Aug 2, 2021

Tokyo Shows an Inflation Pulse for the First Time in a Year

, Bloomberg News

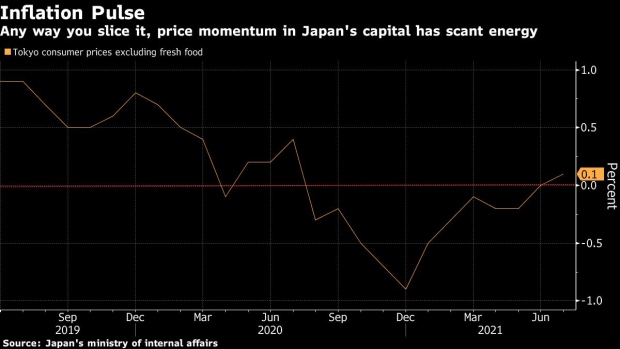

(Bloomberg) -- Tokyo consumer prices unexpectedly rose for the first time in a year, another sign of a recovering inflation pulse in Japan, though the pace of gains was far from the levels fueling fears elsewhere in the world.

Prices in Japan’s capital, excluding those for fresh food, ticked up by 0.1% in July compared with a year earlier, the ministry of internal affairs reported Tuesday. Economists had expected prices in the city to stay flat for a second month following 10 months of falls.

Key Insights

- Downward pressure on Japan’s prices is easing as global energy markets rebound from the pandemic, but inflation remains far more subdued than in many other countries where central banks are considering an eventual withdrawal of monetary stimulus.

- The Bank of Japan, by contrast, sees no end to its easing. The BOJ last month reiterated it doesn’t expect inflation to reach its 2% target anytime before 2024, though it sees prices drifting up from rock-bottom levels once economic activity improves.

- The timetable for a fuller recovery could still be delayed. Japan last week expanded a state of emergency to areas surrounding Tokyo and extended it to the end of August in the face of a record virus surge unfolding as the country hosts the Olympics.

- Another headwind for Japan’s price data could come Friday when statisticians re-base the CPI, using 2020 as the reference year. The change could give even more weight to mobile phone fees that have plunged in response to pressure from Prime Minister Yoshihide Suga.

What Bloomberg Economics Says...

“We expect Tokyo’s CPI gauges to pick up in August, aided by a lower base for prices last year, which were depressed by a government travel promotion campaign. Excluding that factor, the broad inflation trend remains weak.”

--Yuki Masujima, economist

To read the full report, click here.

Get More

- Overall Tokyo prices fell 0.1%, compared with a forecast gain of 0.1%.

- Inflation was flat, when excluding the cost of both fresh food and energy. That matched the projection.

(Adds more information on price changes.)

©2021 Bloomberg L.P.