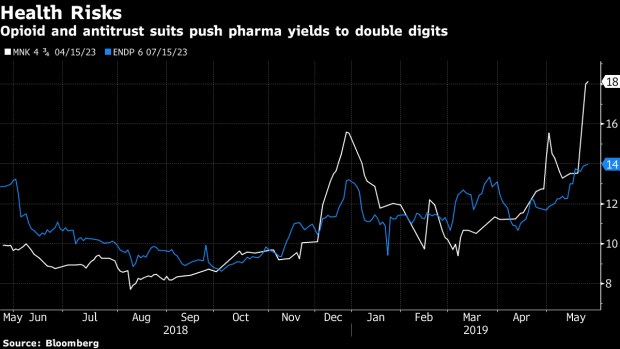

(Bloomberg) -- Debt holders are placing all-or-nothing bets on junk bonds from drug makers embroiled in lawsuits over the opioid epidemic and price-fixing.

The investors are taking advantage of sliding prices for notes issued by companies such as Endo International Plc, Mallinckrodt Plc and Teva Pharmaceutical Industries Ltd., which face allegations that they’ve fueled the opioid epidemic, and that they’ve engaged in price-fixing of generic drugs. Mallinckrodt is also in a legal battle with the U.S. over a plan to slash reimbursements on Acthar, the company’s star drug.

Some junior bonds are trading deep in junk territory, with credit raters warning that some Teva holders could get back only half of face value if there’s a default -- or maybe nothing in Endo’s case. Notes of both companies slid in response to an expanded price-fixing lawsuit, with some trading at less than 80 and 70 cents on the dollar respectively, and Mallinckrodt’s 2023 notes slid to record intraday lows just above 60.

“It’s struck-by-lightning risk,” said John Sherman, a portfolio manager at DDJ Capital, whose firm is avoiding investments in the industry altogether. “Your upside is limited to par, and the downside is you lose most of your money.”

Representatives for the companies didn’t respond to requests for comment. The drug makers previously have said the opioid allegations aren’t true, and that they’re cooperating with the price-fixing probe, which is being handled as an antitrust case.

How steep of a loss investors might have to bear is the billion-dollar question. Eric Axon of CreditSights estimates fines just for price-fixing could total $2 billion to $3 billion. Some drug makers are considering settlements to rid themselves of the legal overhang.

Timing will drive the outcome for each company, said John McClain, a portfolio manager at Diamond Hill Capital Management, who owns positions in high-yield pharma companies. “This is going to be years of litigation, re-litigation and settlements,” McClain said. “Anything in the five- to 10-year horizon is still reasonably safe on the debt side, but anything longer than that, there’s a lot of things that can change.”

Nothing Left

Pharmaceutical names in the high-yield index have rewarded those willing to wait out the uncertainty. The sector is up 10% return year-to-date, compared with 8% for the entire Barclay’s high-yield index.

Some are already so heavily indebted that they can’t afford to settle. Authorities should “look somewhere else” if they want a large settlement out of the U.S. opioid case, Teva Chief Executive Officer Kare Schultz told investors. A debt burden of about $28.6 billion won’t allow Teva to offer anything big, he said on May 2. Insys Therapeutics Inc. says it can’t complete the $150 million opioid settlement it reached with the U.S. Justice Department and may have to declare bankruptcy.

Endo, which carries about $9.1 billion of debt, is interested only in a global settlement that addresses all its claims completely; otherwise it’s prepared to go to trial, Chief Executive Officer Paul Campanelli said at an investor conference this week.

Then there’s the unquantifiable risk of an election year, with high drug prices and the opioid crisis serving as potential campaign fodder for Democratic candidates as well as President Donald Trump. Those issues have caught the public’s attention, with opioid overdose deaths running close to 50,000 a year, and prescription drug price increases outstripping inflation.

“I’m worried about the entire pharmaceutical sector this year” as opioid and price-fixing lawsuits come to a head, Irina Koffler of Mizuho Securities said. “If you burden the companies with a few hundred million of fine payments, then they have to delay their ability to grow the business or reach their de-levering targets,” Koffler said.

The outcome will be company-specific and likely to take time, said Axon at CreditSights.

A closely watched opioid liability trial in Oklahoma is scheduled for May 28. Endo is waiting on the sidelines to see how the judge handles the case, and any broader implications for the industry. “If there’s a way to settle, that’s always something that we would consider,” Campanelli said on an earnings call, but it’s too early to quantify the impact.

Purdue Pharma LP and its controlling Sackler family already agreed to pay $270 million to settle Oklahoma’s claims in March, and gave state officials a commitment it’s not filing for bankruptcy anytime soon. Allegations that it encouraged doctors to over-prescribe OxyContin are “misleading attacks,” the company has said. West Virginia reached a $37 million accord this month with McKesson Corp. to settle claims it improperly distributed opioids to pharmacies; the company admitted no wrongdoing.

The “astronomical” numbers floated for other potential settlements could deplete some drug makers of all their cash, putting their survival at risk, said Christopher Donoho, a bankruptcy attorney at Hogan Lovells who has advised pharmaceutical clients. “The companies that are taking it on the chin right now are the smaller drug makers, particularly the ones that aren’t real cash cows.”

Larger companies could be driven to preserve value for their creditors and shareholders outside of a Chapter 11 process, because a bankruptcy could damage brands. “If you choose to file, in addition to the monetary cost, there’s the potential reputational risk in the eyes of consumers,” said Sean Cannon, a director at GLC Advisors & Co. “You have to weigh that against what you get out of the process.”

--With assistance from Molly Smith, Claire Boston and Jef Feeley.

To contact the reporter on this story: Katherine Doherty in New York at kdoherty23@bloomberg.net

To contact the editors responsible for this story: Rick Green at rgreen18@bloomberg.net, Nicole Bullock

©2019 Bloomberg L.P.