New US Home Sales Jump to Highest Level Since September

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

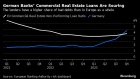

Germany’s financial regulator BaFin is taking a closer look at the real estate used by lenders to secure covered bonds known as Pfandbriefe, a €400 billion market traditionally considered among the safest in credit.

Taylor Wimpey Plc is failing to see lower mortgage rates translate into higher levels of home sales and is maintaining its forecast for fewer deals in 2024.

Chinese mainland investors increased their portion of total turnover of Hong Kong stocks to a record daily average in April, with the latest measures to bolster the city’s position potentially boosting their purchases.

Dec 2, 2020

, BNN Bloomberg

Canada's largest housing market registered another month of double-digit sales growth in November that masked continued underlying weakness in its once red-hot condo market.

There were 8,766 property sales across the Greater Toronto Area last month, according to data released by the Toronto Regional Real Estate Board (TRREB) on Thursday. That represents a 24.3 per cent increase from sales activity a year earlier, but a 17 per cent drop from October’s sales activity.

The average home price across the GTA reached $955,615 in November. While that's an 13.3 per cent increase from year-ago levels, it was a drop-off from October's record-setting average of $968,318.

Detached homes were the hot properties in November, particularly outside the city of Toronto, as sales in that segment surged 33.6 per cent year-over-year in the 905 area code, which includes the cities of Mississauga and Brampton.

It was an entirely different story in the condo market as sales in the city of Toronto inched up just 0.8 per cent from a year earlier and the average selling price fell three per cent to $640,208. Dynamics tilted in buyers' favour amid a surge in supply; indeed, there were 5,018 active listings for condo apartments in Toronto last month, compared to 1,707 in Nov. 2019.

However, the local real estate board struck an optimistic tone that conditions will re-balance on the other side of the pandemic.

"The condominium apartment market is certainly more balanced than in previous years, with some buyers benefitting from lower selling prices compared to last year. However, this may be somewhat of a short-term phenomenon," said TRREB Chief Market Analyst Jason Mercer in a release.

"Once we move into the post-COVID period, we will start to see a resumption of population growth, both from immigration and a return of non-permanent residents. This will lead to an increase in demand for condominium apartments in the ownership and rental markets."