Mar 17, 2023

This Week in China: Chinese Bank Stocks Are World’s Best as US, Europe Crack

, Bloomberg News

(Bloomberg) -- Triumphalism is taking root among China’s equity trading community. The nation’s banking system, the argument goes, is shielded from global volatility and can withstand acute financial distress.

The optimism has been on full display. Of the 166 listed lenders tracked by Bloomberg across the world, almost all the top performers this week are in China. The country’s lenders rallied even as two bank failures in the US and one rescue — plus panic over Credit Suisse Group AG’s future — roiled markets from New York to Zurich and Tokyo. Bank of China Ltd.’s shares just had their best week in four years in Shanghai.

Fueling confidence is a sense that authorities in Beijing are better equipped to handle crises. Targeting and defusing risks was a key priority discussed at the annual session of the National People’s Congress. President Xi Jinping has just consolidated the country’s financial regulators to strengthen oversight of its $60 trillion financial system. Brutal deleveraging campaigns since 2017 have left Chinese banks with healthier balance sheets and adequate liquidity, said one official newspaper.

Analysts agree. Even under Citigroup Inc.’s most extreme stress test, the estimated 31-basis point hit to Chinese banks’ core capital ratios “still looks manageable,” wrote analysts including Judy Zhang. Their scenario models something like the troubles at Silicon Valley Bank happening in China: A sudden half-percentage-point increase in Chinese 10-year yields forcing banks to sell a quarter of their debt portfolios for liquidity.

There are plenty of reasons why this is unlikely — at least for now. The economy’s recovery from the pandemic remains fragile and will need more support, while inflation is muted. This keeps China’s central bank in easing mode. Even if there’s a need to adjust policy, the People’s Bank of China could change course slowly (remember the “no sharp turn” pledge?), giving lenders time to adjust exposure.

State media says this is evidence of China’s superior governance. But a bizarre incident in the country’s bond market showed how policy-making remains unpredictable to outsiders.

Here’s my roundup of the week’s key developments for China markets.

Going dark

Traders in China struggled to access real-time bond prices for a few harrowing days. Widely-used data vendors suddenly stopped providing quotes, triggering a 60% slump in some transactions before a nod from the regulator allowed a few vendors to restore feeds. While normality has since resumed, the abrupt turn of events undermines Beijing’s recent pledge to improve its communication with markets.

- China Does U-Turn on Bond Feeds After Sudden Halt Roiled Market

- China Bond Quotes Suddenly Go Dark, Roiling $21 Trillion Market

Caught in the middle

US politicians are united in targeting TikTok, the video platform owned by Beijing-based ByteDance Ltd. Fears that the app can be used to spy on Americans have spurred calls for a sale of its US operations, which TikTok sees as a last resort. The US business may fetch as much as $50 billion, Bloomberg Intelligence estimates.

- US Demands TikTok’s Chinese Owners Sell Stakes or Face Ban

- TikTok Has Option to Fight Back as US Weighs Ban or Forced Sale

- TikTok Considers Splitting From ByteDance If US Deal Fails

Closing loopholes

China’s securities regulator is putting a stop on the wave of share sales in Zurich — for now. Chinese investors were taking advantage of persistent price gaps between offshore and onshore listings to make an easy-money financial arbitrage trade.

- China Pauses GDR Approvals, Threatening Europe Share Sale Boom

Diplomatic blitz

Xi is rebooting his image as a global statesman after years of isolation. He landed a big win by hosting Iran and Saudi Arabia as they restored diplomatic ties. Xi also plans to visit his Russian counterpart Vladimir Putin in Moscow, hold his first-ever call with Ukrainian leader Volodymyr Zelenskiy and potentially speak to US President Joe Biden again.

- Xi Jinping Seeks New Role — Global Peacemaker: Balance of Power

- What Role Did China Play in Brokering Iran-Saudi Detente: Q&A

Visas

China resumed issuing tourist visas, a significant and symbolic step in its move to rejoin the world. The few remaining remnants of Covid Zero include a requirement that travelers from a swathe of countries like the US provide negative tests before boarding flights.

- China Issuing Visas to Tourists Again as It Reopens to World

No Big Boom

The economy’s rebound from Covid Zero is proving fragile. Consumers aren’t spending much and youth unemployment is high. One positive is the housing market, where sales and prices rose for the first time since 2021.

- China Reports Economy Rebound But Warns of Risks to Recovery

- China Home Prices Rise First Time in 18 Months After Stimulus

... and three things to watch for next week

- Hong Kong will host the Credit Suisse Asian Investment Conference, the HKMA-BIS Joint Conference of central bankers and the international art fair Art Basel.

- Earnings from Tencent Holdings Ltd. and Xiaomi Corp. are due. TikTok’s CEO will testify to Congress.

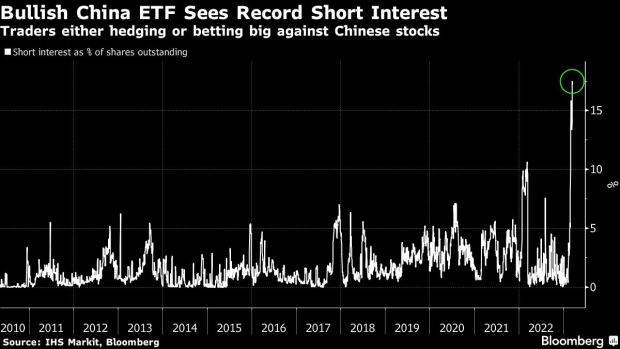

- Short interest is at a record for a leveraged exchange-traded fund tied to Chinese stocks. US traders are either hedging their ultra-bullish positions or using the fund, known by its ticker YINN, to make a speculative bet against the market.

For a deeper dive into where China stands now — and where it’s going next — sign up to the Next China newsletter.

©2023 Bloomberg L.P.