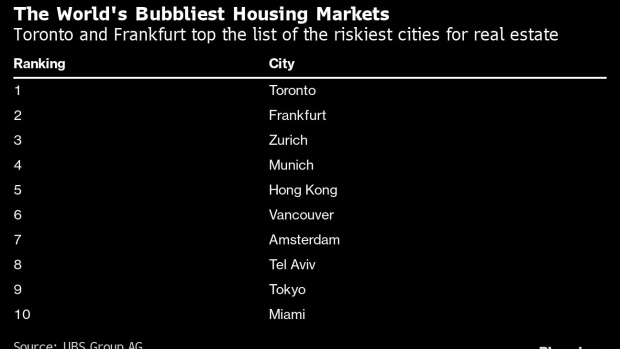

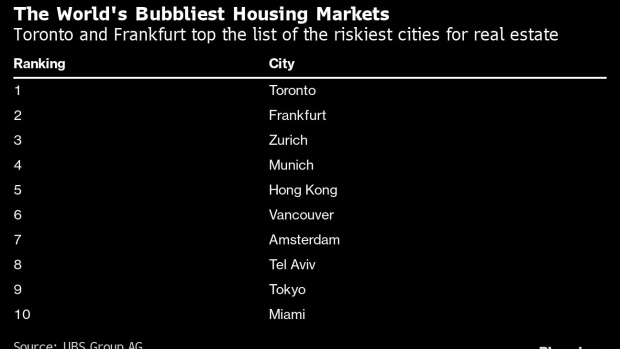

Toronto’s housing market is looking like the world’s biggest real estate bubble, with Frankfurt not far behind in a UBS Group AG study of cities with the greatest potential for home-price declines in the coming months.

Canada’s financial capital rose to the top position in the Swiss bank’s annual ranking of real estate markets most in danger of correcting. Cities from Amsterdam to Tokyo also saw their risk levels increase, according to a report released Wednesday.

Home values in many cities are looking shakier than they have in years as central banks race to tame inflation by jacking up interest rates, suddenly making it far more expensive to get a mortgage. In some places, notably Toronto, that’s already resulted in price declines. But with odds rising that higher borrowing costs will cause a global economic slowdown and job losses, the downturn in real estate may just be getting started, UBS said.

“We are witnessing the global owner-occupied housing boom finally under pressure,” the bank wrote in its report. “In a majority of the highly-valued cities, significant price corrections are to be expected in the coming quarters.”

Record-low interest rates deployed by policy makers through the pandemic, along with the demand for larger living spaces that lockdowns provoked, drove housing markets around the world into a buying frenzy for much of the past two years. That’s now starting to reverse as rates rise.

In Toronto, benchmark home prices jumped 71 per cent in the three years through February, data from the Canadian Real Estate Association show. Since then, they’ve fallen 8.6 per cent.

The bank warned other cities may face the same pressure as homeowners start to get squeezed by higher mortgage costs on one side, and job losses on the other.

Toronto, and Canada, may be leading the way.

“Recent rate hikes by the Bank of Canada could be the last straw that broke the camel’s back,” according to the UBS report. “New buyers and owners during mortgage renegotiations not only need to pay higher interest rates but are also required to provide more income to qualify for a mortgage. Price correction is already in the making.”