Fifth Third Jumps as CEO Calls Bottom on Net Interest Income

Fifth Third Bancorp jumped the most in four months, leading bank stocks higher, with Chief Executive Officer Tim Spence predicting that income from lending has bottomed out.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Fifth Third Bancorp jumped the most in four months, leading bank stocks higher, with Chief Executive Officer Tim Spence predicting that income from lending has bottomed out.

China’s securities regulator said it will encourage the nation’s companies to list in Hong Kong as it unveiled a package of measures to bolster the city’s position as an international financial hub.

Hong Kong’s accounting regulator said it will investigate allegations over PricewaterhouseCoopers LLP’s role auditing China Evergrande Group following a “whistleblower report”.

Hudson Bay Capital Management has raised over $800 million to invest in so-called special opportunities, according to a person with knowledge of the matter.

A group of investors led by a Dubai-based real estate developer is in talks to build a mixed-use tower in Thailand that may vie for the mantle of the world’s tallest building.

May 10, 2017

, BNN Bloomberg

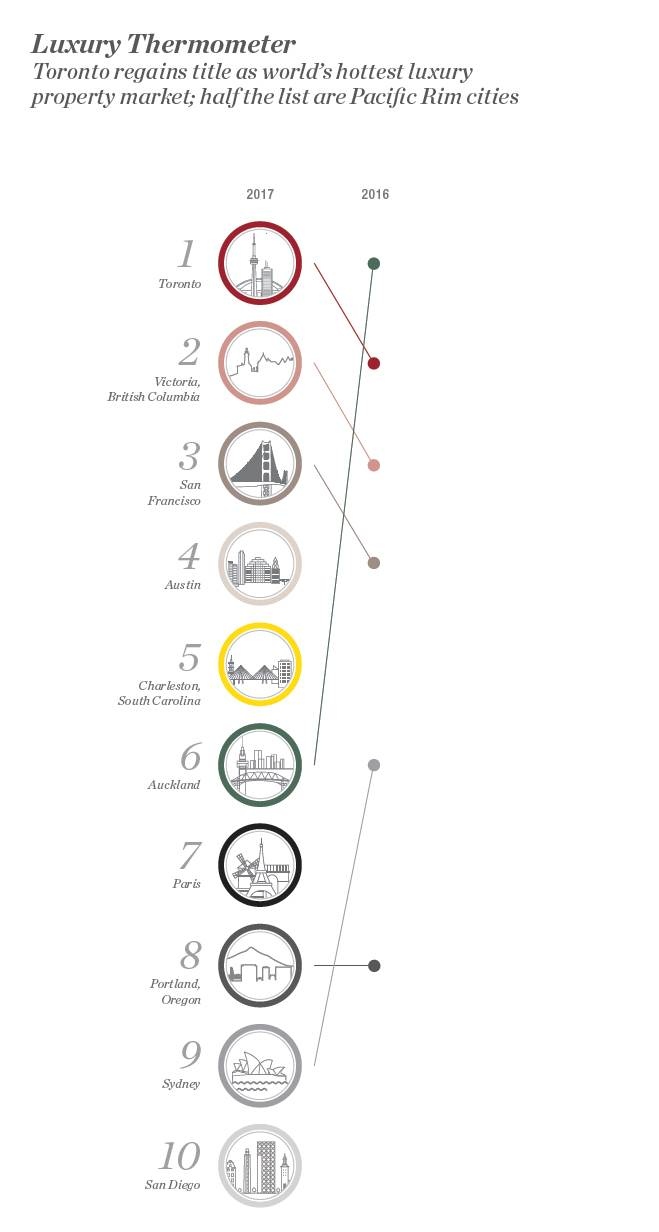

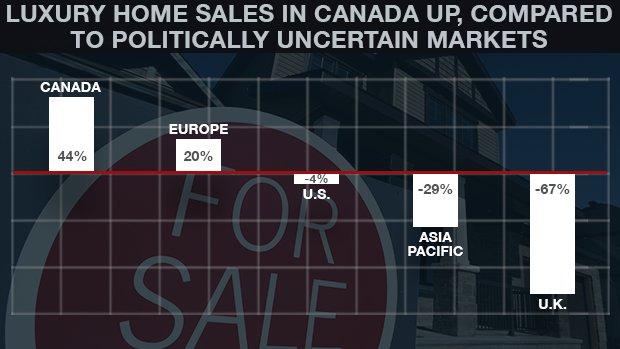

Toronto and Victoria, B.C. are the world’s “hottest” markets for luxury homes as investors flock to Canada for its political and economic stability, according to a new report from Christie’s International Real Estate.

Christie’s CEO Dan Conn told BNN in an interview Wednesday that even with the rise in million-dollar-plus home sales, Toronto is cheap compared to other luxury markets. “I consider Toronto, even with the heat at the upper end of the market, it is still a comparative bargain on the global map,” he said.

Investors interest in Canadian real estate shows no sign of cooling anytime soon, Conn said.

“The reality of the world right now is that, particularly in 2016, we’ve lived through an enormous amount of uncertainty, and one of the real bright lights geopolitically-speaking was Canada,” he said, citing the country’s quality of education, health care, human rights record, and stable government.

“Canada will always be a great place to invest because it will always be a great place to live.”

Hong Kong is now the top luxury residential real estate market in the world, beating London for the first time in five years, but Toronto and Victoria are the globe’s fastest-growing high end markets, the report found. Sales of homes $1 million or more grew by one per cent worldwide, with Toronto and Victoria moving up one spot each to occupy the top two in Christie’s ranking.

The desire for luxury home sales doesn’t seem to be slowing either, according to the report, which saw signs of sustained growth in the high-end market.

Foreign buyers aren’t the main source of heat in Toronto’s market, and recent efforts by the provincial government to crack down on foreign speculators are unlikely to cool the market, said Conn. Last month, Ontario Premier Kathleen Wynne unveiled measures – including a 15 per cent tax on real estate speculation by non-residents.

Instead, Canadian policymakers should shift their focus to adding more housing supply, Conn said.

“I just don’t see this as a fix for inventory and pricing,” he said, speaking on Ontario’s recent measures aimed at cooling the market.

Conn acknowledged the results in Vancouver’s foreign buyers’ tax implemented in August were notable. However, he doubts the same measures will work in Toronto and noted that most of the purchasing is still coming from domestic buyers countrywide.

“Effectively you are squeezing one end of the balloon and air is going into another end,” he said.

The report, titled Luxury Defined, looked at data from over 100 brokerages across the globe, revealed homes that are seven figures and over peaked last year at records levels.