Jul 18, 2019

Trade Wars Are Bad. Except for the Korean Stocks Up $1.5 Billion

, Bloomberg News

(Bloomberg) -- Escalating tensions between South Korea and Japan have darkened the clouds overhanging the global economy. But they’ve brightened up a part of the stock market.

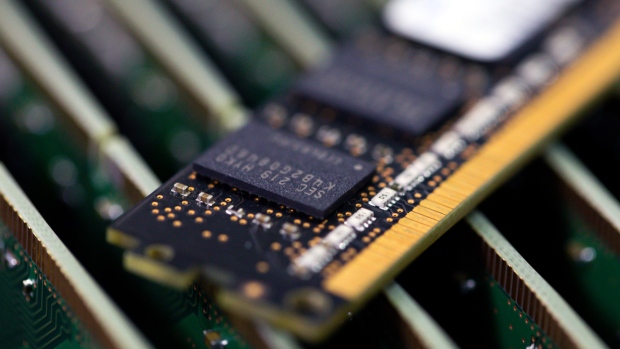

South Korean suppliers of key materials for chipmakers have surged about 19% since Japan unveiled measures targeting its neighbor. The thinking is that these companies may win new business from key players including Samsung Electronics Co. and SK Hynix Inc.

Eleven stocks considered as beneficiaries of the conflict have seen a combined $1.5 billion increase in market capitalization. Among the winners: Foosung Co., which makes hydrogen fluoride, and Soulbrain Co., which trades semiconductor-related chemicals.

The bilateral dispute deepened almost three weeks ago, when Japan moved to restrict materials vital to South Korea’s all-important tech industry. The background is a long-running dispute between the neighbors over events dating back to Japan’s colonization of the Korean peninsula during the first half of the 20th century.

Why Japan and South Korea Still Spar Over History: QuickTake

There could be another twist to the tale, though. Rivals of Korean memory chipmakers may have a window to nab market share while Samsung and SK Hynix are trying to line up suppliers outside of Japan.

“If the Korean producers face a prolonged supply constraint, this is an opportunity for their competitors,” said Casey McLean, an investment analyst at Fidelity International in Hong Kong. “Semiconductor companies are acutely aware that surety-of-supply is critical, with product cycles compressing and lead times shortening.”

Another Winner?

With only three main players in the DRAM chip market, analysts covering Micron Technology Inc. have raised their share-price targets on that company. New chips produced by Korean rivals may not enjoy a long testing period, potentially damaging their data center build-outs.

McLean also questioned whether Samsung or SK Hynix would be able to maintain the quality of their products should they adopt non-Japanese suppliers. “Whilst there are some domestic suppliers for materials, they produce lower-purity products, which would impact memory yields,” he said. “This issue surely increases the desire for the Korean supply chain to localize, but it does raise the question why it has not already occurred.”

SK Group Chairman Chey Tae-Won, who oversees SK Hynix, said the company can produce chips with materials from local suppliers, but “it is a matter of quality,” when asked why the firm hadn’t yet switched to domestic supplies. One of the materials, hydrogen fluoride, is lacking in “details” required for manufacturing chips, Chey said Thursday.

Song Myung-sup, an analyst at HI Investment & Securities Co. in Seoul, is skeptical. Without a plan in place, no one knows how both Korean chipmakers can produce semiconductors with new materials from new suppliers.

“There’s no data on domestic materials yet --- it is nonsense to talk about potential yields of chips made with local materials,” Song said. “The point is, if the trade spat with Japan is not resolved for a long term and supply of Korean chips is halted, everyone would face a significant catastrophe.”

--With assistance from Sohee Kim.

To contact the reporters on this story: Heejin Kim in Seoul at hkim579@bloomberg.net;Matt Turner in Hong Kong at mturner107@bloomberg.net

To contact the editors responsible for this story: Lianting Tu at ltu4@bloomberg.net, Divya Balji, Christopher Anstey

©2019 Bloomberg L.P.