Jun 18, 2019

Three Weeks of Happy Apathy About to Come Due for Stock Bulls

, Bloomberg News

(Bloomberg) -- The ability of equity traders to merrily ignore everything the world throws at them is scheduled to end at 2 p.m. Wednesday.

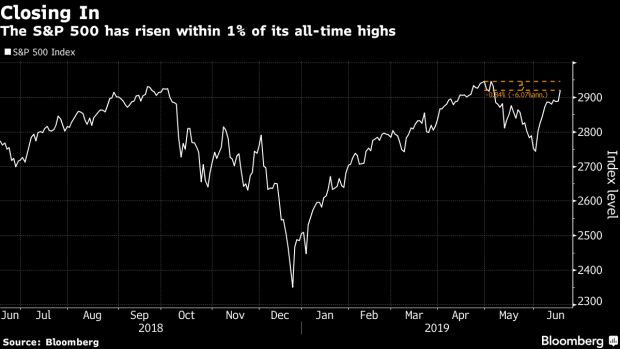

In the balance when the Federal Reserve and Chairman Jerome Powell opine on interest-rate policy will be 12 days of bliss in which the S&P 500 has surged 6.5% to within spitting distance of a record.

Both the central bank and investors have a lot to consider. Parts of the economy are showing weakness -- not that the S&P 500 is registering it. Inflation is low. Central banks around the world are signaling greater willingness to ease. And while the president’s trade war with China rages on, he’s complicating matters by insisting on a cut.

“What the market is hoping for is a clear dovish stance,” said Rob Haworth, senior investment strategist at U.S. Bank Wealth Management in Seattle, which oversees $170 billion. “Given the news flow, that may not be necessary and it may not happen.”

Here are four scenarios equity traders are considering ahead of the decision.

Change of Wording

Most investors don’t expect the Fed to cut rates on Wednesday and think if an easing does come, it’s more likely later in the year. As of Tuesday, futures traders are pricing in about a 20% probability of a June cut and about an 80% chance of one in July. Even so, many are anticipating changes to the Fed’s statement and possibly its chart of member expectations, known as the dot plot. Should the word “patience” be dropped from forward guidance, it could signal a readiness to act.

“That’s exactly what the market is looking for at this point,” said Michael Reynolds, investment strategy officer at Glenmede. “Even if they don’t deliver on the dot plot, that doesn’t mean that the Fed won’t be proactive, but it’s more certainty that this is what’s coming, that more participants are thinking this is appropriate at some point this year, perhaps in the near term.”

Fed Pivots Toward July Cut

If the Fed doesn’t cut rates this week, many are betting it will likely guide the market toward the possibility of policy easing come July. Should that happen, the reaction in stocks might not be straightforward, making language surrounding the Fed’s reasoning all the more important.

“The context will be what’s important in that, and that’s the challenge,” Haworth said. “Is it a growth concern cut or is it a policy uncertainty cut? The policy uncertainty cut is probably a little more constructive than a growth concern. If the Fed’s more concerned about recession, one cut may not be enough and the market may not cheer that as much as they might if it’s just a policy uncertainty to ease financial conditions to make things a little easier while we get through these trade negotiations.”

Surprise Party

Most investors would agree that surprises from the Fed are unwelcome. But what if the central bank comes out with a cut, possibly of 50 basis points?

There is some historical precedent for this scenario: the last two times it began an easing cycle, in 2001 and 2007, it opted for half-percent moves. But some strategists are warning that such a cut would indicate the Fed is seeing profound weakness in the economy -- that just six months after its last hike, things have deteriorated so significantly to warrant extraordinary action.

“A larger cut, like 50 basis points, would be initially celebrated by the market, which could jump a lot higher,” said Chris Zaccarelli, chief investment officer for Independent Advisor Alliance. “But I think that will quickly give way to concern and lead to a sell-off as market participants will start to worry about what the Fed knows that they don’t know. Is the economy at that much risk?”

But what about a move of 25 basis points? Some argue the Fed instituting a so-called insurance cut could help boost growth while the muddle of the U.S. trade war with China gets resolved.

“That appears to be the best-case scenario for growth and rates,” Tom Essaye, a former Merrill Lynch trader who founded “The Sevens Report” newsletter, wrote in a note to clients. “In that outcome, the Fed might just extend this decade-long bull market.”

Fed Remains Patient

It’s unlikely, but maybe Powell hearkens back to his October approach and sticks to his upbeat assessment of the economy. There is some evidence for this, too: after all, markets are flirting with highs, and the last time the Fed raised rates -- just six months ago -- it reaffirmed that a strong U.S. economy will likely warrant further increases. And if inflation is the concern, the central bank could, once again, write it off weakness as “transitory.”

“If the Fed were to retain its patient stance alongside no cut, the equity market would likely be disappointed and sell off,” said Peter Cecchini, the global chief market strategist at Cantor Fitzgerald. “The Fed has at times cut with equity indices near highs, but only when there is an economic justification, which it does not have now but which it may get before the July meeting.”

--With assistance from Olivia Rinaldi.

To contact the reporters on this story: Vildana Hajric in New York at vhajric1@bloomberg.net;Sarah Ponczek in New York at sponczek2@bloomberg.net

To contact the editors responsible for this story: Jeremy Herron at jherron8@bloomberg.net, Chris Nagi

©2019 Bloomberg L.P.